Broker

Your No.1 Choice For US Options Trading

Numerous Choices

Access to full US options market and index options including VIX, SPX, OEX and more.

Multiple Option Strategies

Support long/short single option, covered call, vertical, and more.

Advanced Order Types

uSMART provides various advanced tools. With Grid Trading order to automate your buys and sells.

Ultra-Low Cost

Commission fee as low as USD $0 per contract. Platform fee from USD $0.40 per contract.

Real-Time Data

Free US option streaming quotes and index options quotes.

Simplified And Curated Mobile App

Customizable option chain makes it easy to get all relevant information at a glance.

US Options Fee Comparison

Commission

Platform Fee

uSMART

$0* / Contract

no min fees*

USD 0.40 / Contract

no min fees*

Broker A

USD 0.65 / Contract

min USD 1.99 / Order

USD 0.30 / Contract

min USD 0.99 / Order

Broker B

USD 0.65 / Contract

min USD 1.99 / Order

USD 0.30 / Contract

min USD 1.00 / Order

*Fees vary for different uSMART account types. For more information, please visit the pricing chart.

Disclaimer: The above Comparison Chart is for illustration purposes only and and may vary from time to time.

24x5 Trading For SPX, XSP And VIX Options Is Available

Thanks to the Cboe's extended global trading hours, investors can trade S&P 500 Index (SPX) options, Cboe Volatility Index (VIX) options and Mini-SPX Index (XSP) options to nearly 24 hours a day, five days a week. With extended global trading hours (GTH), investors can react fast to market-moving events that unfold before and after regular U.S. trading hours.

Why Trade Options with uSMART?

