During this year's National Day holiday (October 1-7), overseas markets had mixed performances. The Hong Kong market and U.S.-listed Chinese stocks stood out, while Western markets experienced varied results. After significant gains before the holiday, how will A-shares perform next, considering the ongoing rally in Hong Kong and Chinese stocks abroad? Some brokerage analysts believe that for this rally to evolve into a "long-term bull market," it still requires support from economic fundamentals. Currently, the key to reviving the economy is boosting domestic demand.

According to Wind data, as of 7 p.m. Beijing time on October 7, during the National Day holiday, the Hang Seng Index, Hang Seng Tech Index, and Hang Seng China Enterprises Index rose by 9.30%, 13.36%, and 10.93%, respectively. Among industry sectors, diversified financials led with a 48.75% gain, followed by semiconductors and semiconductor equipment, which rose 40.03%. Insurance, technology hardware and equipment, durable consumer goods and apparel, and real estate sectors all saw gains of over 10%.

On October 8, major Chinese stocks (ADR) showed mixed performance, with the Nasdaq Golden Dragon China Index rising slightly by 0.07%. Li Auto rose over 4%, Baidu over 3%, Alibaba and XPeng both over 2%, while Futu Holdings, Weibo, NIO, and JD.com posted modest gains. Meanwhile, Bilibili fell more than 4%, iQiyi more than 3%, NetEase more than 2%, Tencent Music more than 1%, and Vipshop, Pinduoduo, and Full Truck Alliance saw minor declines.

Chinese Stocks Defy the Trend

Western stock markets closed with mixed results. U.S. stocks declined across the board, with the Dow down 0.94%, the S&P 500 down 0.96%, and the Nasdaq down 1.18%. Among individual stocks, Travelers fell over 4%, and Amazon dropped about 3%, leading the Dow's losses. The TAMAMA Tech Index in the U.S. fell 1.4%, with Tesla down over 3% and Google down more than 2%. However, AMD rose over 15%, achieving its best one-day performance since May 15.

Chinese stocks, however, withstood the pressure. The Nasdaq Golden Dragon China Index briefly fell nearly 3% during the trading session but managed to recover and close in the green. Among them, EHang soared over 21%, Gaotu Group rose more than 11%, Canadian Solar and Dada Group gained about 10%, JinkoSolar rose over 9%, RLX Technology and ACM Research both climbed around 7%, and Kingsoft Cloud and Daqo New Energy gained over 6%.

Additionally, the FTSE China A50 Index futures saw a sharp rise in the night session, closing up 1.98%.

Goldman Sachs: Top 10 Reasons to Buy Chinese Stocks

- Government has shown its threshold for economic and stock market "pain" – The policy bottom is now evident.

- This time it's different in terms of policy measures – Investors have largely received the expected stimulus measures.

- Don’t fight the Chinese central bank – It is providing unprecedented and extraordinary support for the stock market.

- Even after a 30% rally in two weeks, the risk of a pullback may have increased, but revaluation trades triggered by policy shifts rarely stop after a 30% rise.

- Even in long-depressed markets, strong tradable rebounds can occur.

- From a valuation perspective, there are still reasons to buy Chinese stocks.

- Fear of missing out (FOMO) may continue – The shift of capital from developed markets to emerging markets is underway.

- Although more stimulus measures may be needed to turn the situation around, earnings prospects for Chinese listed companies have already improved.

- After the Federal Reserve cuts interest rates, China’s policy space will further expand, and external risks may prompt policymakers to increase stimulus.

- Even if the rally ultimately doesn’t reverse in the medium to long term, Chinese stocks should still have a place in investors' portfolios.

