On the evening of September 10th, 2024 (September 11th, Beijing time), the first televised debate between Democratic presidential candidate Vice President Kamala Harris and Republican presidential candidate former President Donald Trump took place.

The outcome of the debate between the Democrats and Republicans will determine which companies stand to gain. A Republican victory could mean lower corporate taxes and more moderate antitrust regulation, benefiting Wall Street, large tech companies, and others. Conversely, a Democratic win might lead to increased investment in green technology and more disposable income for low-income consumers.

Potential Beneficiaries if the Republicans Win:

Tractor Supply Company

This retail farm and ranch supply chain is expected to benefit from improved consumer confidence in rural communities. A Republican government may continue to support agricultural subsidies and assistance programs, which could boost demand for agricultural equipment, positively impacting Tractor Supply Company.

Goldman Sachs

The Biden-Harris administration has been actively challenging mergers that could harm consumer interests, including the proposed merger between JetBlue and Spirit Airlines, as well as the merger between luxury brands Coach and Michael Kors' parent company. This has created a "chilling effect" on strategic mergers and acquisitions. A Trump victory could lead to a surge in deals, with Goldman Sachs, as a leading M&A bank, likely to benefit. The Republican tendency to reduce financial industry regulations could also benefit Goldman Sachs by lowering compliance costs and providing greater business flexibility, such as fewer regulatory restrictions on transactions and investments.

Tesla

If the Republicans are in power, they might eliminate additional incentives for corporate investment in new green technologies while retaining incentives for projects already underway. This could benefit Tesla, as reduced zero-emission investment by competitors would allow Tesla to capture a larger market share.

Apple

Earlier this year, the Biden-Harris administration's Department of Justice filed an antitrust lawsuit against this iPhone manufacturer, accusing it of overly restrictive control over interactions between its devices and external applications. Investors may anticipate a Republican administration to adopt a more lenient approach to antitrust issues and AI regulation, benefiting Apple as it integrates AI into its popular phones.

AT&T

As a major corporate taxpayer, AT&T would benefit if Republicans follow through on their promise to lower the corporate tax rate from 21% to 15%. In contrast, the Democrats have expressed a desire to increase the rate to 28%.

Potential Beneficiaries if the Democrats Win:

Comcast

Democrats are expected to support allowing unlicensed or shared use of newly available wireless spectrum, whereas Republicans favor licensing agreements. This approach could help Comcast expand its growing mobile business.

AppLovin

This company assists software developers in finding ways to monetize their applications. If the Democrats win, AppLovin could emerge as a significant beneficiary.

SunRun

This solar panel installation company is likely to benefit from the Democrats' commitment to clean energy. Democrats are more inclined to invest in green infrastructure and support the development of renewable energy technologies, including wind, solar, and electric vehicles.

KKR

KKR has raised billions in infrastructure funds, which will benefit as the U.S. and other countries transition from fossil fuels to clean energy. A Democratic victory could accelerate this transition.

Five Below

Inflation has severely impacted Five Below's core low-income customers, dragging down the discount retailer's stock price. However, Democratic tax policies could increase these consumers' disposable income while reducing the risk of rising tariffs on Chinese imports, a significant potential headwind for companies reliant on imported goods.