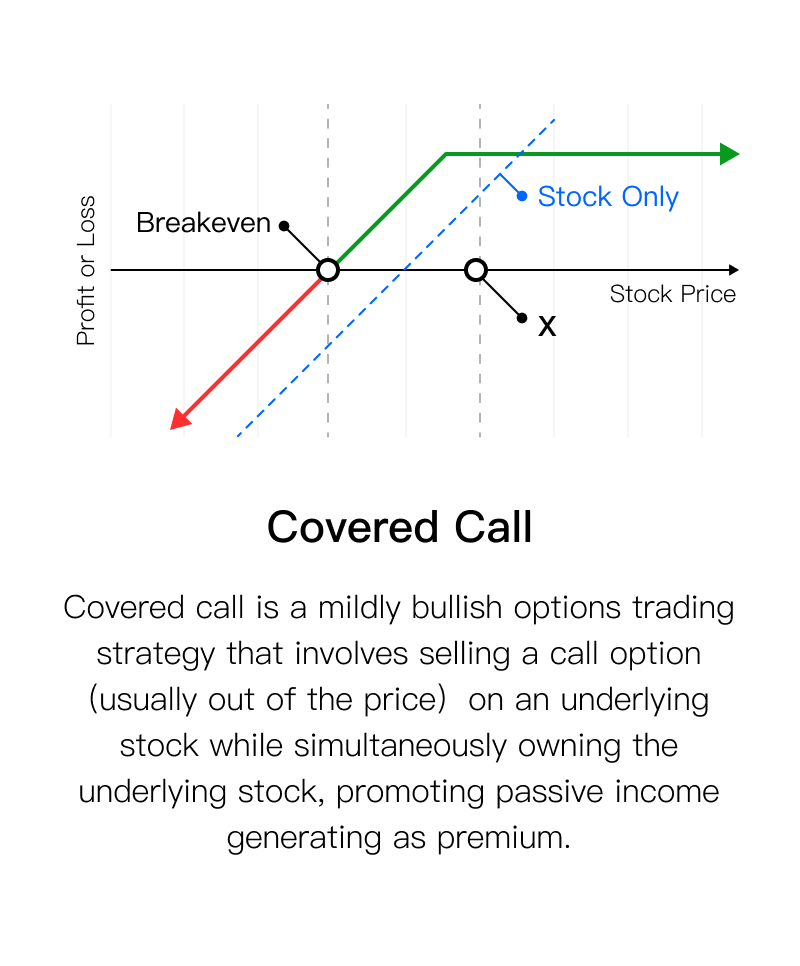

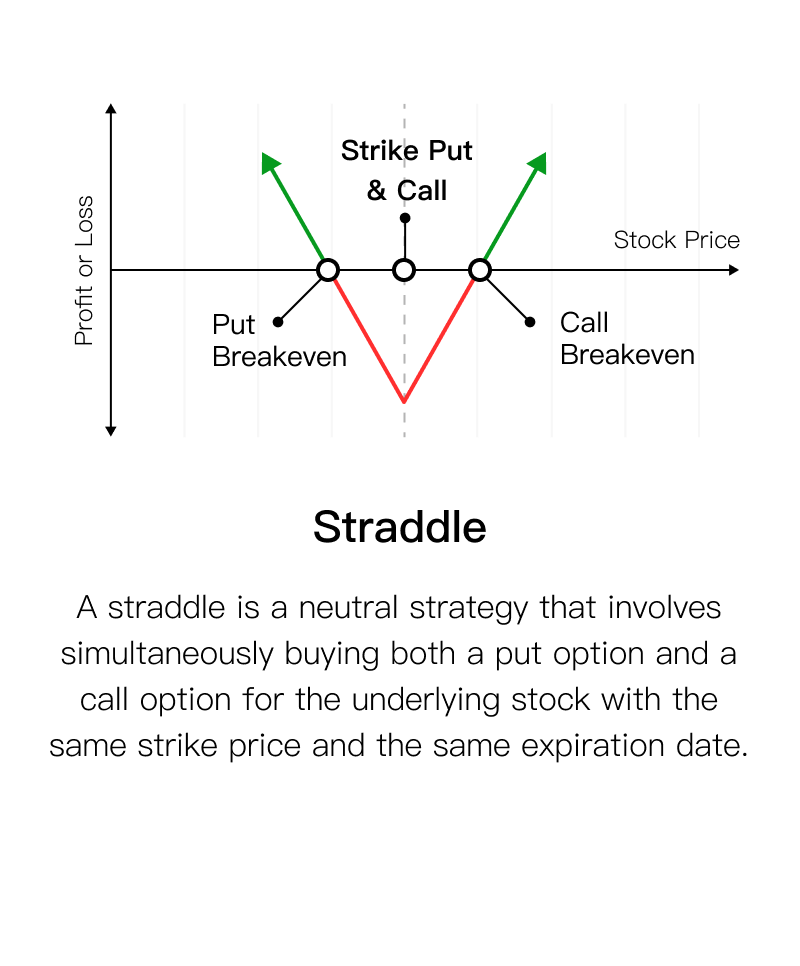

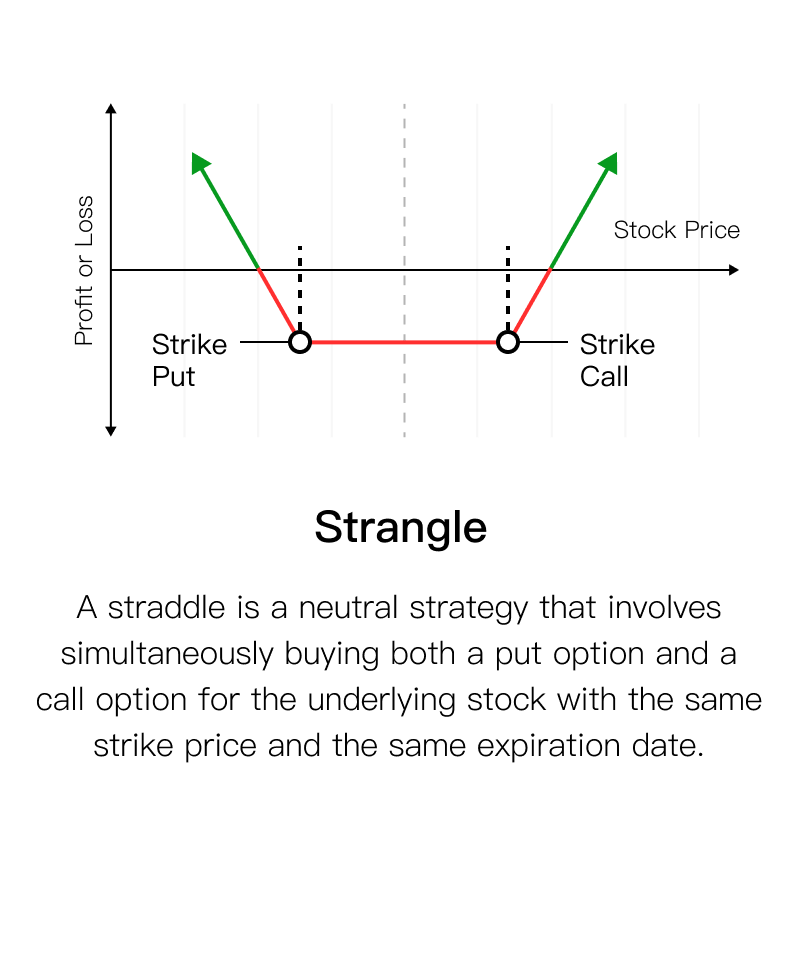

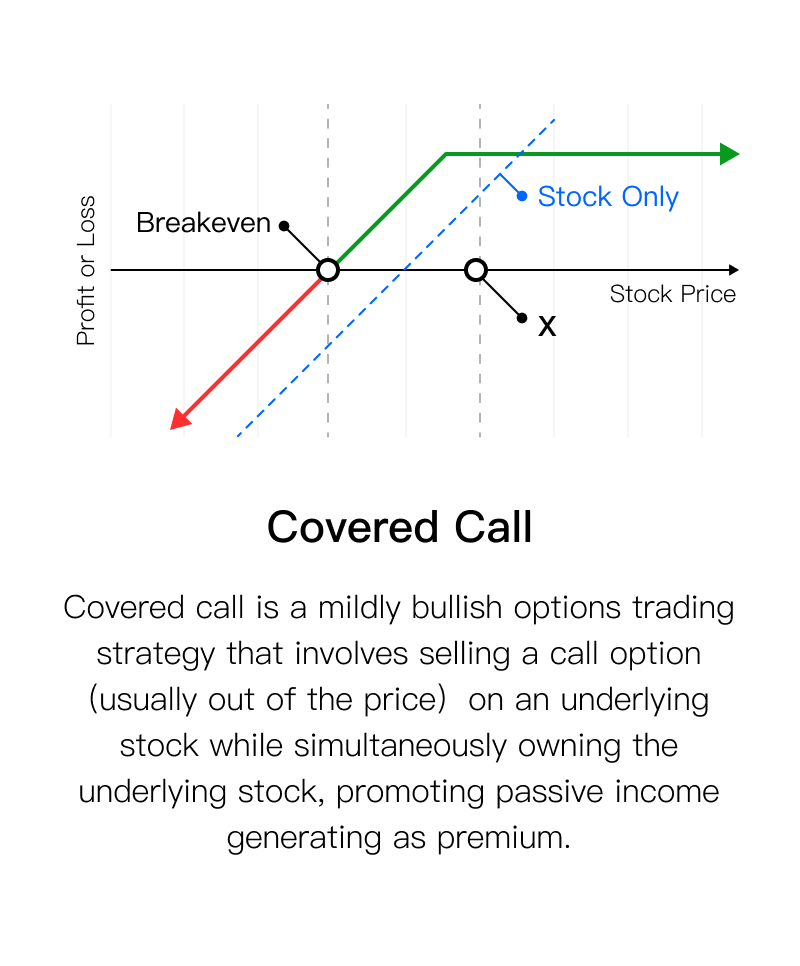

