In the context of increased market volatility, high-dividend stocks have become a popular choice for conservative investors. This article will introduce 25 high-dividend stocks with yields ranging from 4% to over 10%, providing you with investment opportunities and options for steady returns.

The top 25 high dividend stocks analyzed below possess these traits and have:

- A dividend yield above 4% (some as high as 10%)

- A Borderline Safe, Safe, or Very Safe Dividend Safety Score™

- An investment-grade credit rating (except for two unrated stocks)

- An ability and desire to protect their dividends during downturns

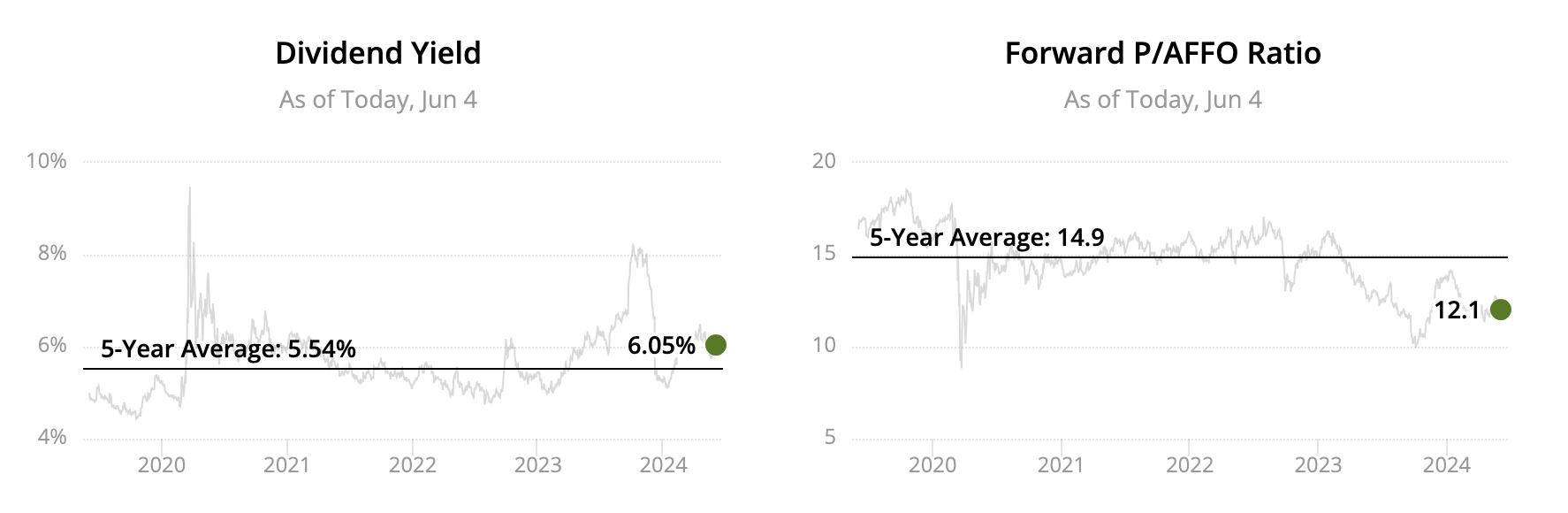

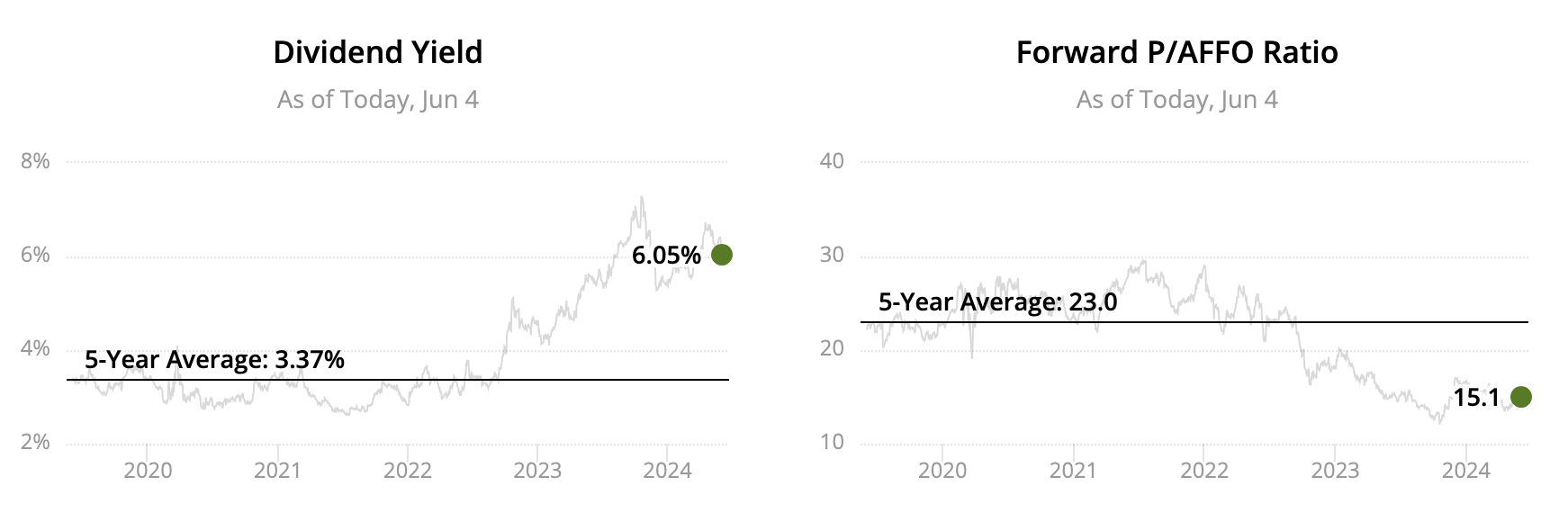

High Dividend Stock #25: W.P. Carey

Sector: Real Estate – Diversified REITs

Dividend Yield: 6.0%

Dividend Safety Score: Safe

Uninterrupted Dividend Streak: 0 years

Source: Simply Safe Dividends

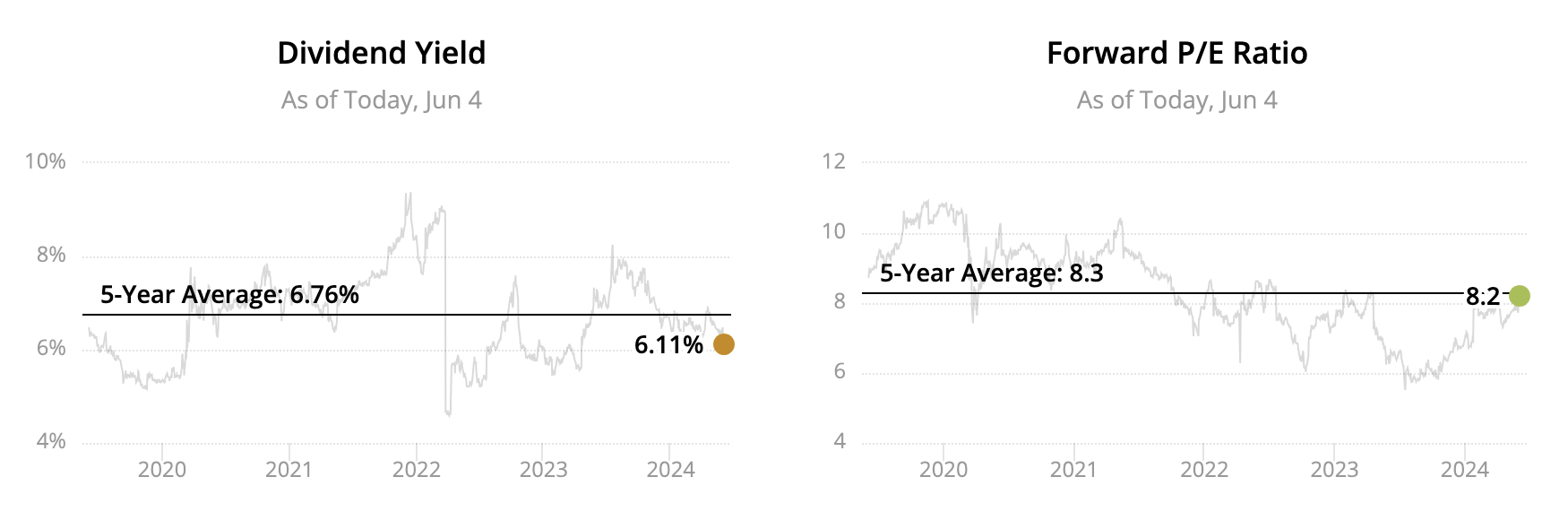

High Dividend Stock #24: AT&T

Sector: Communications – Wireless and Internet Services

Dividend Yield: 6.1%

Dividend Safety Score: Borderline Safe

Uninterrupted Dividend Streak: 1 year

Source: Simply Safe Dividends

