Chipmaker and infrastructure software provider Broadcom (AVGO) reported earnings for the third quarter on Thursday evening that slightly exceeded Wall Street expectations, but its revenue forecast for the period was slightly below predictions. As a result, Broadcom's stock price fell in after-hours trading.

Source: uSMART SG

Key Financial Data for Broadcom:

- evenue:$13.072 billion for the third quarter, up 47% year-over-year.

- AAP Net Loss:$1.875 billion for the third quarter; non-GAAP net income of $6.12 billion for the third quarter.

- djusted EBITDA:$8.223 billion for the third quarter, representing 63% of revenue.

- AAP Diluted Loss Per Share:$0.40 for the third quarter; non-GAAP diluted EPS of $1.24 for the third quarter.

- ash Flow from Operating Activities:$4.963 billion for the third quarter, with capital expenditures of $172 million, resulting in free cash flow of $4.791 billion, or 37% of revenue.

- uarterly Dividend:$0.53 per share.

- 4 FY2024 Revenue Guidance:Approximately $14 billion, including a 51% increase from VMware compared to the previous year.

- 4 FY2024 Adjusted EBITDA Guidance:About 64% of the expected revenue.

Broadcom's Stock Declines After Earnings Report

Broadcom (AVGO) shares fell after Thursday's close due to a loss reported for the quarter, driven by increased merger-related expenses. The company reported a net loss of $1.875 billion compared to a profit of $3.3 billion in the same period last year. After adjusting for $1.5 billion in acquisition-related intangible asset amortization and other restructuring costs, Broadcom's EPS was $1.24.

The company expects revenue for Q4 to be around $14 billion, slightly below analysts' expectations. CEO Hock Tan indicated that the company anticipates AI revenue to reach $12 billion for the year, “primarily driven by custom accelerators for Ethernet networks and AI data centers.”

Broadcom acquired software company VMware in November 2023. Tan remarked, “Broadcom’s Q3 performance reflects the continued strong performance of our (AI) semiconductor solutions and VMware.”

Broadcom’s stock dropped over 6% in after-hours trading. Year-to-date, the company's stock had surged approximately 40%.

Weak Non-AI Demand Drags Down Q4 Guidance

“Broadcom’s Q3 performance reflects the continued strong performance of our AI semiconductor solutions and VMware. We expect $12 billion in AI-driven revenue for FY2024, with Ethernet networks and AI data center custom accelerators being key drivers,” said President and CEO Hock Tan. “The transformation of VMware continues to progress well. By the end of FY2024, VMware’s adjusted EBITDA margin is expected to rise to 64% of revenue.”

“Total revenue grew 47% year-over-year to $13.1 billion, including a 4% increase from VMware. Adjusted EBITDA rose 42% year-over-year to $8.2 billion,” said Kirsten Spears, CFO of Broadcom. “Free cash flow for the quarter, excluding restructuring and integration costs, was $5.3 billion, up 14% year-over-year.”

Based on guidance, Broadcom expects continued revenue growth in Q4, with an anticipated increase of 51%, though still slightly below analysts' expectations. Analysts suggest that the Q4 guidance indicates weaker-than-expected growth in Broadcom’s non-AI business, reflecting soft demand in non-AI sectors. Some of Broadcom’s business areas, not closely tied to the AI boom, have not benefited from the surge in enterprise AI spending.

