Oracle Shares Surge Over 11% to Record High as Oil Prices Plunge to Three-Year Low

JPMorgan Chase shares dropped more than 5% due to lowered earnings forecasts, at one point falling 7.5%—the worst drop in four years. Bank of America reported that its investment banking performance would fall short of expectations, while Goldman Sachs anticipated a 10% decline in trading revenues year-over-year. Ally Financial reported worsening borrower credit, leading to a series of pessimistic forecasts for the financial sector, which heightened risk aversion in U.S. stock markets. The Dow Jones Industrial Average briefly dropped over 400 points. However, tech giants’ rising stock prices boosted the market, offsetting the decline in financial stocks. Oracle shares soared nearly 15% to a historic high, propelling the Nasdaq to lead major indices.

After the close of trading yesterday, Oracle released its first-quarter fiscal results for the year ending August 30. The company’s quarterly sales and earnings exceeded Wall Street’s average expectations, and it announced new cloud partnerships with Amazon and Alphabet.

Data Source: uSMART SG

Strong Cloud Computing Growth Drives Oracle’s Q1 Results Above Expectations

Oracle reported non-GAAP adjusted earnings per share (EPS) of $1.39 for Q1, with revenue totaling $13.3 billion. The company’s earnings performance was $0.06 per share above analysts' average expectations, and sales exceeded the average forecast by $60 million.

Sales grew by 6.8% year-over-year, with even more encouraging growth metrics. Remaining performance obligations (a measure of services from signed contracts yet to be delivered and recorded as revenue) increased 53% year-over-year to $99 billion. Meanwhile, total cloud revenue grew 21% year-over-year to $5.6 billion.

Within the cloud segment, Infrastructure as a Service (IaaS) sales grew 45% year-over-year to $2.2 billion, and Software as a Service (SaaS) revenue increased 10% year-over-year to $3.3 billion.

Oracle Provides Solid Guidance and Secures New Cloud Partnerships

For the second fiscal quarter, Oracle expects sales to grow by 7% to 9% at constant currency. Management forecasts cloud revenue growth of 23% to 25% adjusted for currency, with EPS expected between $1.42 and $1.46—a midpoint growth rate of about 8%.

In addition to reliable forward guidance, the company introduced new cloud integrations. In yesterday’s earnings update, Oracle announced a new partnership with Amazon Web Services (AWS) and introduced a new service allowing AWS users to utilize Oracle Autonomous Database and Oracle Exadata services. Oracle also highlighted similar offerings from Alphabet’s Google Cloud Infrastructure.

Compared to Amazon, Microsoft, and Alphabet, Oracle remains a smaller player in the cloud infrastructure space, but it has shown some encouraging momentum. The new database integrations with leading IaaS providers should help the company expand its overall influence in this sector and become a more important part of customers’ multi-cloud strategies.

International Oil Prices Plunge

On September 10th, U.S. Eastern Time, international oil prices plummeted, with U.S. crude oil briefly falling over 5% to a near three-year low. On September 10th, OPEC (Organization of the Petroleum Exporting Countries) released its latest monthly report, downgrading its global oil demand growth forecast for this and next year—marking the second consecutive reduction.

By the close of U.S. markets, October WTI crude oil futures settled down $2.96, or 4.31%, at $65.75 per barrel, currently trading at $66.31 per barrel.

Data Source: uSMART SG

International Oil Prices Hit New Lows

On the evening of September 10th, international oil prices “crashed” significantly. Prices fell again due to strong supply, demand concerns, and rampant speculative selling. Brent crude oil fell below $70 per barrel for the first time since December 2021, with a nearly 4% drop during the day, while U.S. crude prices fell nearly 5%.

The sharp drop in crude oil prices led to a decline in U.S. energy stocks across the board. The S&P 500 Energy Index fell over 2.3%, reaching its lowest point since February. Individual stocks also suffered: ExxonMobil fell 3.65%, Schlumberger dropped 2%, ConocoPhillips declined 1.52%, Chevron fell 1.48%, and Occidental Petroleum dropped 1.1%.

Multiple Negative Factors Pressuring Oil Prices

Recent declines in oil prices have wiped out all gains made since the start of 2024. Concerns about a potential oversupply of oil have been triggered by Libya’s full resumption of production and OPEC+ extending production cuts.

Analysts point out that weak economic data has raised concerns about oil demand in the world’s two largest consuming countries, exacerbating fears of an oversupply next year.

Oil production from non-OPEC countries has surged, further aggravating the situation. Speculators currently hold the lowest net long positions in crude oil on record, indicating that part of the oil price drop is driven by significant changes in financial positions.

OPEC’s monthly report on Tuesday forecasted that global oil demand will increase by 2.03 million barrels per day in 2024, down from the previously expected 2.11 million barrels. OPEC also revised its 2025 global demand growth forecast down from 1.78 million barrels to 1.74 million barrels.