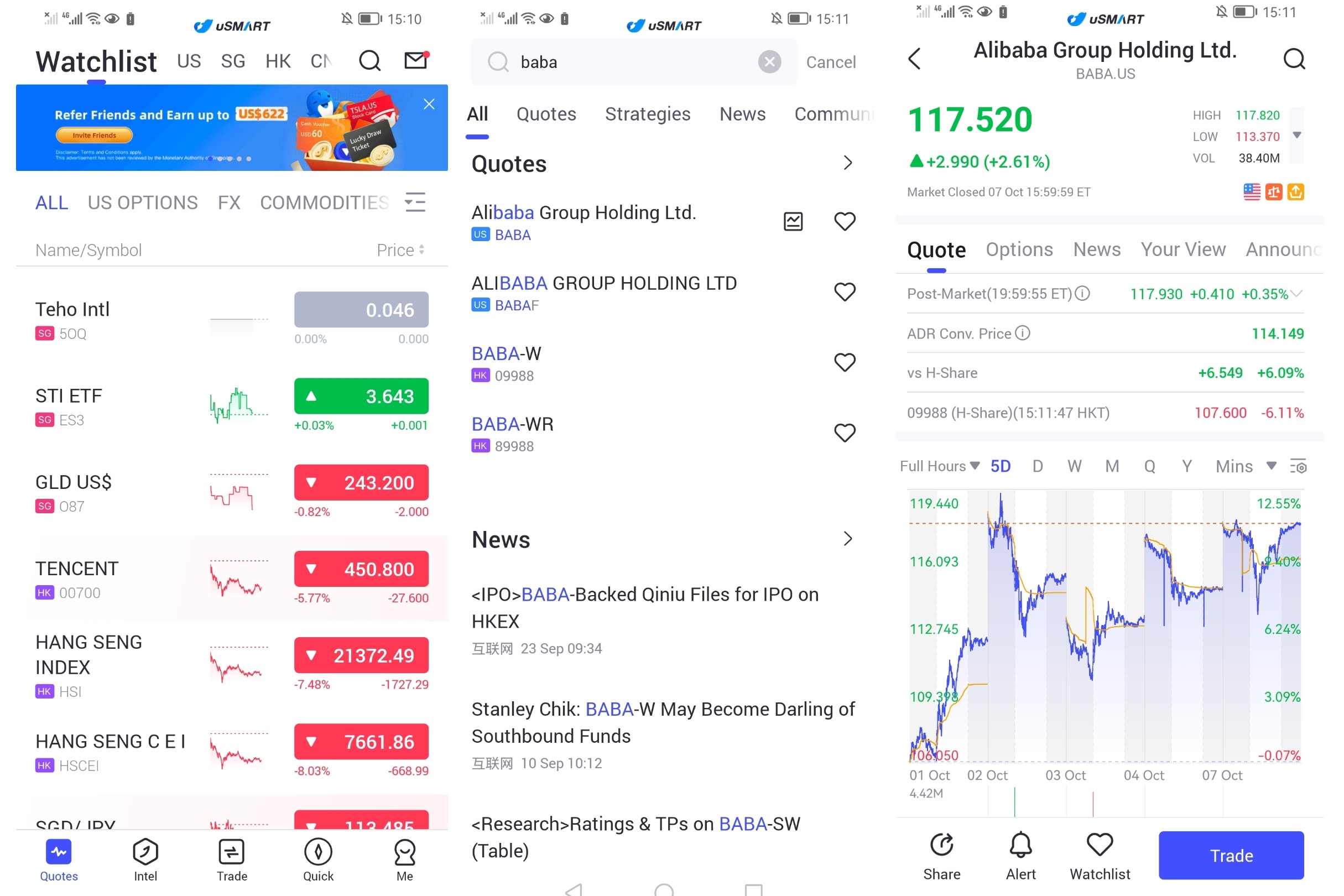

How to trade investments on uSMART:

After logging into uSMART SG APP, click "Search" from the upper right corner of the page, enter the target code, such as "BABA", and enter the details page to learn about transaction details and historical trends. Click "Trade" in the lower right corner and select "Buy/Sell" "Send" function, finally fill in the transaction conditions and send the order; the image operation instructions are as follows:

Source: uSMART SG

Follow us

Find us on Twitter, Instagram, YouTube, and TikTok for frequent updates on all things investing.

Have a financial topic you would like to discuss? Head over to the uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Important Notice and Disclaimer:

We have based this article on our internal research and information available to the public from sources we believe to be reliable. While we have taken all reasonable care in preparing this article, we do not represent the information contained in this article is accurate or complete and we accept no responsibility for errors of fact or for any opinion expressed in this article. Opinions, projections and estimates reflect our assessments as of the article date and are subject to change. We have no obligation to notify you or anyone of any such change. You must make your own independent judgment with respect to any matter contained in this article. Neither we or our respective directors, officers or employees will be responsible for any losses or damages which any person may suffer or incur as a result of relying upon anything stated or omitted from this article.

This document should not be construed in any jurisdiction as constituting an offer, solicitation, recommendation, inducement, endorsement, opinion, or guarantee to purchase, sell, or trade any securities, financial products, or instruments or to engage in any investment or any transaction of any kind, nor is there any intention to solicit or invite the purchase or sale of any securities.

The value of these securities and the income from them may fall or rise. Your investment is subject to investment risk, including loss of income and capital invested. Past performance figures as well as any projection or forecast used in this article is not indicative of its future performance.

This advertisement has not been reviewed by the Monetary Authority of Singapore

Singapore

Singapore Hongkong

Hongkong Global

Global Group

Group