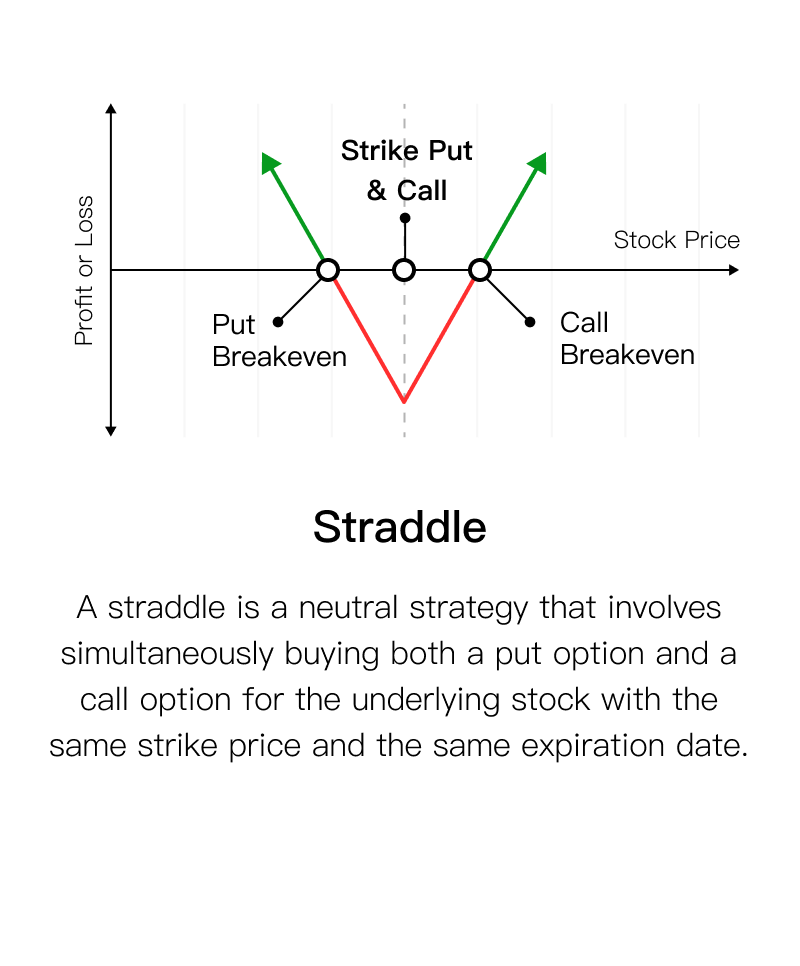

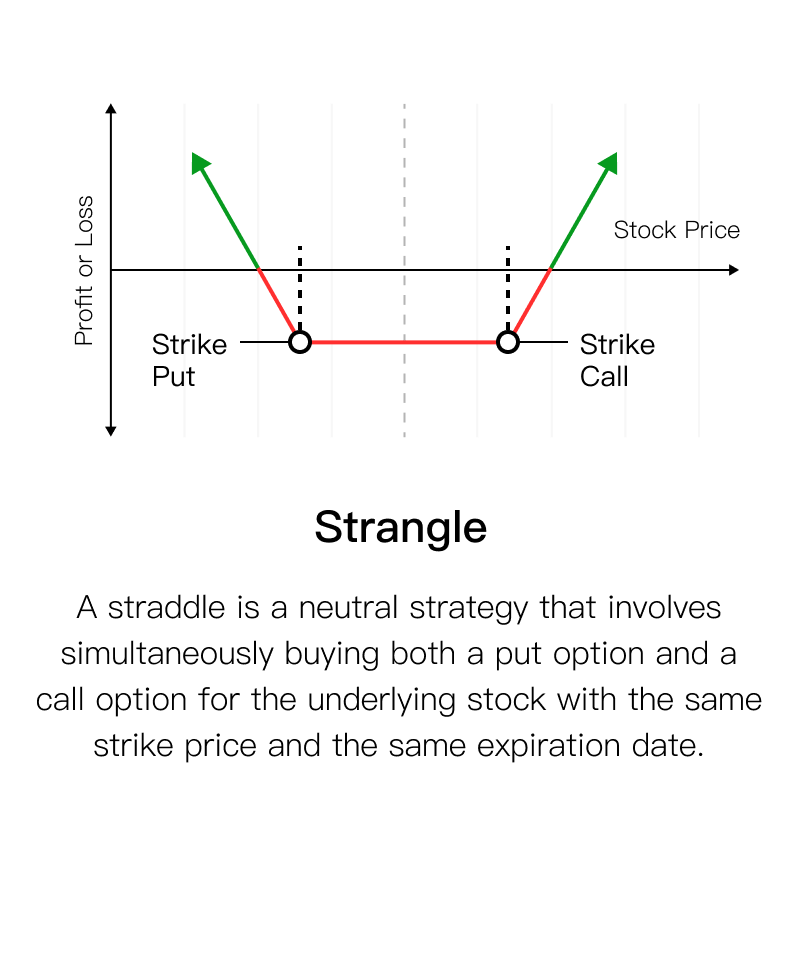

Multiple Option Trading Strategies To Choose

Multiple option trading strategies to choose from on uSMART, including long/short single option, covered call, vertical, straddle, strangle and more.