How to trade investments on uSMART:

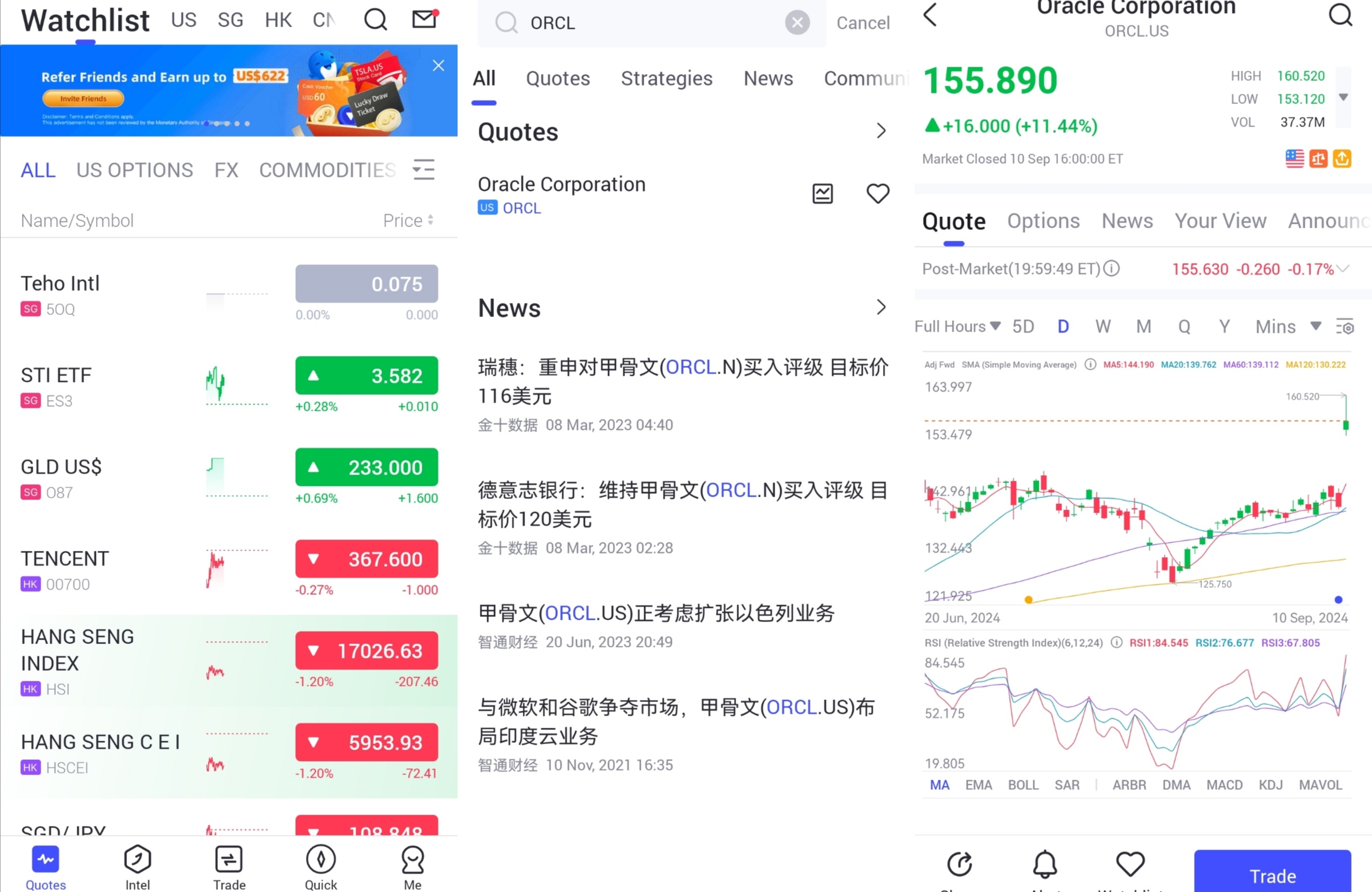

After logging into uSMART SG APP, click "Search" from the upper right corner of the page, enter the target code, such as "ORCL", and enter the details page to learn about transaction details and historical trends. Click "Trade" in the lower right corner and select "Buy/Sell" "Send" function, finally fill in the transaction conditions and send the order; the image operation instructions are as follows:

Source: uSMART SG

Follow us

Find us on Twitter, Instagram, YouTube, and TikTok for frequent updates on all things investing.

Have a financial topic you would like to discuss? Head over to the uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Important Notice and Disclaimer:

We have based this article on our internal research and information available to the public from sources we believe to be reliable. While we have taken all reasonable care in preparing this article, we do not represent the information contained in this article is accurate or complete and we accept no responsibility for errors of fact or for any opinion expressed in this article. Opinions, projections and estimates reflect our assessments as of the article date and are subject to change. We have no obligation to notify you or anyone of any such change. You must make your own independent judgment with respect to any matter contained in this article. Neither we or our respective directors, officers or employees will be responsible for any losses or damages which any person may suffer or incur as a result of relying upon anything stated or omitted from this article.

This document should not be construed in any jurisdiction as constituting an offer, solicitation, recommendation, inducement, endorsement, opinion, or guarantee to purchase, sell, or trade any securities, financial products, or instruments or to engage in any investment or any transaction of any kind, nor is there any intention to solicit or invite the purchase or sale of any securities.

The value of these securities and the income from them may fall or rise. Your investment is subject to investment risk, including loss of income and capital invested. Past performance figures as well as any projection or forecast used in this article is not indicative of its future performance.

This advertisement has not been reviewed by the Monetary Authority of Singapore

Singapore

Singapore Hongkong

Hongkong Global

Global Group

Group