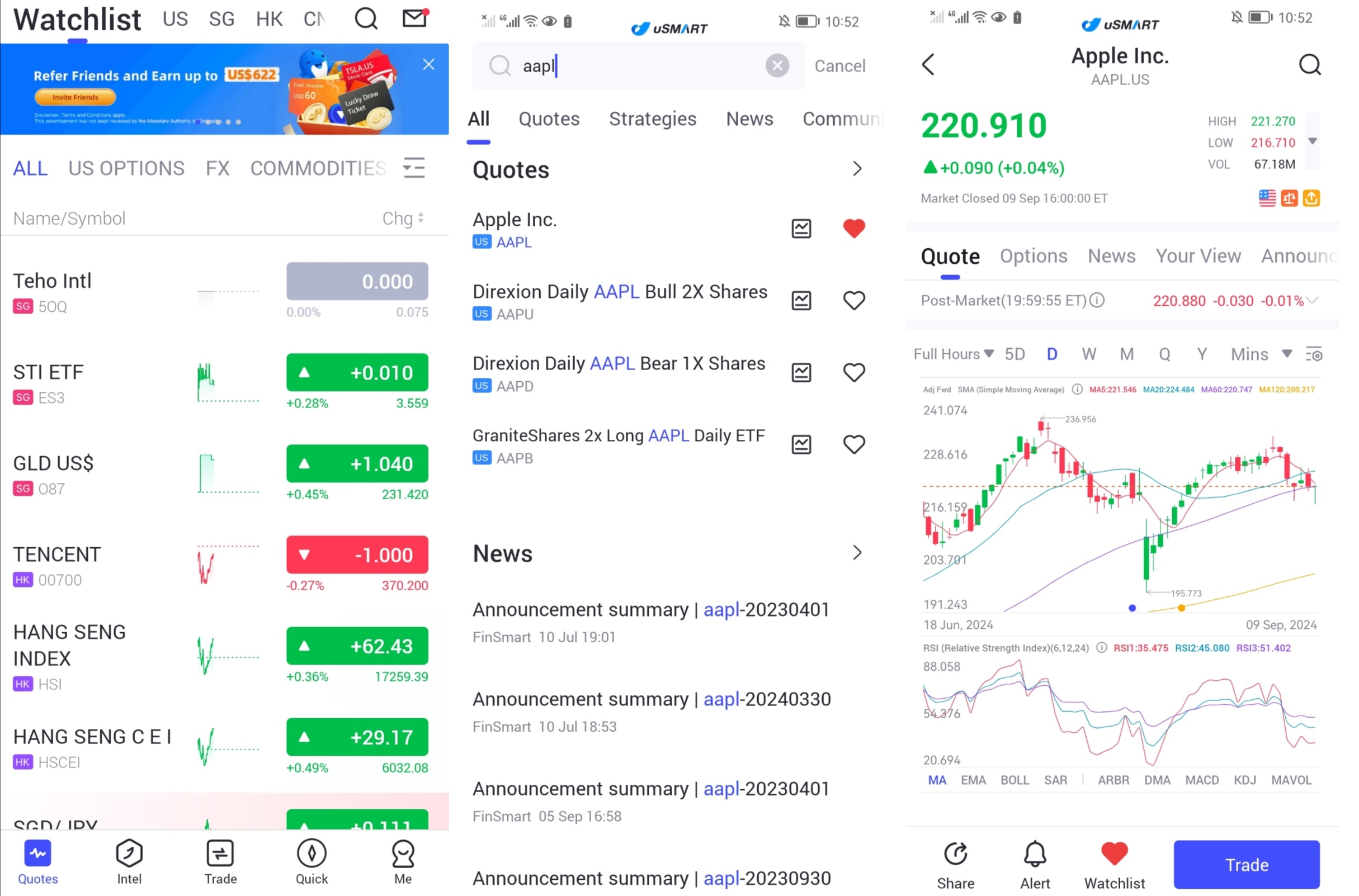

How to trade investments on uSMART:

After logging into uSMART SG APP, click "Search" from the upper right corner of the page, enter the target code, such as "APPL", and enter the details page to learn about transaction details and historical trends. Click "Trade" in the lower right corner and select "Buy/Sell" "Send" function, finally fill in the transaction conditions and send the order; the image operation instructions are as follows:

Source: uSMART SG

Follow us

Find us on Twitter, Instagram, YouTube, and TikTok for frequent updates on all things investing.

Have a financial topic you would like to discuss? Head over to the uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Important Notice and Disclaimer:

We have based this article on our internal research and information available to the public from sources we believe to be reliable. While we have taken all reasonable care in preparing this article, we do not represent the information contained in this article is accurate or complete and we accept no responsibility for errors of fact or for any opinion expressed in this article. Opinions, projections and estimates reflect our assessments as of the article date and are subject to change. We have no obligation to notify you or anyone of any such change. You must make your own independent judgment with respect to any matter contained in this article. Neither we or our respective directors, officers or employees will be responsible for any losses or damages which any person may suffer or incur as a result of relying upon anything stated or omitted from this article.

This document should not be construed in any jurisdiction as constituting an offer, solicitation, recommendation, inducement, endorsement, opinion, or guarantee to purchase, sell, or trade any securities, financial products, or instruments or to engage in any investment or any transaction of any kind, nor is there any intention to solicit or invite the purchase or sale of any securities.

The value of these securities and the income from them may fall or rise. Your investment is subject to investment risk, including loss of income and capital invested. Past performance figures as well as any projection or forecast used in this article is not indicative of its future performance.

This advertisement has not been reviewed by the Monetary Authority of Singapore

Singapore

Singapore Hongkong

Hongkong Group

Group Global

Global