Options Trading Guide

Only Simple Steps To Start Your Options Trading Journey

Options Basics

Options contracts are agreements between a buyer and seller which give the buyer the right to buy or sell a particular asset at a later date...

more

Options Chain

An option chain is a chart that provide in-depth information about all options contact.

more

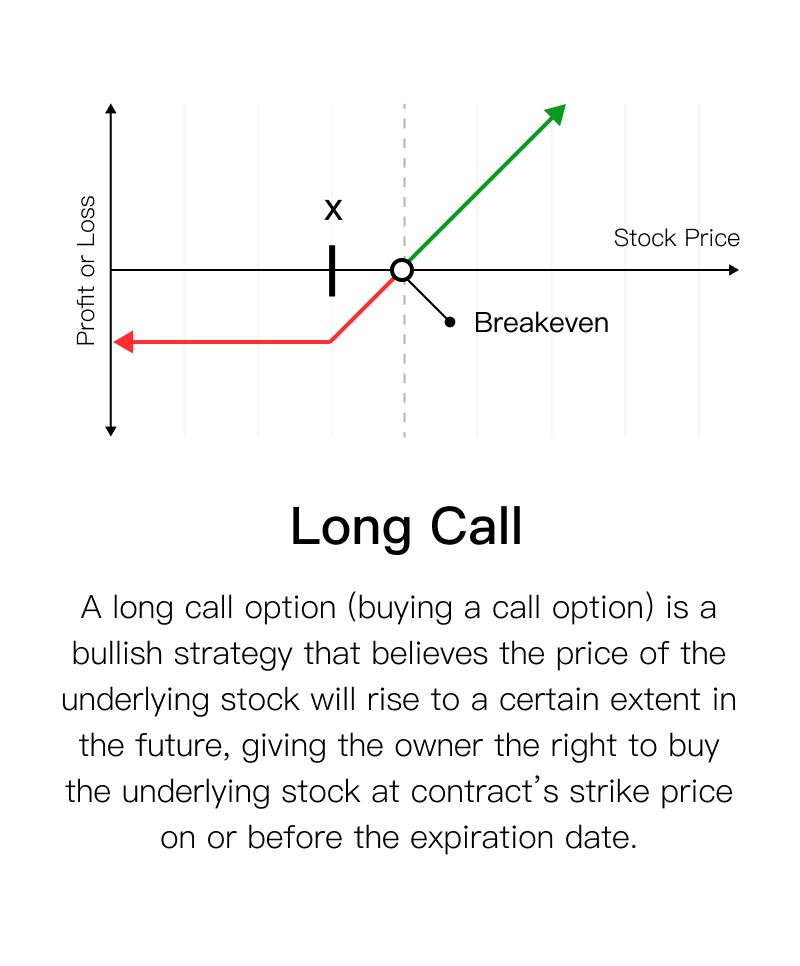

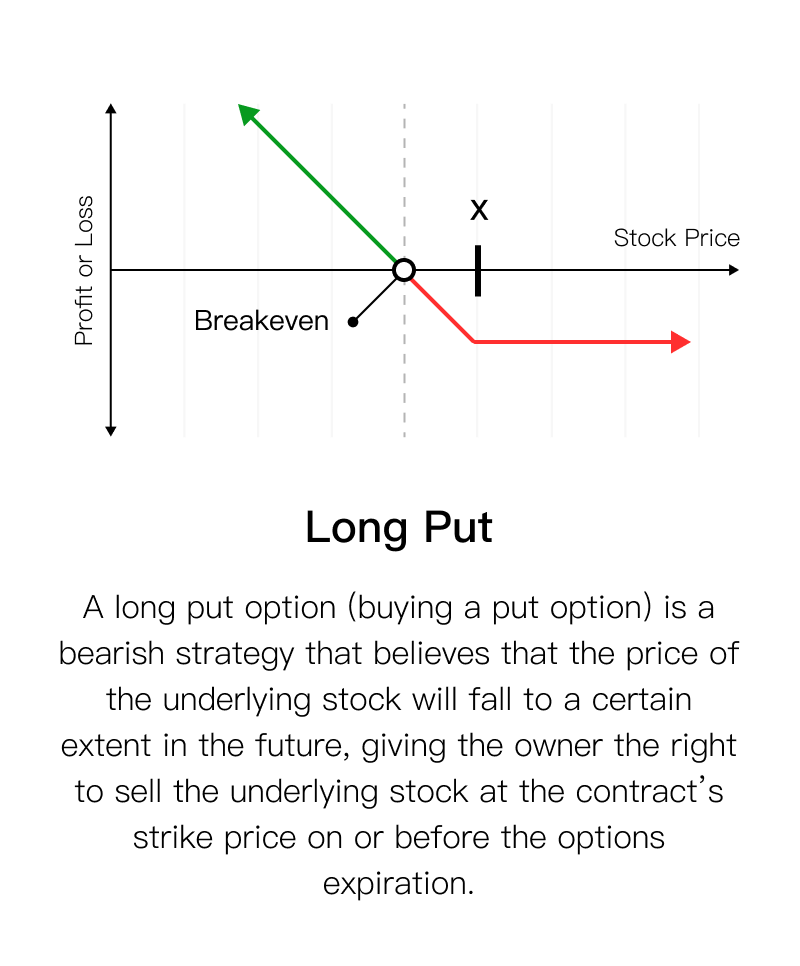

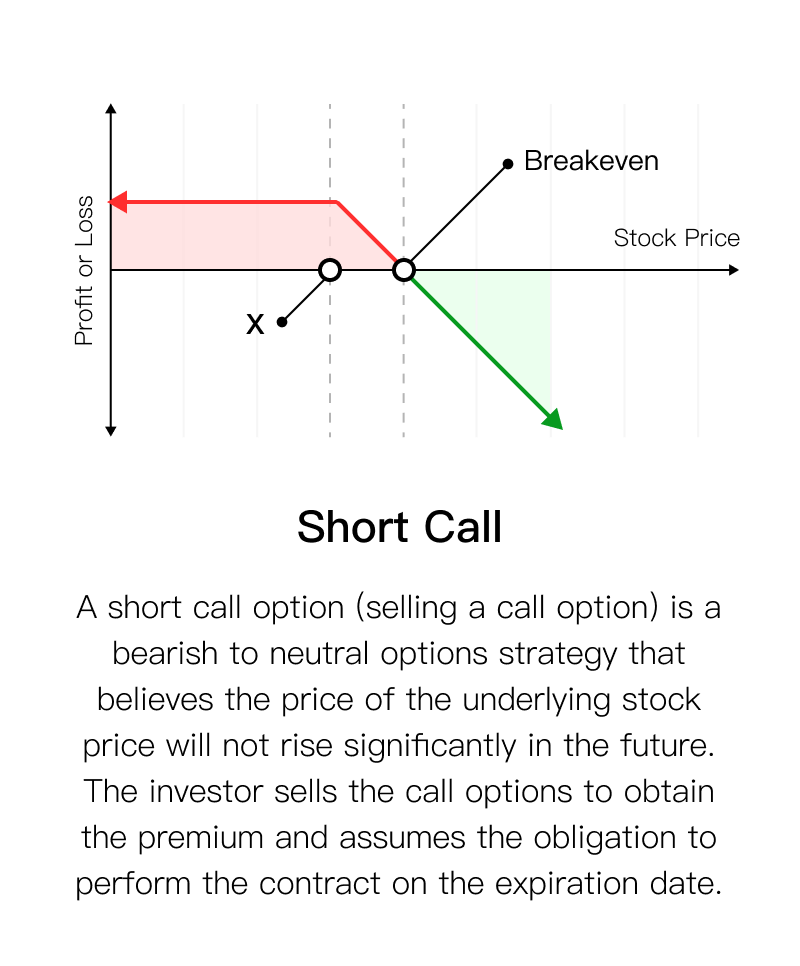

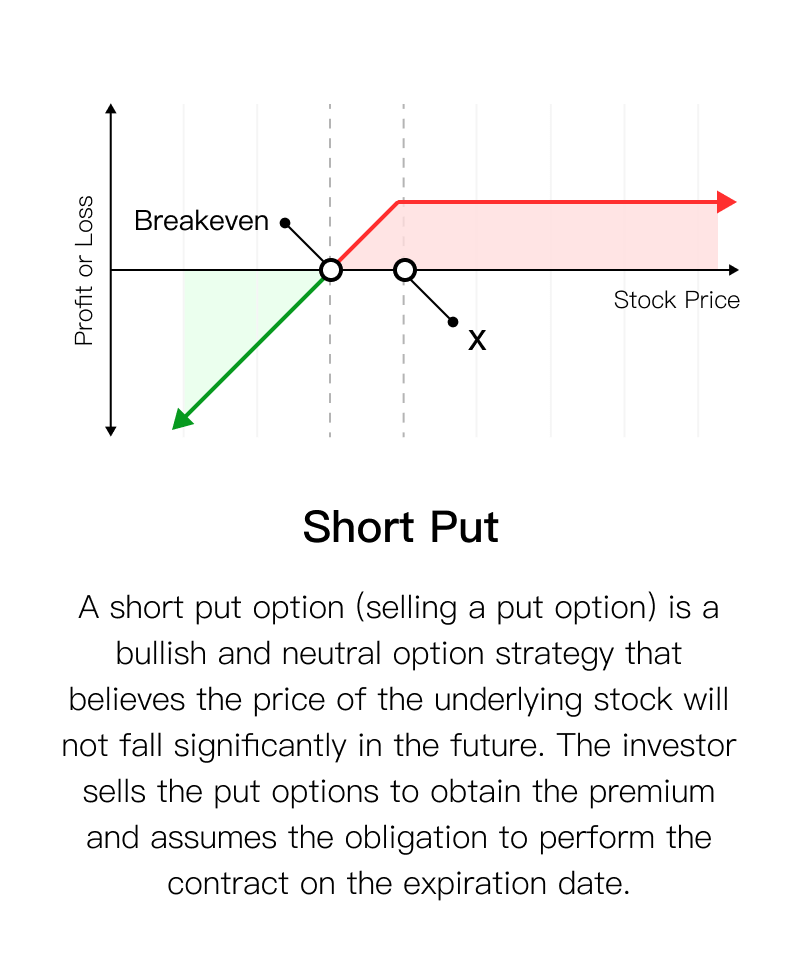

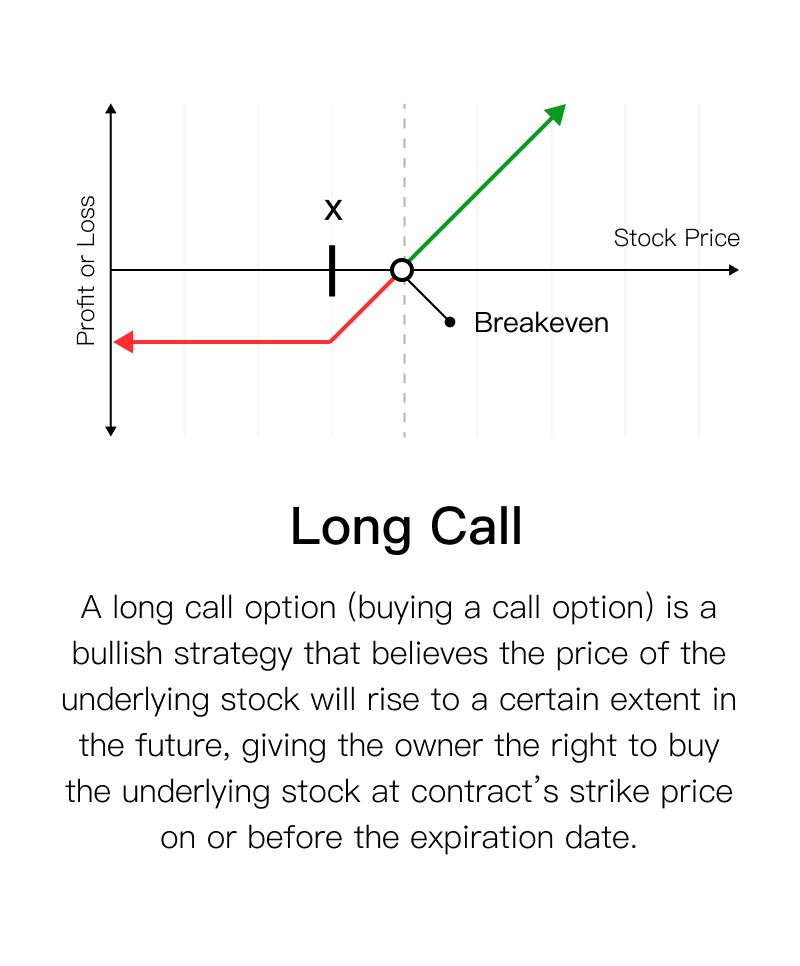

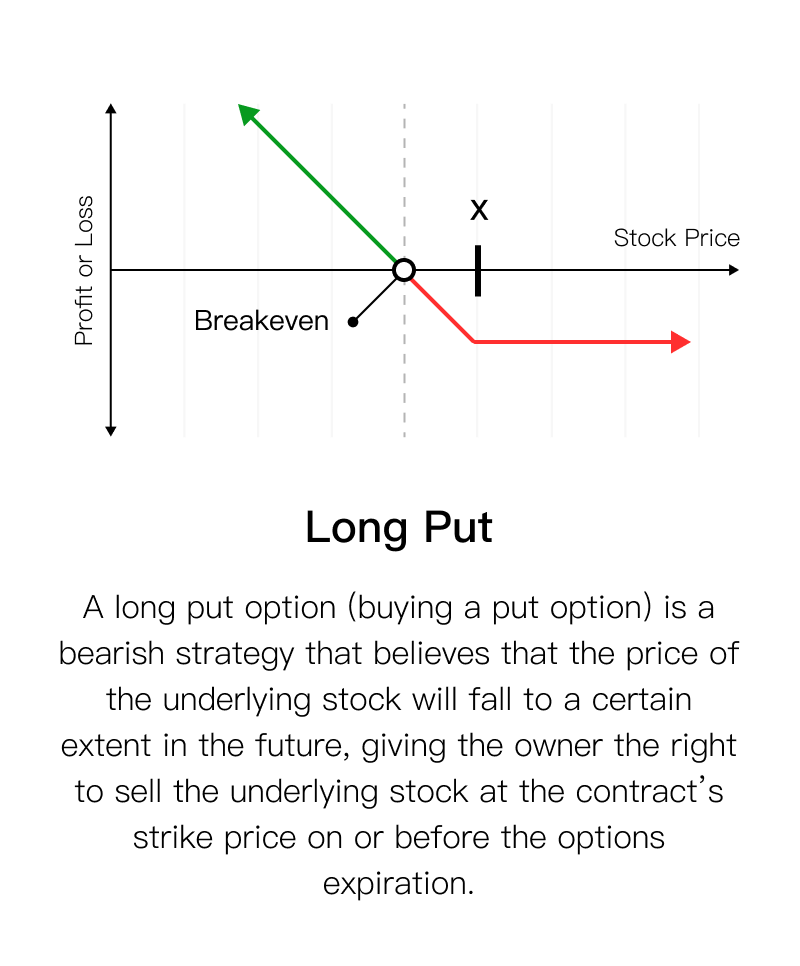

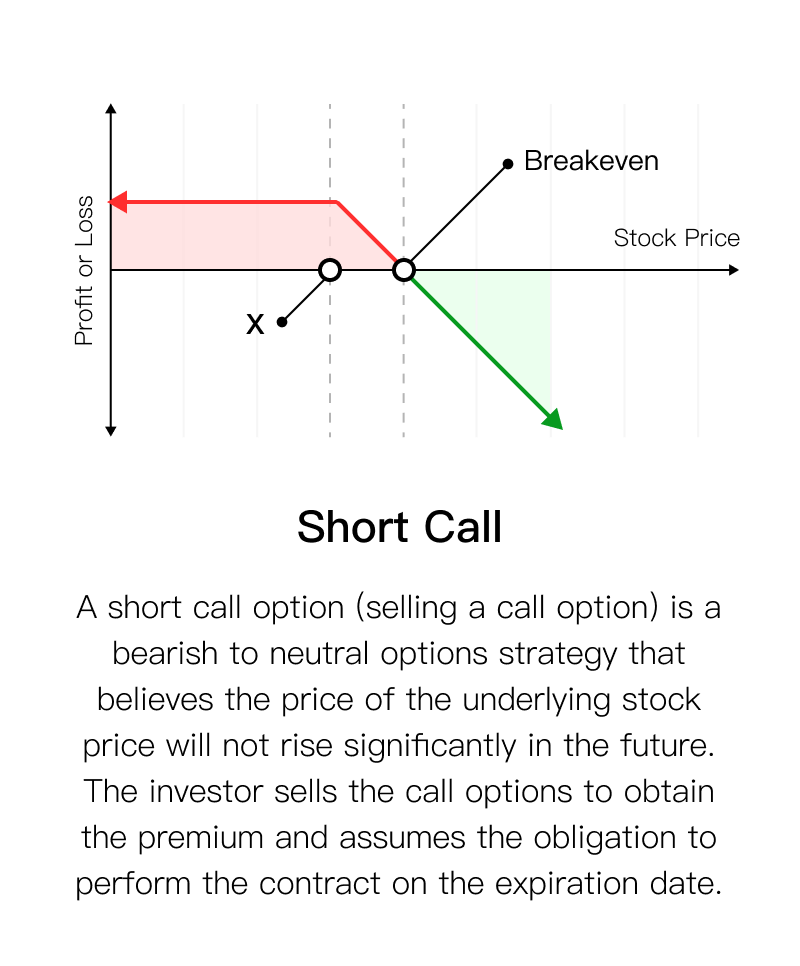