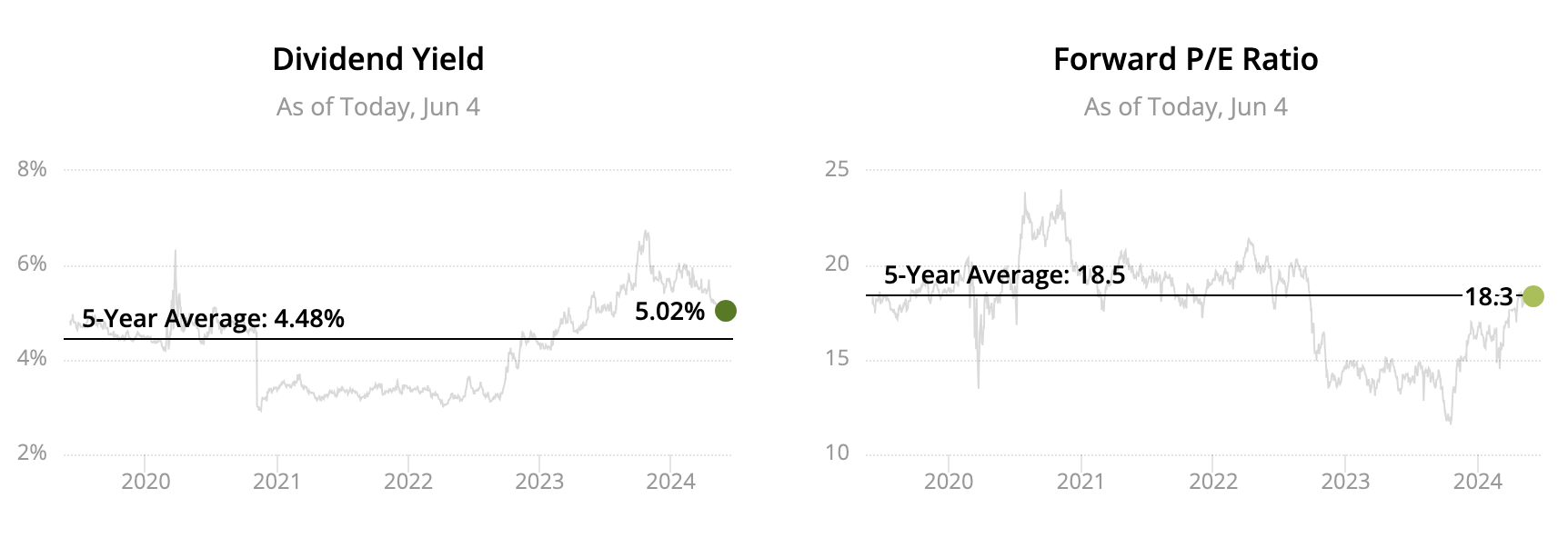

High Dividend Stock #23: Dominion Energy

Sector: Utilities – Electric Utilities

Dividend Yield: 5.0%

Dividend Safety Score: Safe

Uninterrupted Dividend Streak: 2 years

Source: Simply Safe Dividends

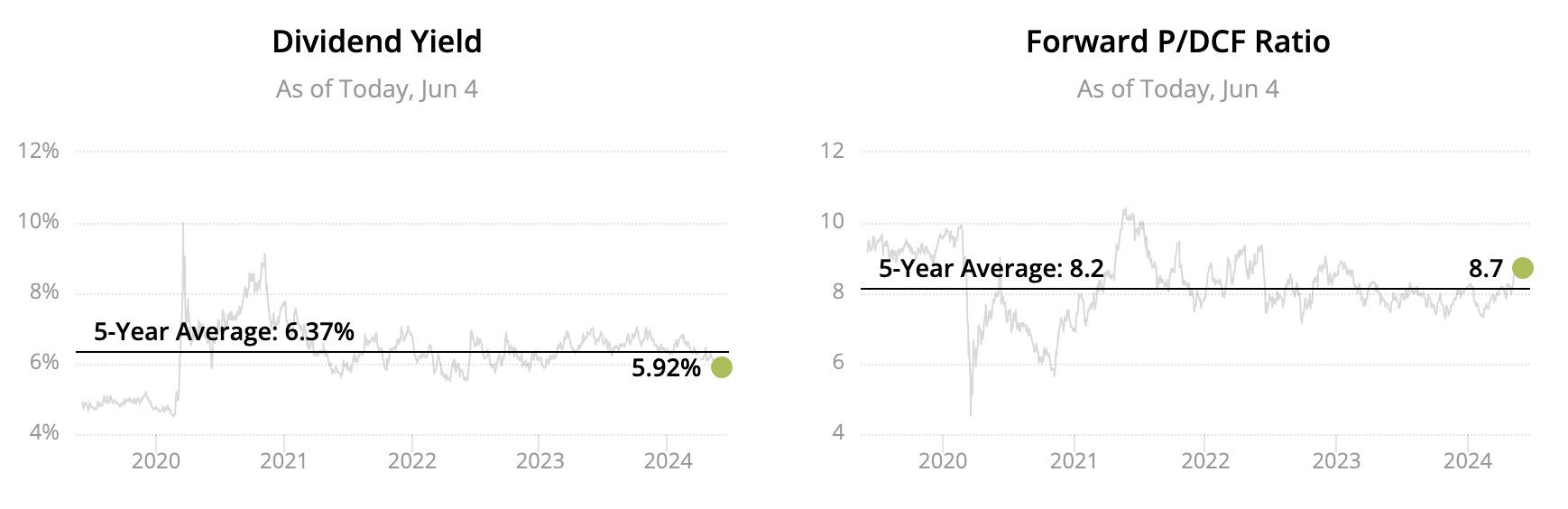

High Dividend Stock #22: Kinder Morgan

Sector: Energy – Oil and Gas Storage and Transportation

Dividend Yield: 5.9%

Dividend Safety Score: Safe

Uninterrupted Dividend Streak: 7 years

Source: Simply Safe Dividends

High Dividend Stock #21: Crown Castle

Sector: Real Estate – Wireless Infrastructure REIT

Dividend Yield: 6.0%

Dividend Safety Score: Borderline Safe

Uninterrupted Dividend Streak: 9 years

Source: Simply Safe Dividends

High Dividend Stock #20: LyondellBasell

Sector: Materials – Commodity Chemicals

Dividend Yield: 5.6%

Dividend Safety Score: Borderline Safe

Uninterrupted Dividend Streak: 11 years

Source: Simply Safe Dividends

High Dividend Stock #19: Dow

Sector: Materials – Commodity Chemicals

Dividend Yield: 5.1%

Dividend Safety Score: Borderline Safe

Uninterrupted Dividend Streak: 14 years

Source: Simply Safe Dividends

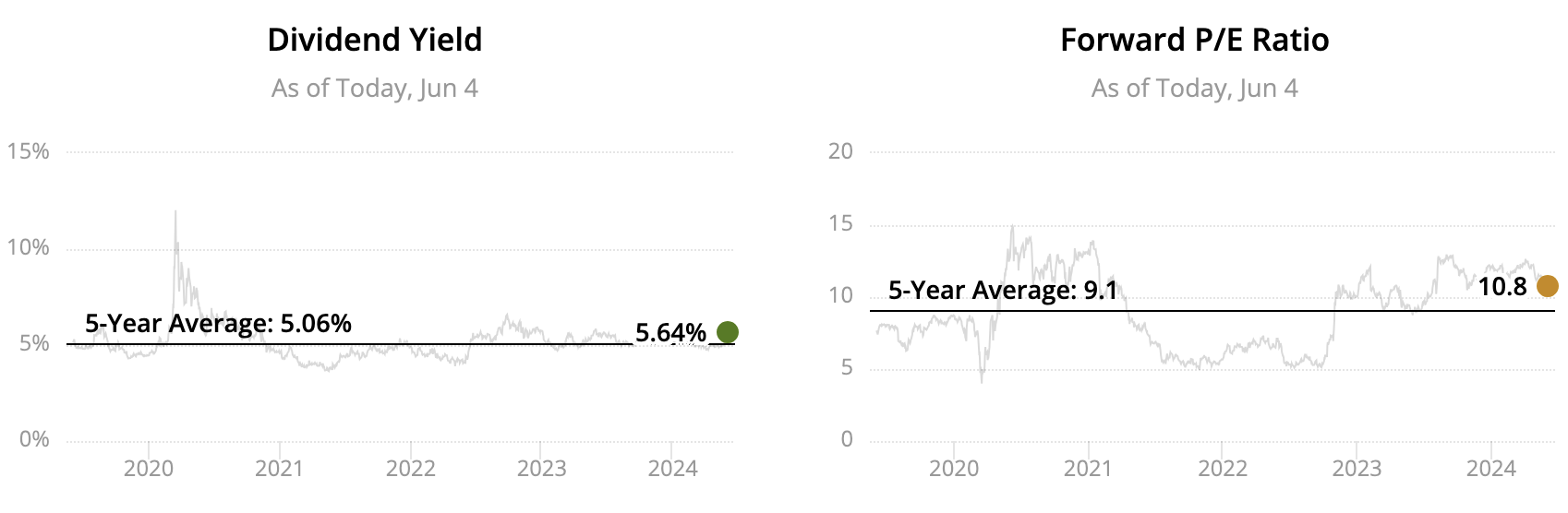

