In the frequently fluctuating economic environment of 2024, investors are seeking stable investment opportunities. Consumer goods stocks, with their fundamental demand and long-term stability, have become a preferred choice for many investors. Today, we will delve into five consumer stocks that are performing exceptionally well in the current market conditions, helping you find a safe investment haven amidst economic uncertainty.

Many essential consumer goods share the characteristic that:

price increases tend to be permanent, leading to continuous price growth

even with price hikes, sales volumes remain unaffected

Therefore, while investing in these consumer stocks may not lead to overnight riches, patience can lead to stable asset growth, making them indispensable components of a diversified investment portfolio.

This article highlights leading consumer stocks in the U.S. and lists five noteworthy stocks to consider:

Consumer Stock #1: Procter & Gamble (PG)

Procter & Gamble is a global leader in the consumer goods market, offering everyday necessities such as shampoos, toilet paper, and cleaning products. Its products typically perform well during economic fluctuations and exhibit strong risk resilience.

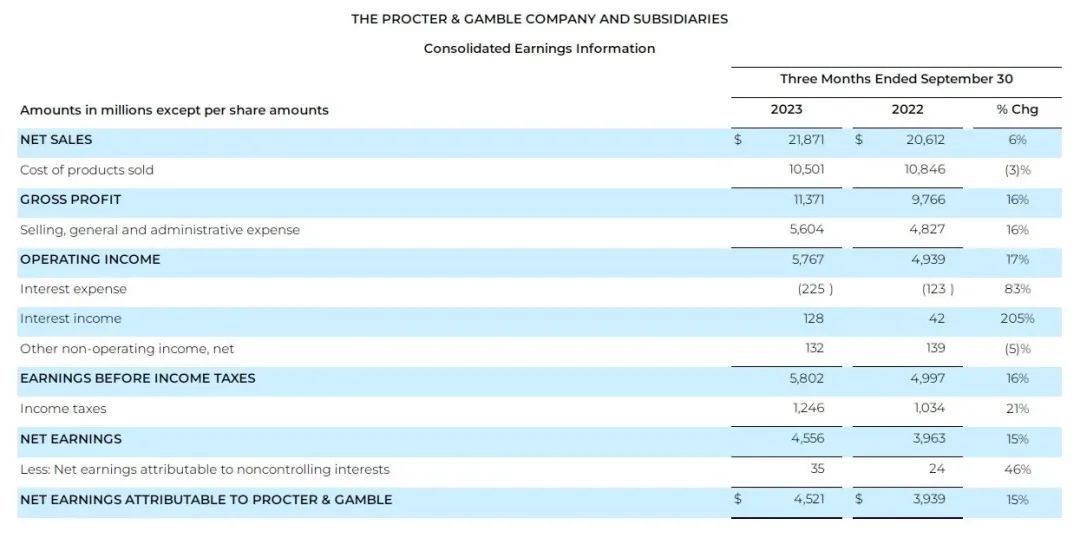

According to financial reports, Procter & Gamble's net sales for Q1 of fiscal year 2024 were $21.87 billion, a 6% year-over-year increase. Organic sales (excluding foreign exchange and acquisition/divestiture effects) grew by 7%, slightly exceeding Wall Street's forecast of $21.58 billion. Earnings per share (EPS) were $1.83, also above the expected $1.72. The company’s net income attributable to shareholders was $4.52 billion, reflecting a 14.94% year-over-year increase.

Source: Procter & Gamble

Source: Procter & Gamble

Consumer Stock #2: Coca-Cola (KO)

Coca-Cola holds a significant position in the beverage market due to its strong brand influence and global distribution network. Despite intense competition in the beverage industry, Coca-Cola’s brand loyalty and market coverage make it relatively robust in economic turmoil.

On July 23, Coca-Cola released its Q2 2024 financial report, showing revenue of $12.36 billion, a 3% increase, exceeding the market expectation of $11.75 billion. Operating income was $2.63 billion, up 10%. EPS was $0.84, a 7% increase, higher than the anticipated $0.81.