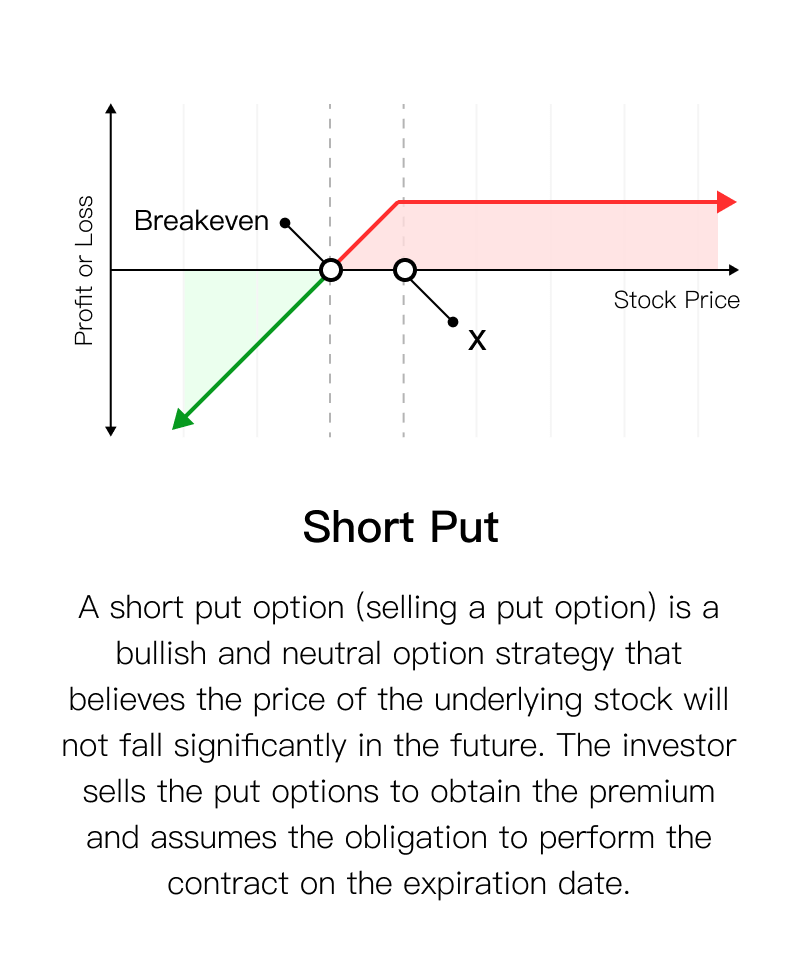

Big Four Options Trading

Explore the four fundamental concepts of Options Trading, which include Call, Put, Long, and Short.

more

Covered Call Option

A covered call, is a combination of a long position in the underlying stock and a short call position.