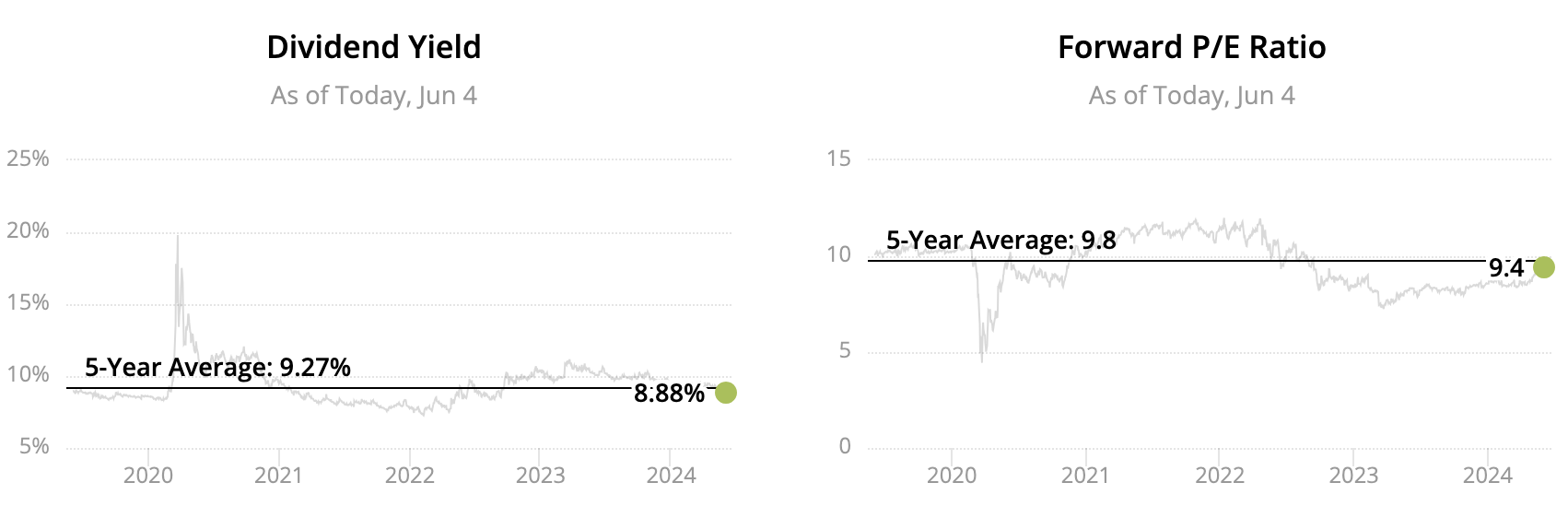

High Dividend Stock #18: Ares Capital

Sector: Financials – Business Development Companies

Dividend Yield: 8.9%

Dividend Safety Score: Borderline Safe

Uninterrupted Dividend Streak: 13 years

Source: Simply Safe Dividends

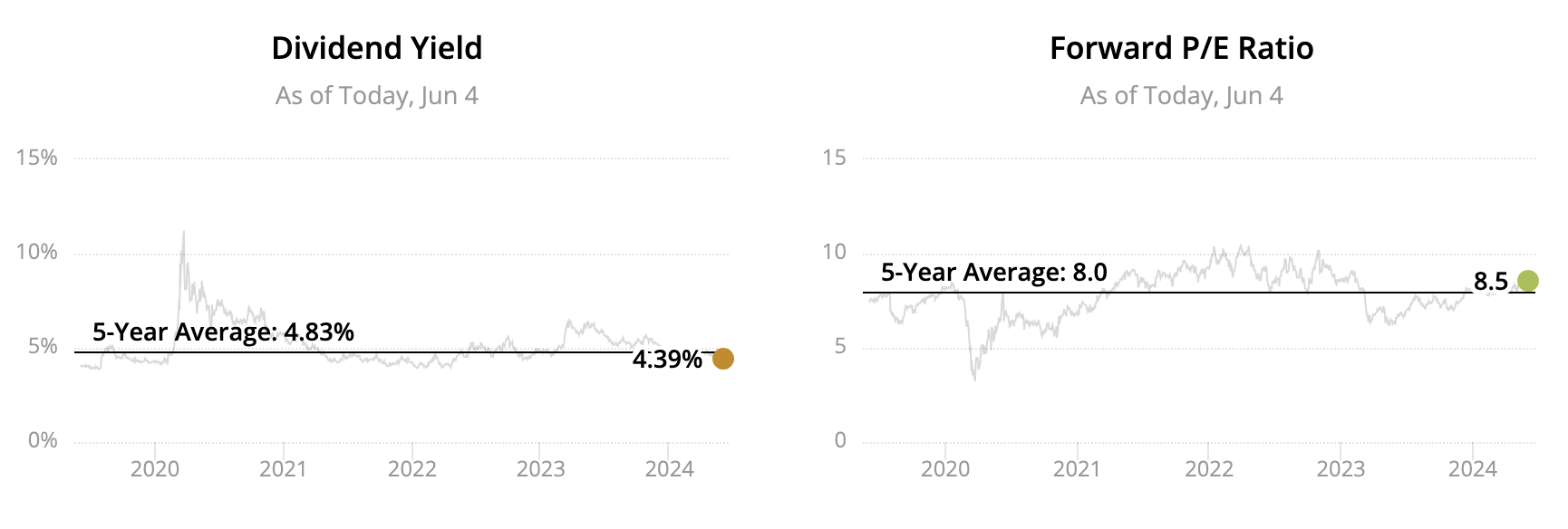

High Dividend Stock #17: Prudential Financial

Sector: Financials – Life and Health Insurance

Dividend Yield: 4.4%

Dividend Safety Score: Safe

Uninterrupted Dividend Streak: 15 years

Source: Simply Safe Dividends

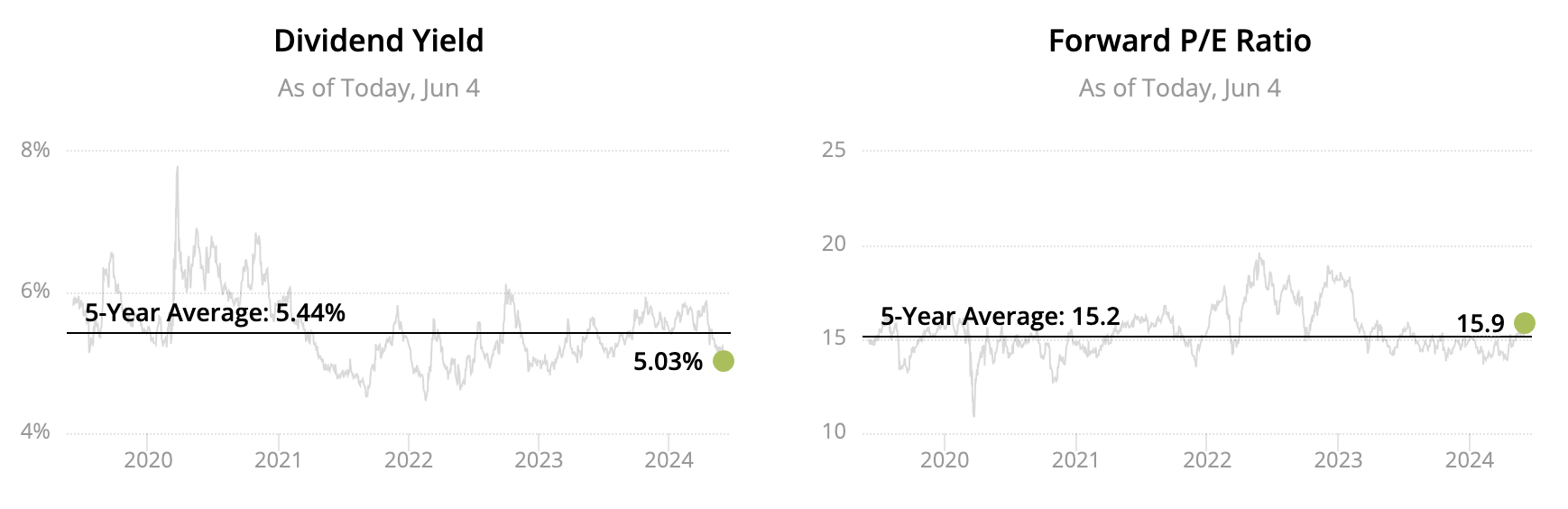

High Dividend Stock #16: Philip Morris International

Sector: Consumer Staples – Tobacco

Dividend Yield: 5.0%

Dividend Safety Score: Safe

Uninterrupted Dividend Streak: 15 years

Source: Simply Safe Dividends

High Dividend Stock #15: Main Street Capital

Sector: Financials – Business Development Companies

Dividend Yield: 5.9%

Dividend Safety Score: Safe

Uninterrupted Dividend Streak: 16 years

Source: Simply Safe Dividends

High Dividend Stock #14: Highwoods Properties

Sector: Real Estate – Office REITs

Dividend Yield: 7.8%

Dividend Safety Score: Borderline Safe

Uninterrupted Dividend Streak: 19 years

