The U.S. stock market had a rough start in September, with the Dow Jones Industrial Average falling by 2.93% this week, the S&P 500 dropping by 4.25%, and the Nasdaq Composite falling by 5.77%. Both the Dow and the S&P 500 experienced their largest weekly declines since March 2023, ending a three-week streak of gains, while the Nasdaq saw its largest weekly drop since January 2022.

Recently, chip stocks have been struggling. Intel, a direct competitor to Nvidia, has dropped nearly 9% from a one-month high, while AMD has fallen almost 8% to a three-week low. TSMC, the world's largest semiconductor foundry, saw its U.S. stock fall by 6.5%, and another major foundry, GlobalFoundries, declined by 8.6%. Semiconductor equipment manufacturers such as KLA dropped 9.5%, Applied Materials fell by 7%, and ASML decreased by 6.5%. Qualcomm dropped 6.9%, and Broadcom, which is set to release its third-quarter report on Thursday, fell more than 6%. Micron Technology also dropped about 8%, and ARM, which had bucked the trend and risen last Thursday while Nvidia fell, saw its stock decline by nearly 7%.

Despite Nvidia’s recent stock downturn, most analysts still maintain a "buy" rating on the company, suggesting that there is still room for stock price appreciation and that Nvidia’s long-term prospects remain positive. For instance, Tesla CEO Elon Musk has highlighted that despite recent investor concerns, demand for Nvidia’s existing product line remains strong. His AI startup, xAI, has successfully launched the Colossus AI training infrastructure in just 122 days, powered by 100,000 Nvidia H100 GPUs, and will integrate Nvidia’s H200 chips in the future, doubling its scale within a few months.

Here are some chip stocks that many analysts are particularly optimistic about:

NVIDIA: Recently, Nvidia’s CEO Jensen Huang revealed that demand for Blackwell chips is so high that it has led to a supply shortage. This statement caused Nvidia’s stock to surge in the short term and, more importantly, boosted investor confidence in the company's AI-related investments.

AMD: In the CPU battle of the second quarter this year, AMD stood out significantly, surpassing Intel and becoming a focal point in the market. While Cramer noted that Nvidia faces competition in the semiconductor sector, he asserted that AMD’s product demand remains strong and that AMD is a close competitor in the supercomputing market. He was also impressed with AMD’s performance in the recent quarter and the deals announced this summer.

Micron: Some investors consider Micron to be the "leader in the memory chip market," noting that large-scale data center builders need memory chips. Based on the company’s earnings forecast for the next fiscal year, some believe that the stock is currently undervalued.

Arm: Since its IPO a year ago, Arm’s stock has more than doubled, and the chip design company's licensing fees provide a predictable revenue stream. The stock rose on Monday following a report that Apple is developing a chip using Arm’s designs, likely for the iPhone 16.

How to trade investments on uSMART:

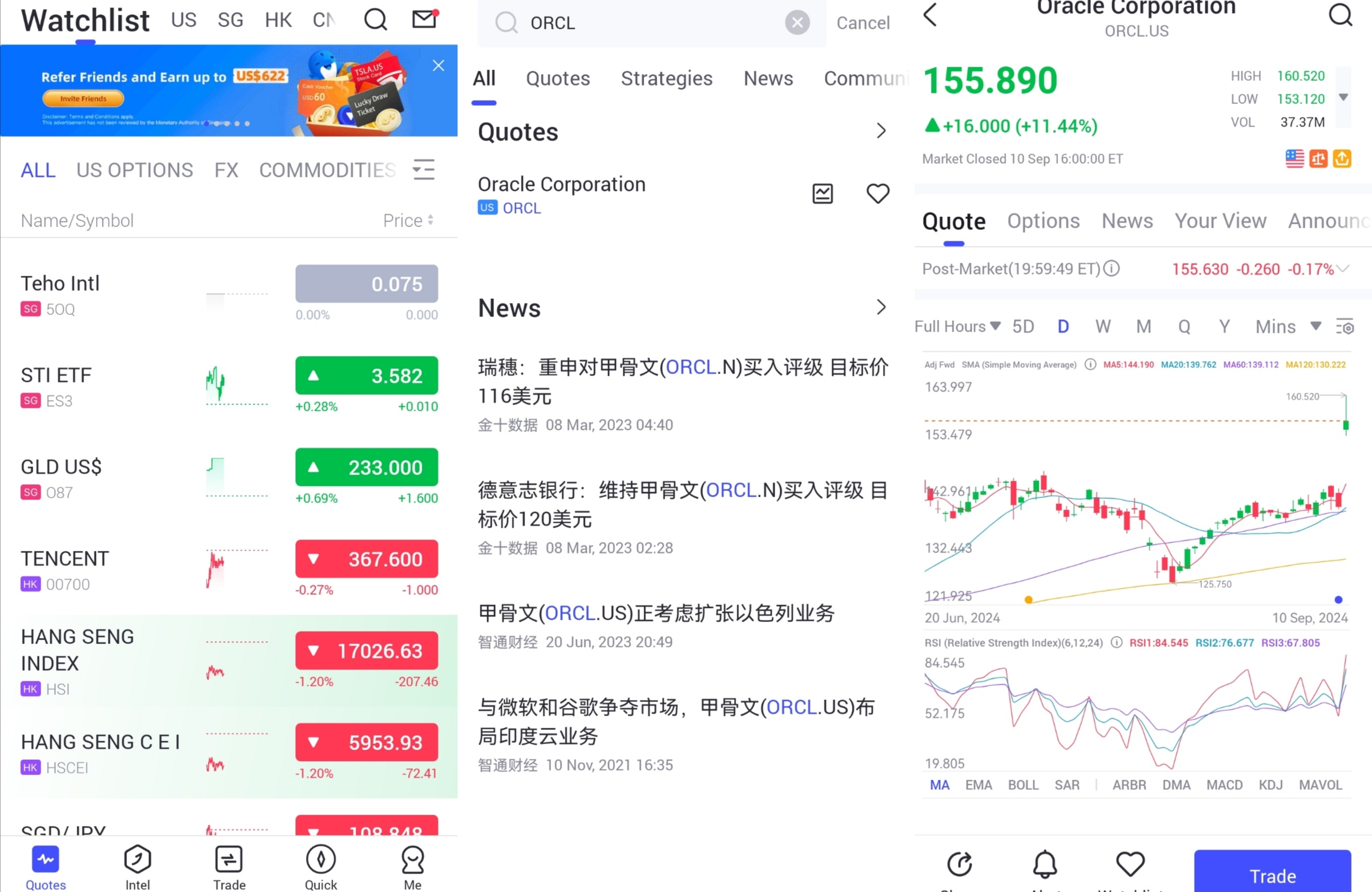

After logging into uSMART SG APP, click "Search" from the upper right corner of the page, enter the target code, such as "NVDA, and enter the details page to learn about transaction details and historical trends. Click "Trade" in the lower right corner and select "Buy/Sell" "Send" function, finally fill in the transaction conditions and send the order; the image operation instructions are as follows:

Source: uSMART SG

Follow us

Find us on Twitter, Instagram, YouTube, and TikTok for frequent updates on all things investing.

Have a financial topic you would like to discuss? Head over to the uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Important Notice and Disclaimer:

We have based this article on our internal research and information available to the public from sources we believe to be reliable. While we have taken all reasonable care in preparing this article, we do not represent the information contained in this article is accurate or complete and we accept no responsibility for errors of fact or for any opinion expressed in this article. Opinions, projections and estimates reflect our assessments as of the article date and are subject to change. We have no obligation to notify you or anyone of any such change. You must make your own independent judgment with respect to any matter contained in this article. Neither we or our respective directors, officers or employees will be responsible for any losses or damages which any person may suffer or incur as a result of relying upon anything stated or omitted from this article.

This document should not be construed in any jurisdiction as constituting an offer, solicitation, recommendation, inducement, endorsement, opinion, or guarantee to purchase, sell, or trade any securities, financial products, or instruments or to engage in any investment or any transaction of any kind, nor is there any intention to solicit or invite the purchase or sale of any securities.

The value of these securities and the income from them may fall or rise. Your investment is subject to investment risk, including loss of income and capital invested. Past performance figures as well as any projection or forecast used in this article is not indicative of its future performance.

This advertisement has not been reviewed by the Monetary Authority of Singapore

Singapore

Singapore Hongkong

Hongkong Group

Group Global

Global