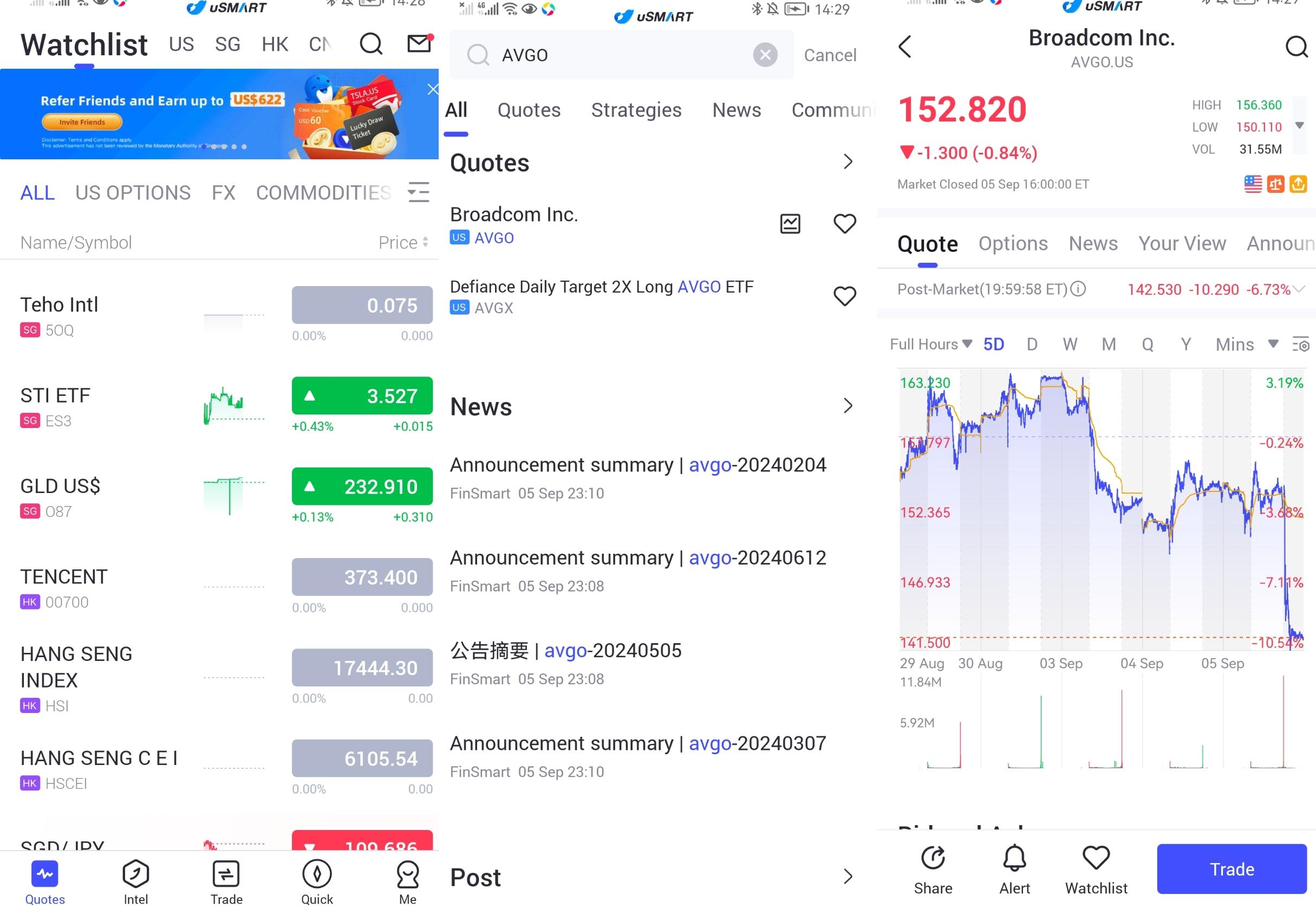

How to trade investments on uSMART:

After logging into uSMART SG APP, click "Search" from the upper right corner of the page, enter the target code, such as "AVGO", and enter the details page to learn about transaction details and historical trends. Click "Trade" in the lower right corner and select "Buy/Sell" "Send" function, finally fill in the transaction conditions and send the order; the image operation instructions are as follows:

Source: uSMART SG

Follow us

Find us on Twitter, Instagram, YouTube, and TikTok for frequent updates on all things investing.

Have a financial topic you would like to discuss? Head over to the uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Important Notice and Disclaimer:

We have based this article on our internal research and information available to the public from sources we believe to be reliable. While we have taken all reasonable care in preparing this article, we do not represent the information contained in this article is accurate or complete and we accept no responsibility for errors of fact or for any opinion expressed in this article. Opinions, projections and estimates reflect our assessments as of the article date and are subject to change. We have no obligation to notify you or anyone of any such change. You must make your own independent judgment with respect to any matter contained in this article. Neither we or our respective directors, officers or employees will be responsible for any losses or damages which any person may suffer or incur as a result of relying upon anything stated or omitted from this article.

This document should not be construed in any jurisdiction as constituting an offer, solicitation, recommendation, inducement, endorsement, opinion, or guarantee to purchase, sell, or trade any securities, financial products, or instruments or to engage in any investment or any transaction of any kind, nor is there any intention to solicit or invite the purchase or sale of any securities.

The value of these securities and the income from them may fall or rise. Your investment is subject to investment risk, including loss of income and capital invested. Past performance figures as well as any projection or forecast used in this article is not indicative of its future performance.

This advertisement has not been reviewed by the Monetary Authority of Singapore

Singapore

Singapore Hongkong

Hongkong Global

Global Group

Group