Source: Simply Safe Dividends

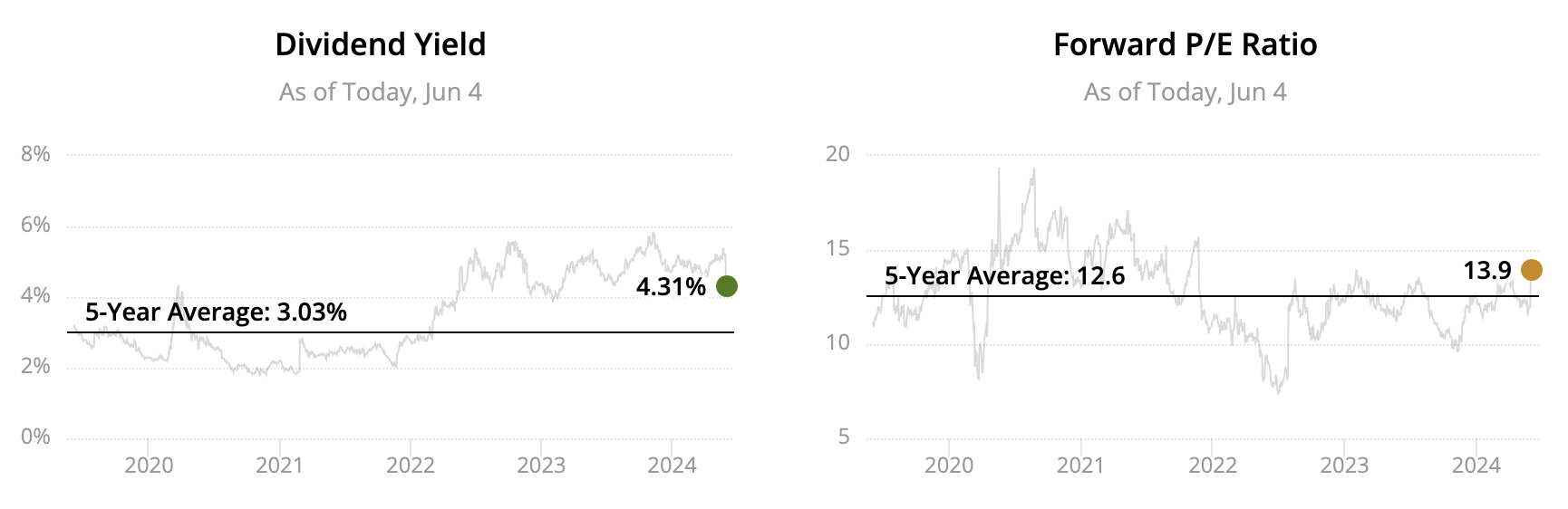

High Dividend Stock #13 Best Buy

Sector: Consumer Discretionary – Computer and Electronics Retail

Dividend Yield: 4.3%

Dividend Safety Score: Borderline Safe

Uninterrupted Dividend Streak: 20 years

Source: Simply Safe Dividends

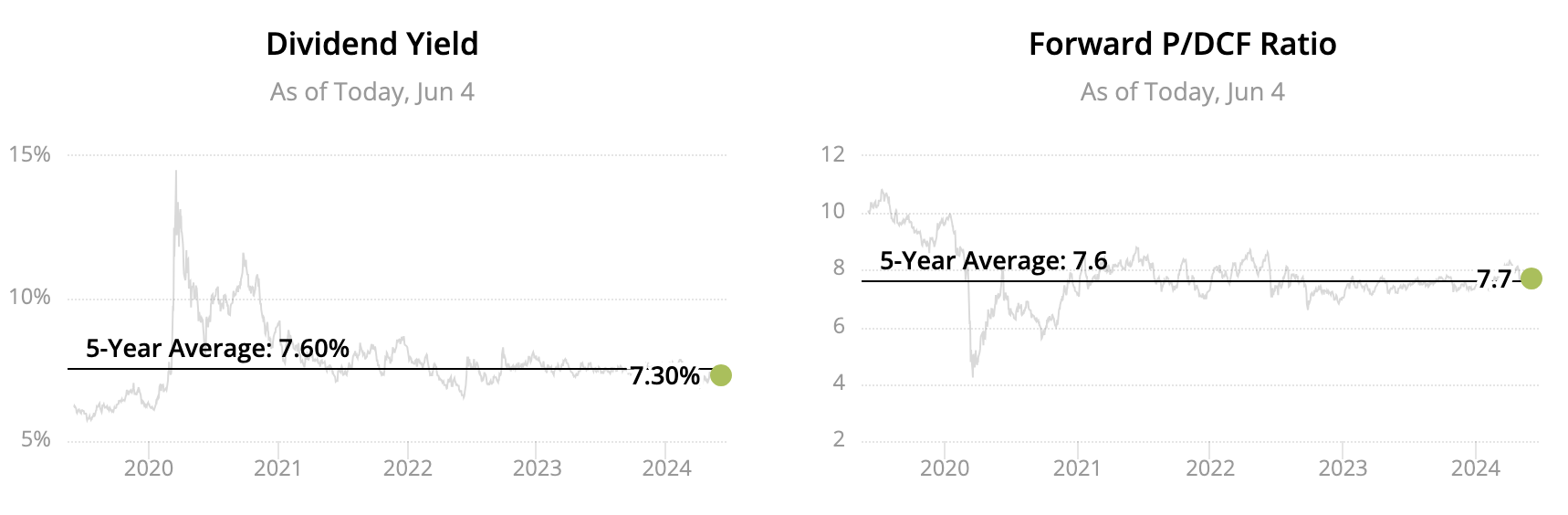

High Dividend Stock #12: Enterprise Products Partners

Sector: Energy – Oil and Gas Storage and Transportation

Dividend Yield: 7.3%

Dividend Safety Score: Safe

Uninterrupted Dividend Streak: 25 years

Source: Simply Safe Dividends

High Dividend Stock #11: Pembina Pipeline

Sector: Energy – Oil and Gas Storage and Transportation

Dividend Yield: 5.5%

Dividend Safety Score: Safe

Uninterrupted Dividend Streak: 27 years

Source: Simply Safe Dividends

High Dividend Stock #10: Pinnacle West

Sector: Utilities – Electric Utilities

Dividend Yield: 4.6%

Dividend Safety Score: Safe

Uninterrupted Dividend Streak: 30 years

Source: Simply Safe Dividends

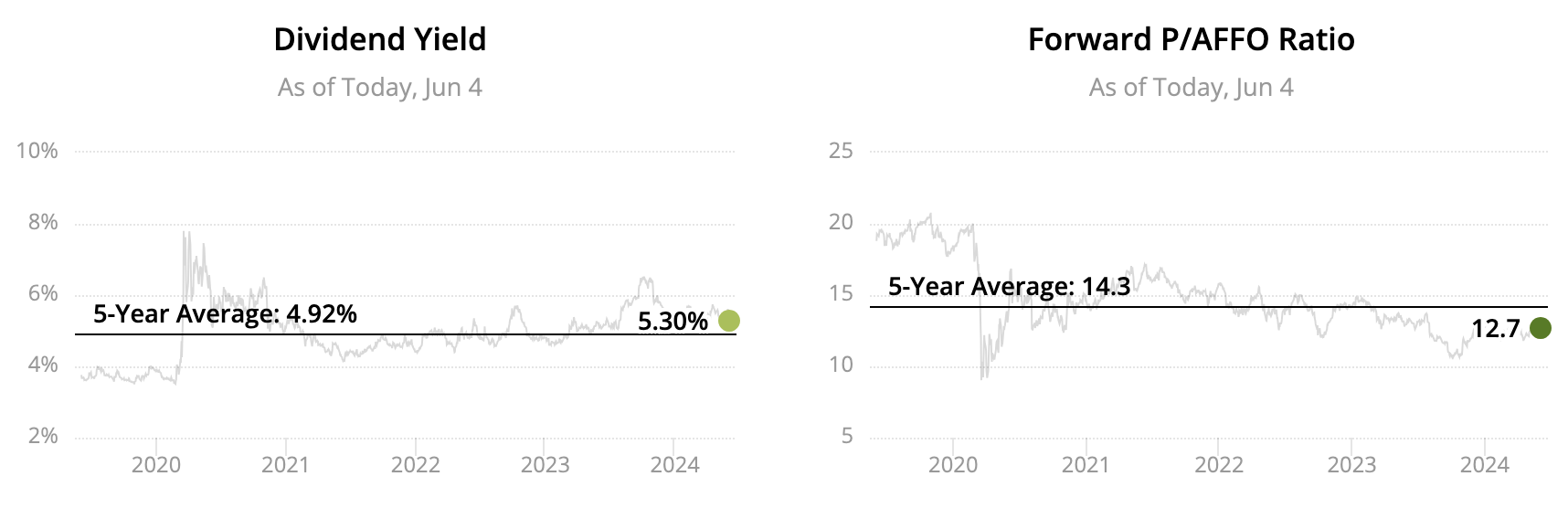

High Dividend Stock #9: NNN REIT

Sector: Real Estate – Retail REITs

Dividend Yield: 5.3%

Dividend Safety Score: Safe