more

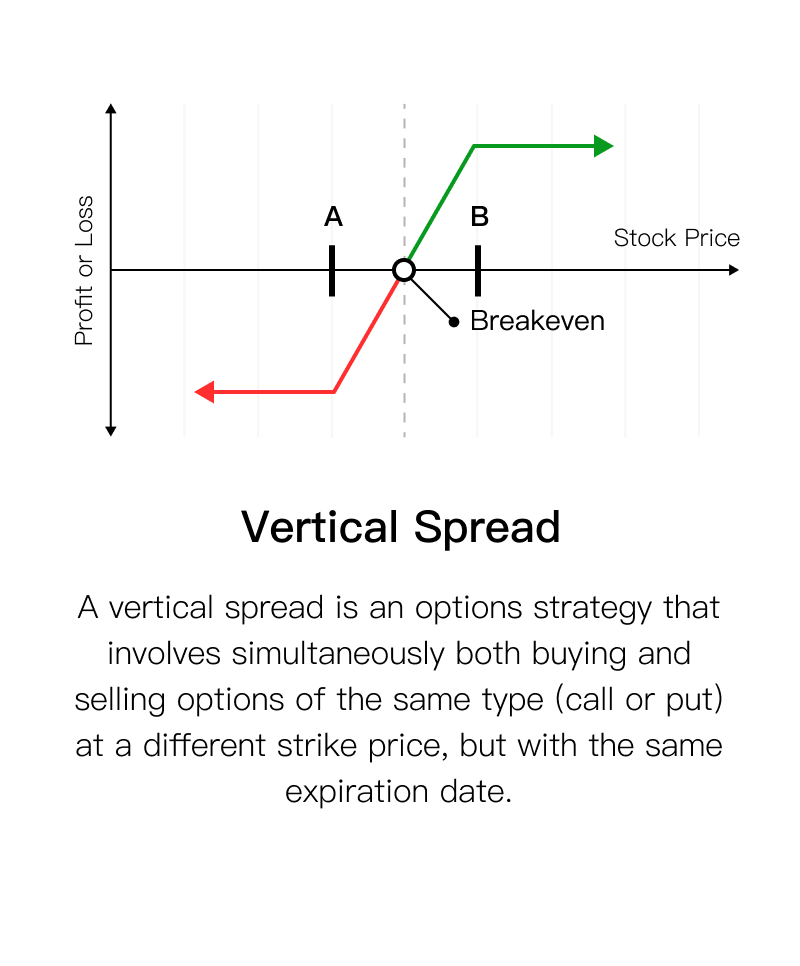

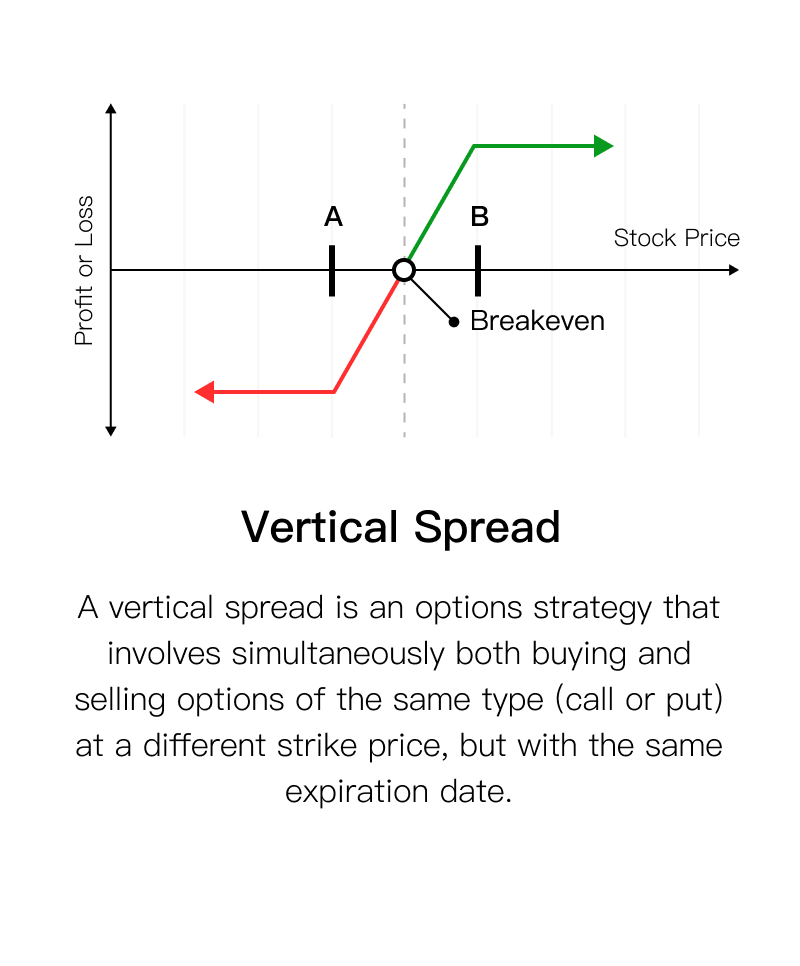

Vertical Spread Option

It is a strategy where investors can reduce the premuim payment required in debit spreads and minimise their risk associated with credit spreads.

more

FAQs

Disclosure:The risk of options trading is very high. In some situation, the loss bore by customers may exceed the initial margin deposit. Investors should understand the types of options (Call Options or Put Options) and the related risk they are planning to trade no matter they are buying or selling options. Regulatory and Exchange fees apply to options trades. If you want to know more details related to options trading, please go to the Help Center.

Singapore

Singapore Hongkong

Hongkong Group

Group Global

Global