In terms of sales, global unit case volume increased by 2%. In the Asia-Pacific market, unit case volume grew by 3% year-over-year. By category, global sales of sparkling beverages grew by 3%, driven mainly by growth in the Asia-Pacific and Latin American markets. The flagship brand Coca-Cola saw global sales growth of 2%, mainly driven by Latin America and the Asia-Pacific market. Diet Coca-Cola saw global sales growth of 6%. Flavored sparkling waters grew by 3%, driven mainly by the Asia-Pacific market. Sales of juice drinks, dairy products, and plant-based beverages grew by 2%, driven primarily by North America and the Asia-Pacific market. Sales of bottled water, sports drinks, coffee, and tea were flat compared to the previous year.

Source: uSMART SG

Source: uSMART SG

Consumer Stock #3: PepsiCo (PEP)

PepsiCo's business not only includes beverages but also encompasses snacks and other consumer products. Its diversified product portfolio helps the company maintain growth under various market conditions and benefit from multiple consumer demands.

PepsiCo’s Q2 2024 financial report showed year-to-date revenue of $40.75 billion, up 1.45% from $40.17 billion in the same period last year. Net income for the first half of the fiscal year was $5.15 billion, a 9.16% increase from $4.72 billion the previous year. The year-to-date basic EPS was $3.73, compared to $3.40 in the same period last year.

Source: uSMART SG

Source: uSMART SG

Consumer Stock #4: Starbucks Corporation (SBUX)

Starbucks is a leading global coffee chain known for its high-quality coffee and unique in-store experience. Its brand influence and customer loyalty are very strong worldwide. Starbucks' core business of selling coffee and related beverages has relatively stable demand in consumers' daily lives, especially during economic uncertainty, as coffee consumption habits tend to remain stable.

In addition to coffee, Starbucks also sells food, tea beverages, and other drinks, diversifying its product line to increase revenue sources.

For Q2 of fiscal year 2024, Starbucks reported revenue of $8.56 billion, a 2% decline year-over-year. Net income was $770 million, a 15% decrease. For the first half of fiscal year 2024, Starbucks reported revenue of $17.99 billion, a 3% increase year-over-year, and net income of $1.80 billion, a slight 2% increase.

In Q2 of fiscal year 2024, Starbucks added 118 new stores in China, a 14% increase year-over-year, and entered 20 new cities, covering nearly 900 county-level cities. The number of active members in lower-tier markets grew rapidly, with membership growth exceeding that in higher-tier cities. Membership sales grew significantly, with sales growth twice that of higher-tier cities.

Source: uSMART SG

Source: uSMART SG

Consumer Stock #5: Costco Wholesale (COST)

Costco is a leading membership-based retailer in the U.S., known for its efficient supply chain and bulk sales model. During economic uncertainty, consumers may prefer to shop at large retailers like Costco for cost-effective goods, enhancing Costco's business growth potential.

In the latest quarter, Costco reported revenue of $58.44 billion, a 5.7% increase year-over-year. Net income was $1.74 billion, an 18.9% increase. While revenue fell short of Bloomberg's expectations, net income exceeded expectations. However, the company received a $94 million tax benefit this quarter. Excluding this benefit, net income was $1.65 billion, still slightly above expectations.

