Following statements by Nvidia CEO Jensen Huang, the company's stock price surged as he mentioned strong demand. Huang stated that Nvidia plans to expand production in the fourth quarter due to overwhelming demand for the Blackwell chips. He also predicted that innovation in AI computing will continue to accelerate, with Nvidia aiming for significant performance improvements every two years.

Huang's comments about the huge demand for AI chips drove Nvidia’s stock price up significantly. During early trading, Nvidia's stock briefly fell to $107 but closed at $116.90, marking an 8.15% increase and adding $215.8 billion to its market value, which translates to 1.5369 trillion RMB. Analysts noted that this is the first time since October 2022—almost two years—when the S&P 500 and Nasdaq 100 indexes have completely erased an intraday decline of at least 1.5%. In other words, Nvidia and Huang managed to counteract the negative impact of the U.S. August CPI inflation data on the stock market with their performance.

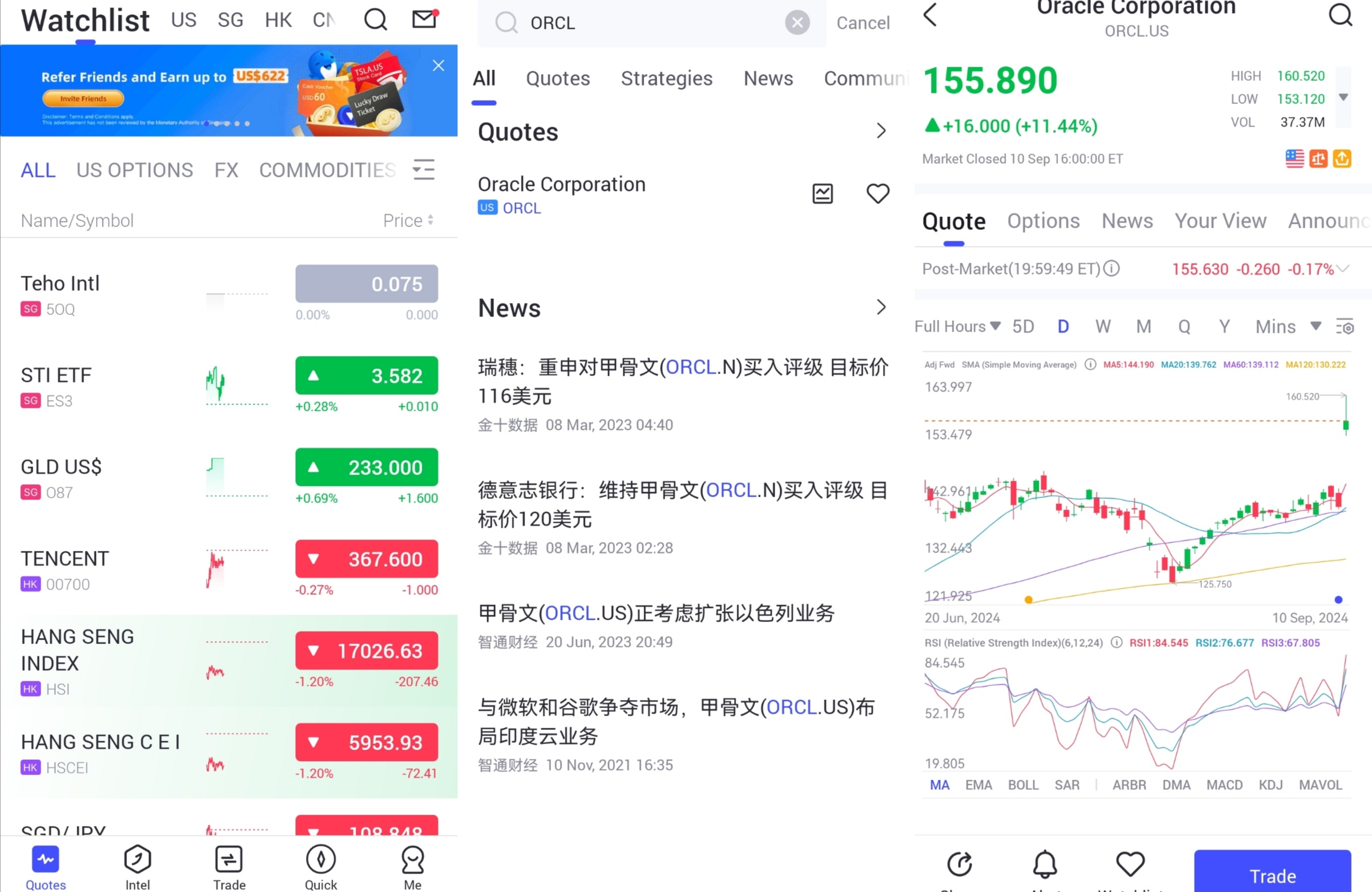

Data Source: uSMART SG

Blackwell's High Demand Creates Tension with Clients

Nvidia CEO Jensen Huang commented that limited supply of popular chip products has frustrated some clients, leading to strained relationships. Speaking at a Goldman Sachs technology conference in San Francisco, he said, "The demand is so high that everyone wants to be among the first to get them. Everyone wants to order as many as possible. Our clients are understandably excited and quite tense, and we are doing our best." The strong demand for Nvidia’s latest-generation AI chip, Blackwell, has led businesses to adopt "accelerated computing" to meet AI needs. Analysts noted that Huang’s keynote was seen as an opportunity to calm investor anxieties, following a nearly 14% drop in Nvidia’s stock and a $400 billion drop in market value the previous week. Despite recent sell-offs, Nvidia's stock has still risen nearly 150% over the past 12 months.

Nvidia's Q2 Performance

Nvidia's earnings exceeded Wall Street expectations. Revenue was $30.04 billion, surpassing analysts’ expectations of $28.7 billion and representing a 122% increase from the same period last year. Earnings also beat the forecast of $0.65 per share, reaching $0.68 per share, a 152% increase from the previous year. The leading AI chip company also expects revenue for the current quarter to reach $32.5 billion, above the expected $31.7 billion.