Uninterrupted Dividend Streak: 36 years

Source: Simply Safe Dividends

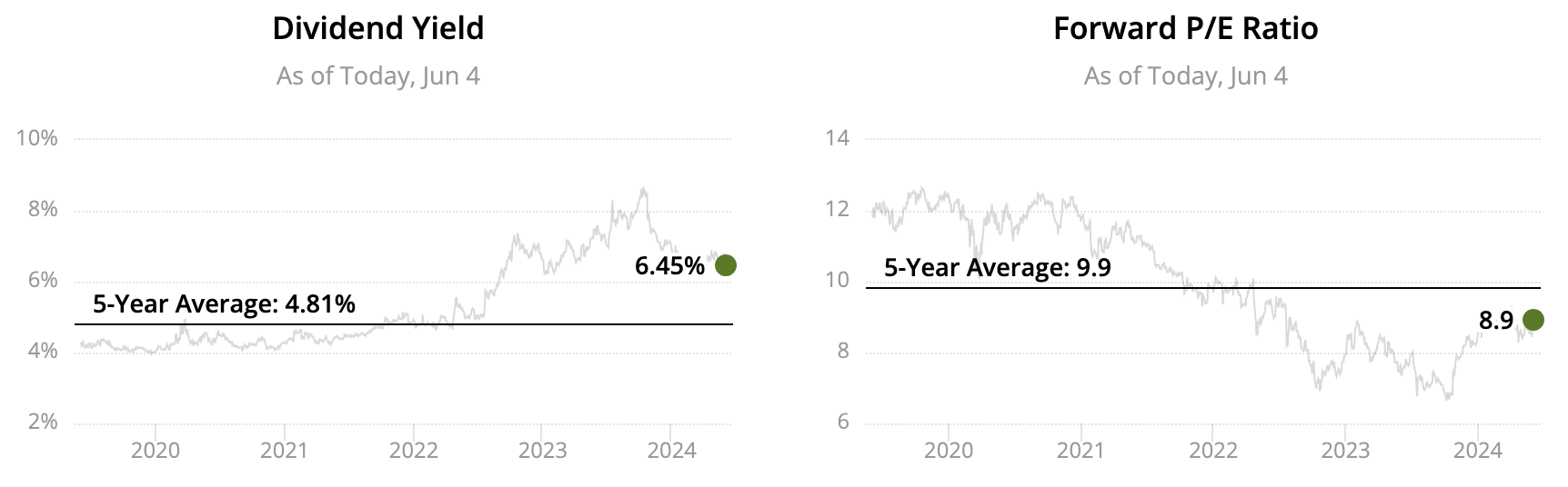

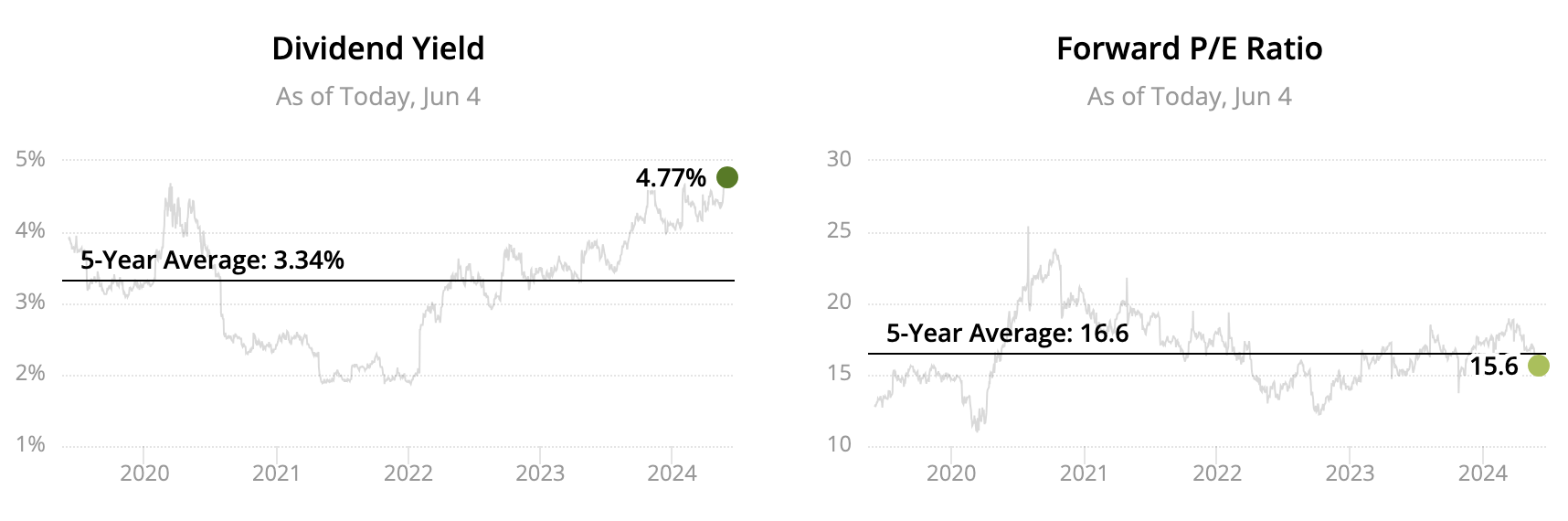

High Dividend Stock #8: Verizon

Sector: Communications – Wireless and Internet Services

Dividend Yield: 6.5%

Dividend Safety Score: Safe

Uninterrupted Dividend Streak: 40 years

Source: Simply Safe Dividends

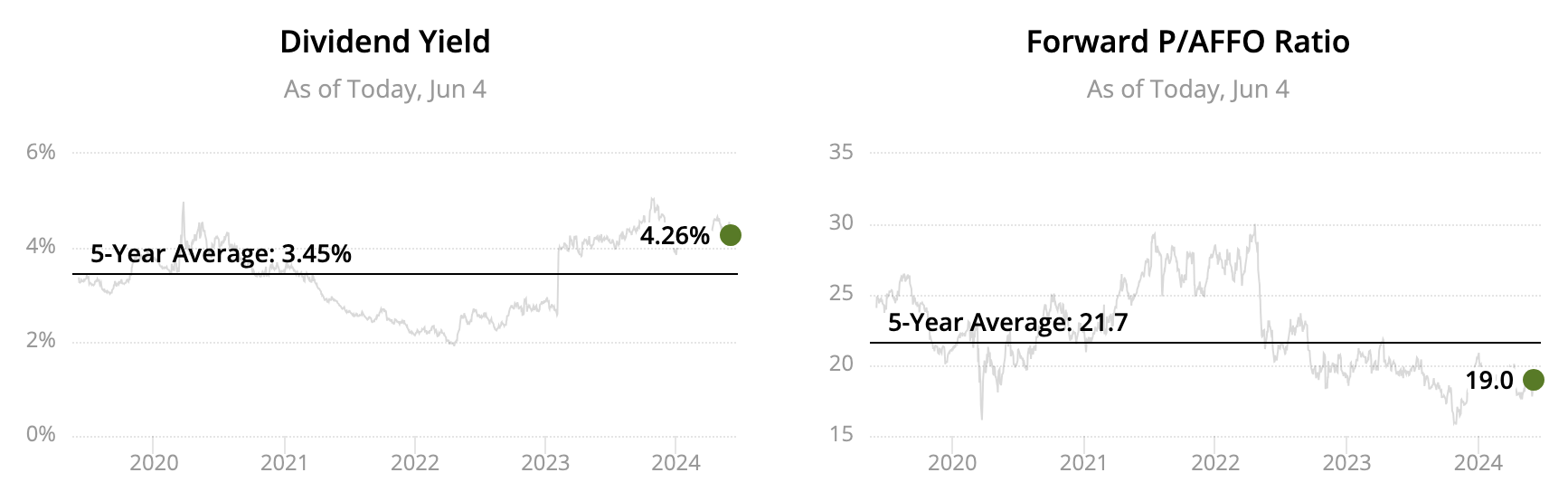

High Dividend Stock #7: Public Storage

Sector: Real Estate – Self-Storage REITs

Dividend Yield: 4.3%

Dividend Safety Score: Very Safe

Uninterrupted Dividend Streak: 43 years

Source: Simply Safe Dividends

High Dividend Stock #6: Ennis

Sector: Industrials – Commercial Printing

Dividend Yield: 4.8%

Dividend Safety Score: Safe

Uninterrupted Dividend Streak: 50 years

Source: Simply Safe Dividends

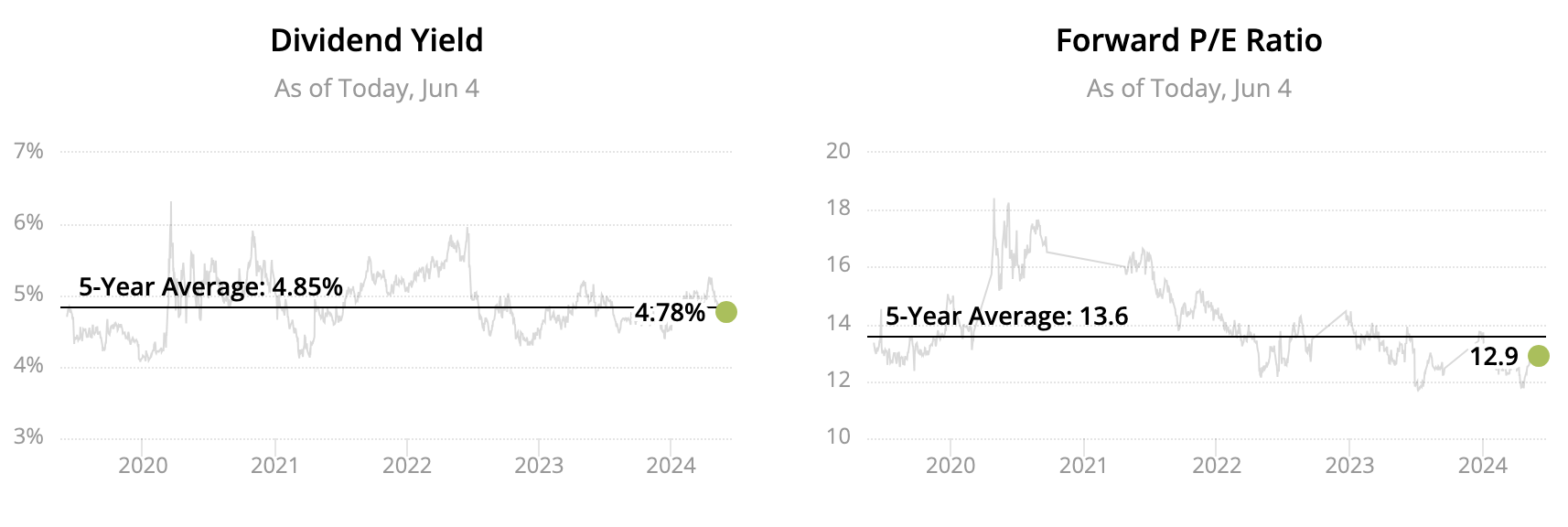

High Dividend Stock #5: United Parcel Service

Sector: Industrials – Air Freight and Logistics

Dividend Yield: 4.8%

Dividend Safety Score: Safe

Uninterrupted Dividend Streak: 55 years

Source: Simply Safe Dividends

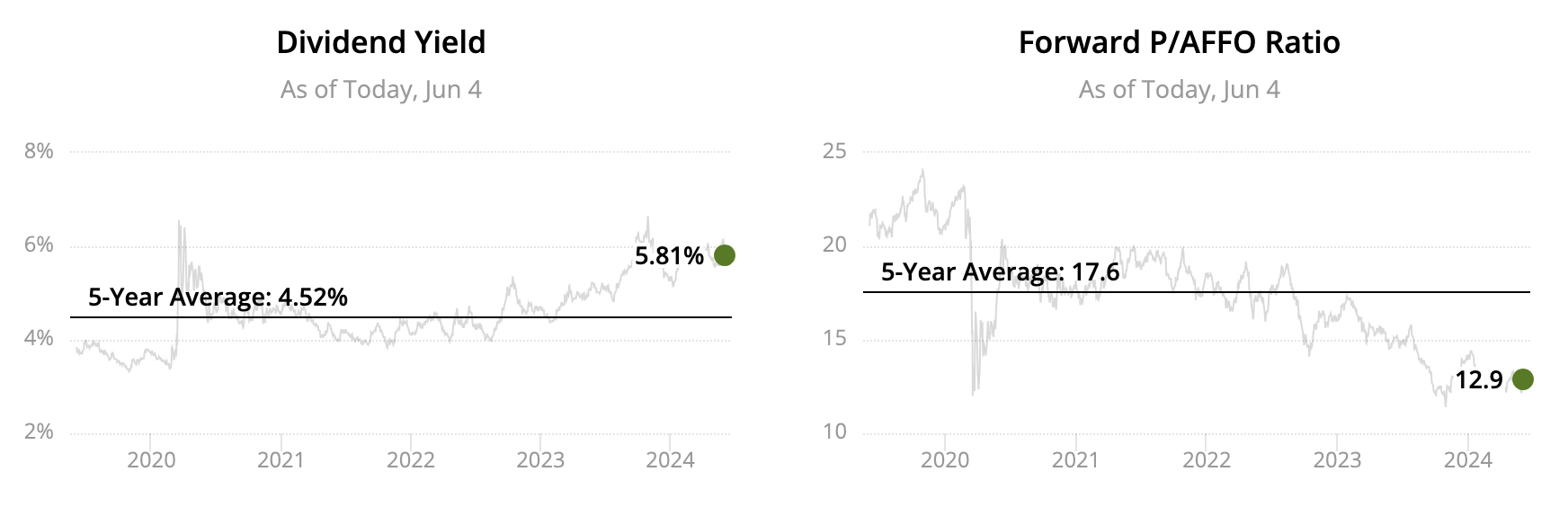

High Dividend Stock #4: Realty Income

Sector: Real Estate – Retail REITs

Dividend Yield: 5.8%