Source: uSMART SG

Source: uSMART SG

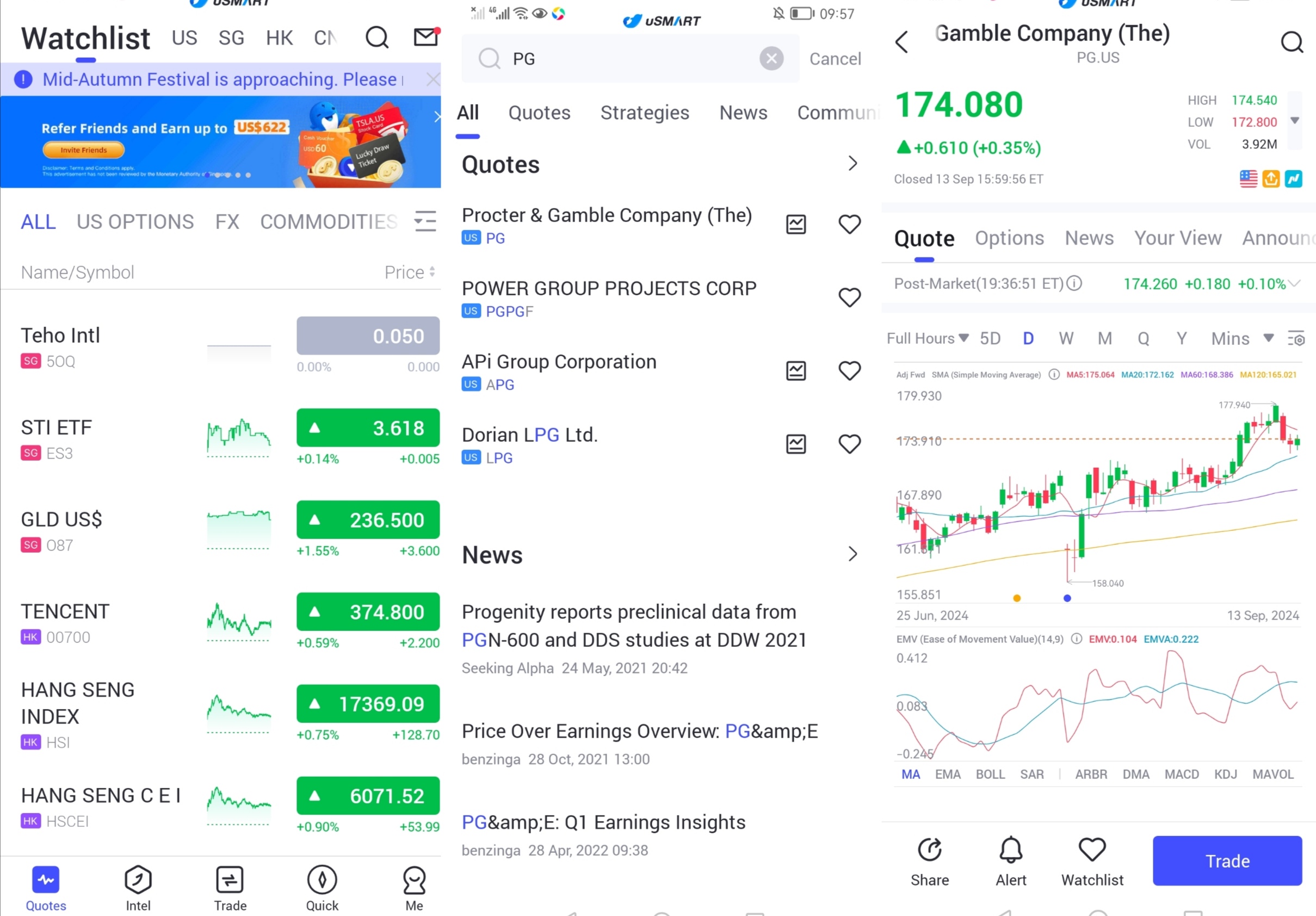

How to trade investments on uSMART:

After logging into uSMART SG APP, click "Search" from the upper right corner of the page, enter the target code, such as "PG", and enter the details page to learn about transaction details and historical trends. Click "Trade" in the lower right corner and select "Buy/Sell" "Send" function, finally fill in the transaction conditions and send the order; the image operation instructions are as follows:

Source: uSMART SG

Follow us

Find us on Twitter, Instagram, YouTube, and TikTok for frequent updates on all things investing.

Have a financial topic you would like to discuss? Head over to the uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Important Notice and Disclaimer:

We have based this article on our internal research and information available to the public from sources we believe to be reliable. While we have taken all reasonable care in preparing this article, we do not represent the information contained in this article is accurate or complete and we accept no responsibility for errors of fact or for any opinion expressed in this article. Opinions, projections and estimates reflect our assessments as of the article date and are subject to change. We have no obligation to notify you or anyone of any such change. You must make your own independent judgment with respect to any matter contained in this article. Neither we or our respective directors, officers or employees will be responsible for any losses or damages which any person may suffer or incur as a result of relying upon anything stated or omitted from this article.

This document should not be construed in any jurisdiction as constituting an offer, solicitation, recommendation, inducement, endorsement, opinion, or guarantee to purchase, sell, or trade any securities, financial products, or instruments or to engage in any investment or any transaction of any kind, nor is there any intention to solicit or invite the purchase or sale of any securities.

The value of these securities and the income from them may fall or rise. Your investment is subject to investment risk, including loss of income and capital invested. Past performance figures as well as any projection or forecast used in this article is not indicative of its future performance.

This advertisement has not been reviewed by the Monetary Authority of Singapore

Singapore

Singapore Hongkong

Hongkong Global

Global Group

Group