After the earnings report, the stock rebounded above the 50-day moving average but fell below it by the end of the trading day. Ongoing market volatility highlights the importance of risk management and timing in stock selection. Nvidia’s all-time high adjusted for stock splits is $140.76, which might be the next buying point. Prior to the earnings report, the stock briefly broke through the trend line around $130.75. The trend line entry point offers an earlier buying opportunity for investors but is considered a more aggressive entry point, especially before earnings are announced. The stock remains below this level.

How to trade investments on uSMART:

After logging into uSMART SG APP, click "Search" from the upper right corner of the page, enter the target code, such as "NVDA, and enter the details page to learn about transaction details and historical trends. Click "Trade" in the lower right corner and select "Buy/Sell" "Send" function, finally fill in the transaction conditions and send the order; the image operation instructions are as follows:

Source: uSMART SG

Follow us

Find us on Twitter, Instagram, YouTube, and TikTok for frequent updates on all things investing.

Have a financial topic you would like to discuss? Head over to the uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Important Notice and Disclaimer:

We have based this article on our internal research and information available to the public from sources we believe to be reliable. While we have taken all reasonable care in preparing this article, we do not represent the information contained in this article is accurate or complete and we accept no responsibility for errors of fact or for any opinion expressed in this article. Opinions, projections and estimates reflect our assessments as of the article date and are subject to change. We have no obligation to notify you or anyone of any such change. You must make your own independent judgment with respect to any matter contained in this article. Neither we or our respective directors, officers or employees will be responsible for any losses or damages which any person may suffer or incur as a result of relying upon anything stated or omitted from this article.

This document should not be construed in any jurisdiction as constituting an offer, solicitation, recommendation, inducement, endorsement, opinion, or guarantee to purchase, sell, or trade any securities, financial products, or instruments or to engage in any investment or any transaction of any kind, nor is there any intention to solicit or invite the purchase or sale of any securities.

The value of these securities and the income from them may fall or rise. Your investment is subject to investment risk, including loss of income and capital invested. Past performance figures as well as any projection or forecast used in this article is not indicative of its future performance.

This advertisement has not been reviewed by the Monetary Authority of Singapore

Singapore

Singapore Hongkong

Hongkong Group

Group Global

Global