Dividend Safety Score: Safe

Uninterrupted Dividend Streak: 55 years

Source: Simply Safe Dividends

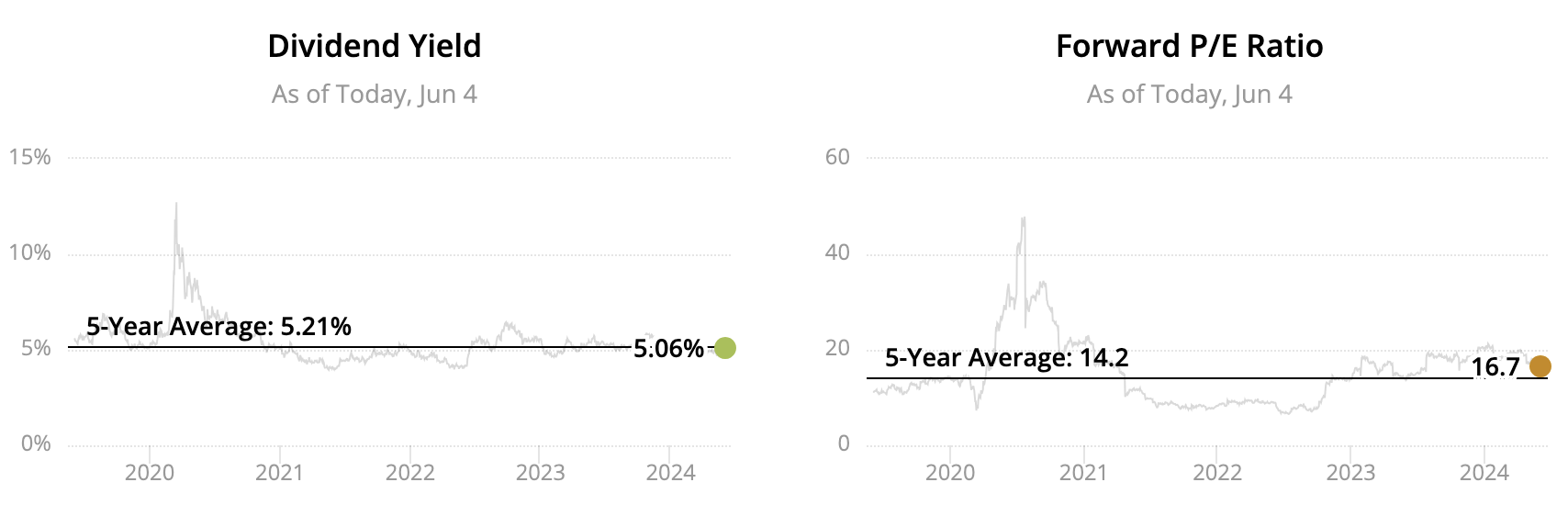

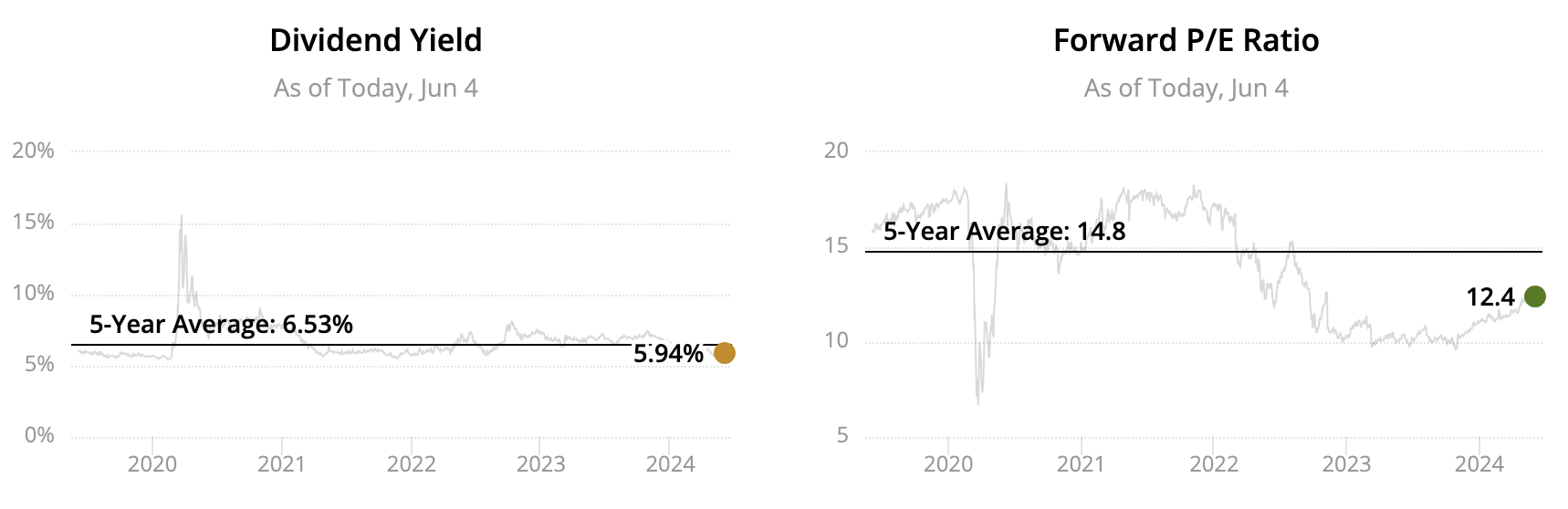

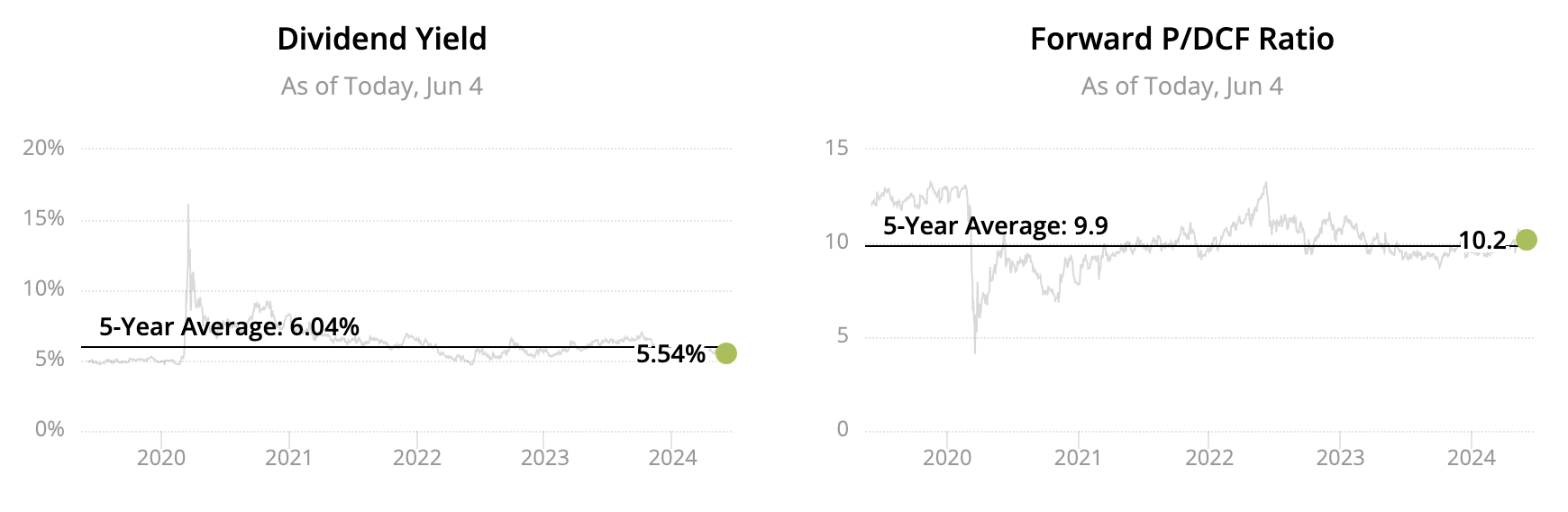

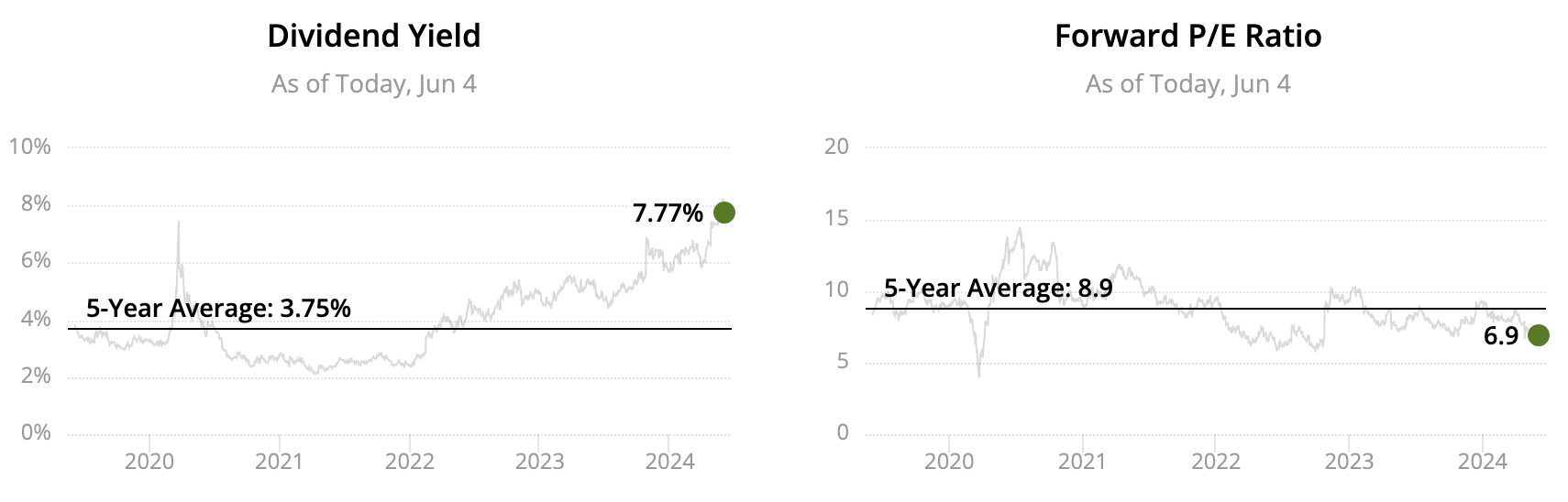

High Dividend Stock #3: Whirlpool

Sector: Consumer Discretionary – Household Appliances

Dividend Yield: 7.8%

Dividend Safety Score: Borderline Safe

Uninterrupted Dividend Streak: 68 years

Source: Simply Safe Dividends

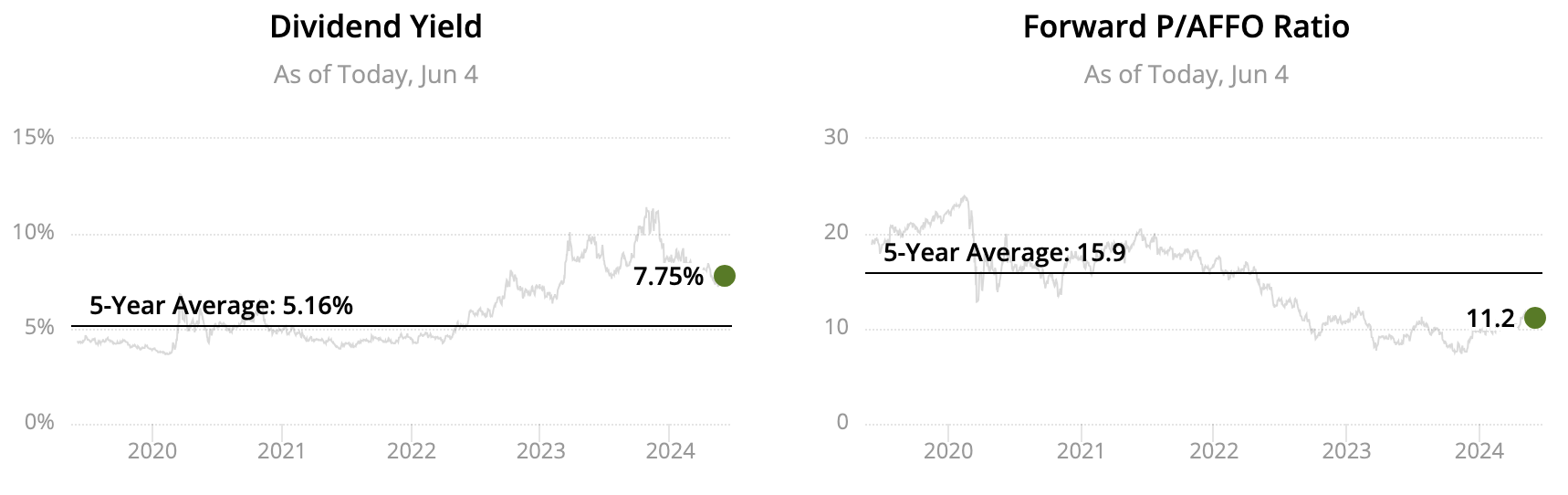

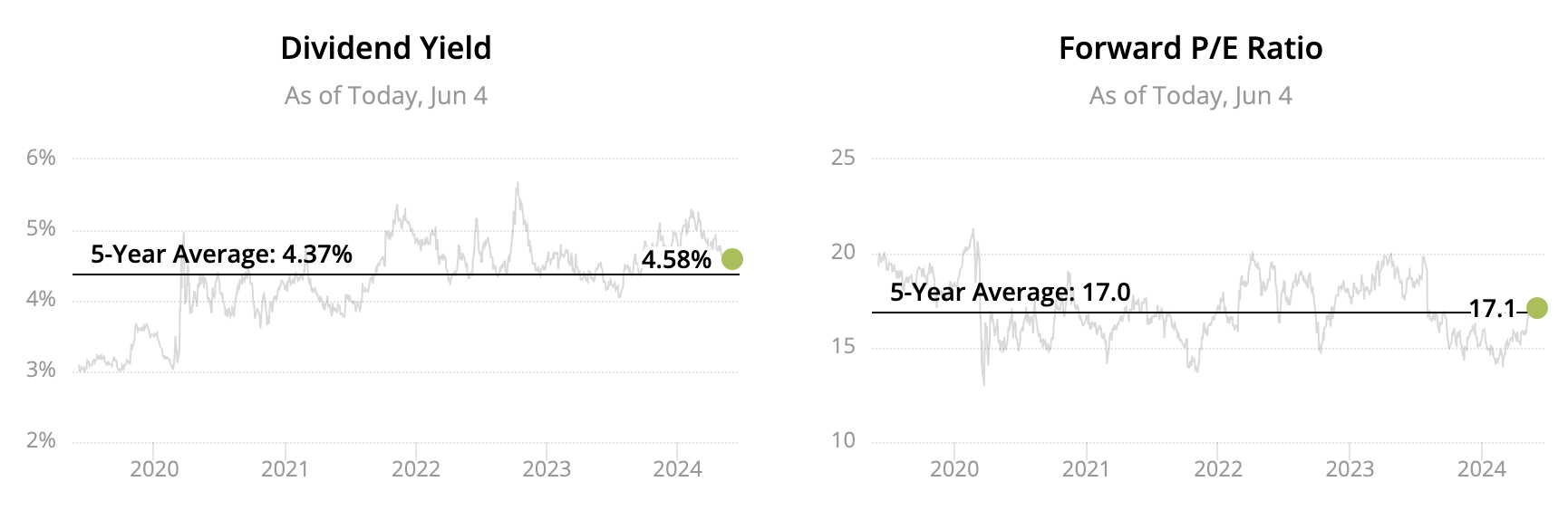

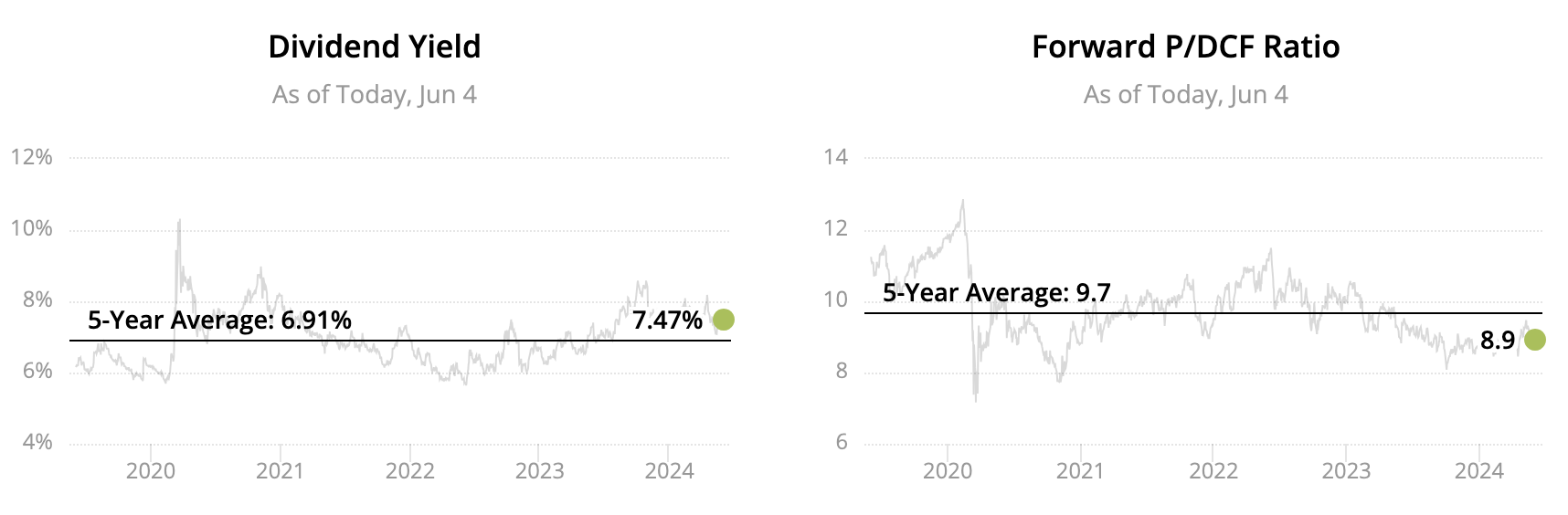

High Dividend Stock #2: Enbridge

Sector: Energy – Oil and Gas Storage and Transportation

Dividend Yield: 7.5%

Dividend Safety Score: Safe

Uninterrupted Dividend Streak: 71 years

Source: Simply Safe Dividends

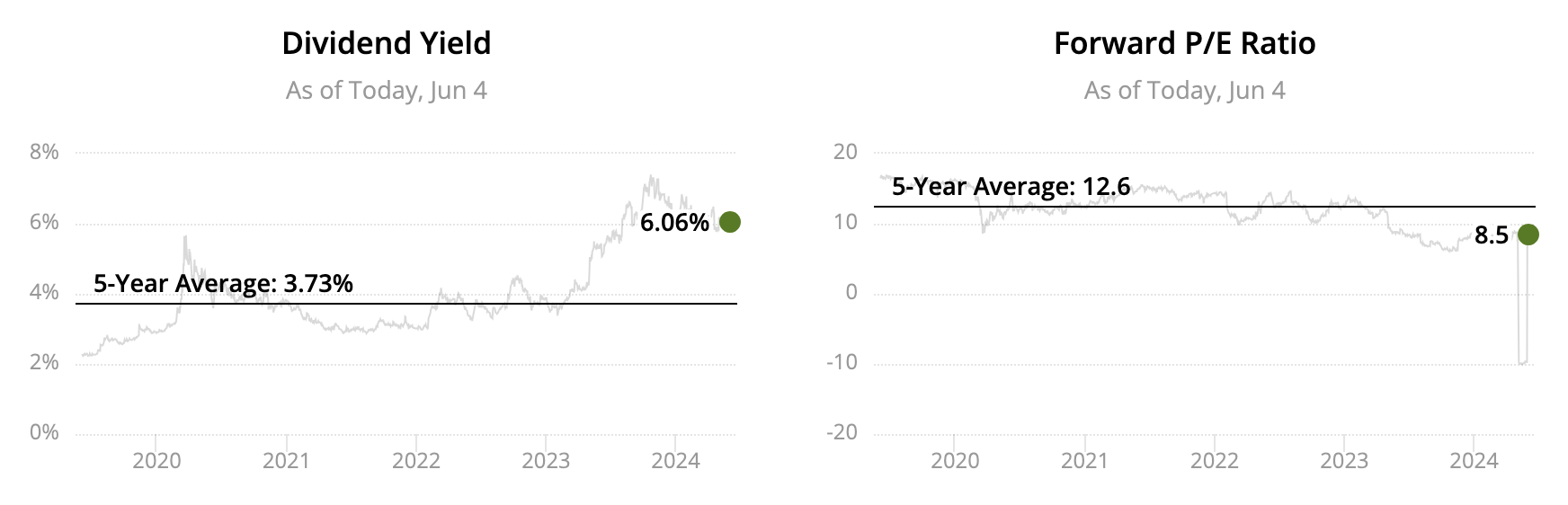

High Dividend Stock #1: UGI

Sector: Utilities – Gas Utilities

Dividend Yield: 6.1%

Dividend Safety Score: Borderline Safe

Uninterrupted Dividend Streak: 139 years

Source: Simply Safe Dividends

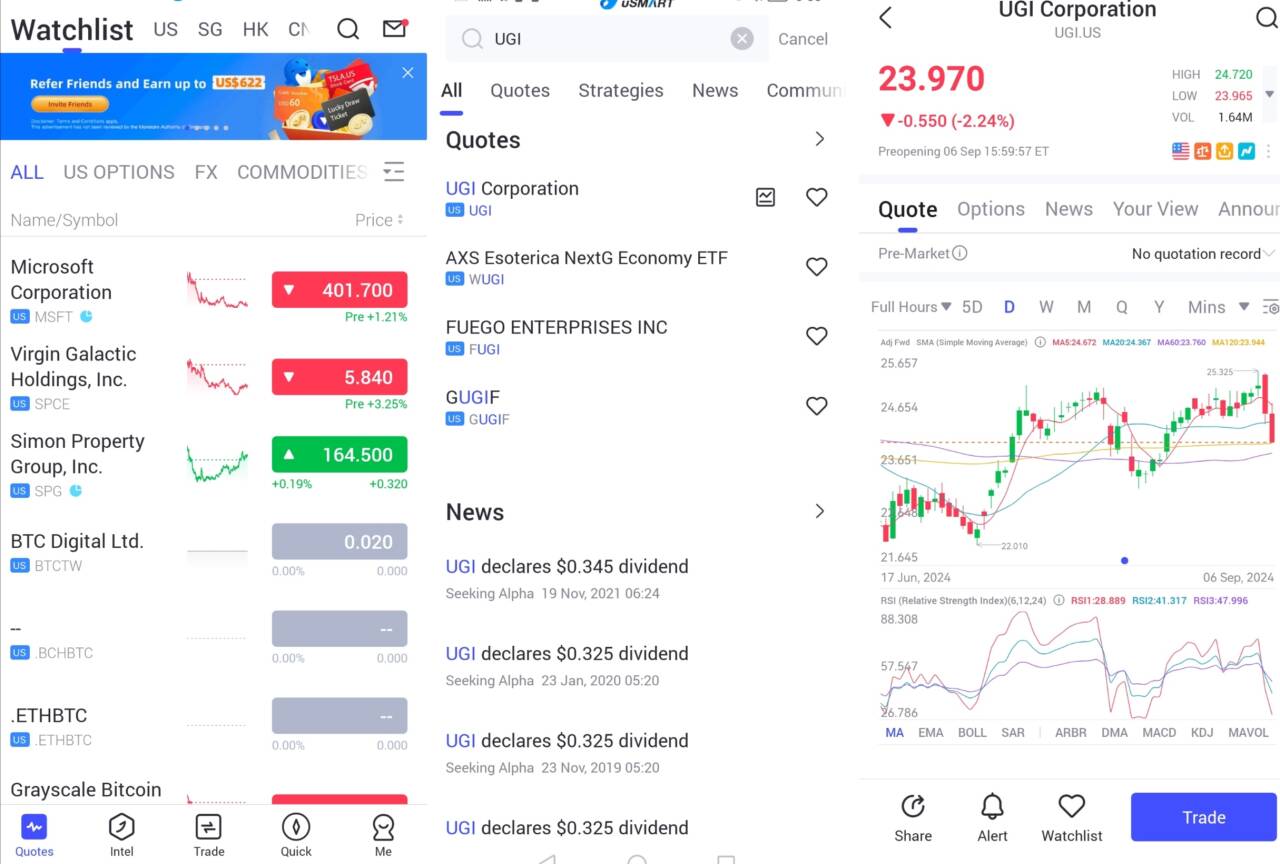

How to trade investments on uSMART:

After logging into uSMART SG APP, click "Search" from the upper right corner of the page, enter the target code, such as "UGI", and enter the details page to learn about transaction details and historical trends. Click "Trade" in the lower right corner and select "Buy/Sell" "Send" function, finally fill in the transaction conditions and send the order; the image operation instructions are as follows:

Source: uSMART SG

Follow us

Find us on Twitter, Instagram, YouTube, and TikTok for frequent updates on all things investing.

Have a financial topic you would like to discuss? Head over to the uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Important Notice and Disclaimer:

We have based this article on our internal research and information available to the public from sources we believe to be reliable. While we have taken all reasonable care in preparing this article, we do not represent the information contained in this article is accurate or complete and we accept no responsibility for errors of fact or for any opinion expressed in this article. Opinions, projections and estimates reflect our assessments as of the article date and are subject to change. We have no obligation to notify you or anyone of any such change. You must make your own independent judgment with respect to any matter contained in this article. Neither we or our respective directors, officers or employees will be responsible for any losses or damages which any person may suffer or incur as a result of relying upon anything stated or omitted from this article.

This document should not be construed in any jurisdiction as constituting an offer, solicitation, recommendation, inducement, endorsement, opinion, or guarantee to purchase, sell, or trade any securities, financial products, or instruments or to engage in any investment or any transaction of any kind, nor is there any intention to solicit or invite the purchase or sale of any securities.

The value of these securities and the income from them may fall or rise. Your investment is subject to investment risk, including loss of income and capital invested. Past performance figures as well as any projection or forecast used in this article is not indicative of its future performance.

This advertisement has not been reviewed by the Monetary Authority of Singapore

Singapore

Singapore Hongkong

Hongkong Global

Global Group

Group