With the rise in financial awareness, more and more people are beginning to pay attention to different types of investment tools. Among the many options available, stocks, funds, and bonds are the three most common methods, each with its own characteristics that cater to different groups of investors. If you are just entering the world of investing, understanding the basics of these three options, as well as their pros and cons, can help you make more informed decisions.

- Stocks: High Risk, High Reward Investment

Concept: Stocks represent a portion of ownership in a company. By purchasing stocks, you become one of the company’s shareholders, entitled to participate in profit distribution and to vote on major corporate matters. Familiar names in the stock market include technology stocks like Apple (AAPL), Tesla (TSLA), and NVIDIA (NVDA), while financial stocks such as JPMorgan Chase (JPM) and Goldman Sachs (GS) fall into the banking sector.

Advantages:

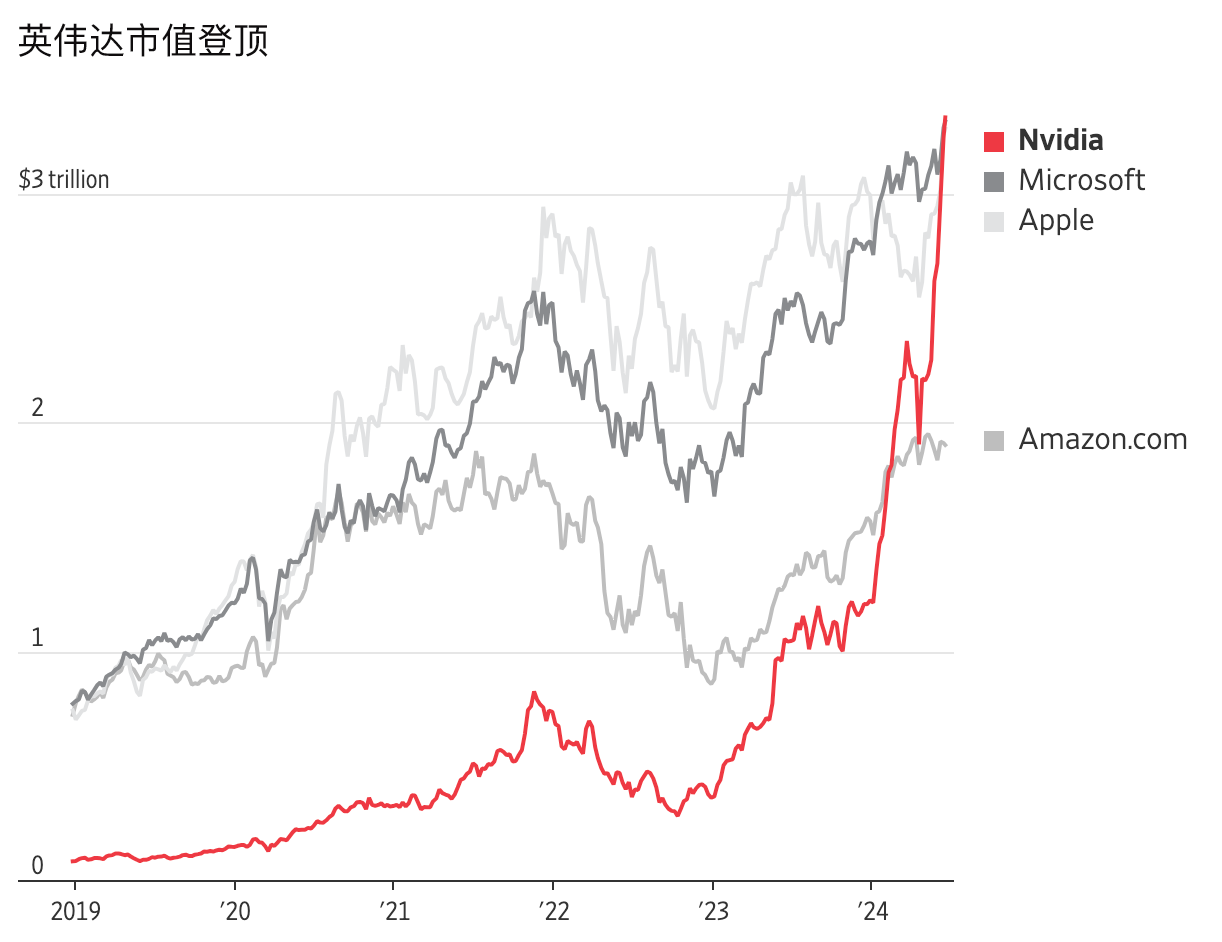

High Returns: Over the long term, stocks are one of the best ways to achieve high returns. For example, the stock of technology giant NVIDIA has seen remarkable growth in recent years, providing substantial returns to investors.

High Liquidity: Stocks can be traded at any time, making them suitable for investors who require flexibility with their funds.

Disadvantages:

High Volatility: The stock market is influenced by various factors such as market sentiment, policy changes, and company performance, which can lead to significant short-term fluctuations. For instance, Tesla’s stock price has experienced dramatic swings; during its recent event, it fell by 8%, but after the release of its third-quarter earnings report, the stock surged nearly 10%. Such high volatility may not suit all investors.

Company Risk: Poor business performance, intense industry competition, or other factors can cause stock prices to fall, potentially resulting in total loss of investment.

Suitable for: Stocks are suitable for investors who have a certain risk tolerance, seek high returns, and have the time to research stocks. In particular, younger investors may consider diversifying into promising growth companies, such as Google (GOOGL) and Microsoft (MSFT).

- Funds: A Diversified Investment Option

Concept: A fund pools money from multiple investors and is managed by a professional institution that invests in stocks, bonds, or other financial instruments. Funds can be further divided into equity funds, bond funds, and hybrid funds. Among them, the S&P 500 Index Fund (such as Vanguard’s VFIAX or SPDR’s SPY) is a common equity fund, while bond funds like PIMCO’s BOND primarily invest in bonds.

Advantages:

Diversification of Risk: Funds lower the risk of individual stocks or bonds through diversified investments. For example, the S&P 500 Index Fund covers the stocks of the 500 largest companies in the U.S., so even if individual companies perform poorly, the overall performance can balance the risk.

Time-Saving: Funds are operated by professional managers, allowing investors to avoid spending a lot of time analyzing and managing investments.

Wide Selection: There are many types of funds available to cater to different needs, allowing investors to choose funds that match their risk tolerance and return goals.

Disadvantages:

Management Fees: Funds typically charge management fees. For example, mutual funds generally charge an annual management fee of around 0.5% to 1%, while ETFs usually have lower fees.

Fluctuating Returns: Although fund returns are generally less volatile than individual stocks, they can still be affected by overall market conditions, especially equity funds that fluctuate with stock market movements.

Suitable for: Funds are suitable for investors with lower risk tolerance and those without time to study the market. For instance, some index funds are suitable for long-term investors as retirement investments, such as Vanguard’s VTSAX and Fidelity’s FXAIX, which aim to track overall market performance, making them suitable for conservative investors.

- Bonds: A Steady and Safe Income Source

Concept: Bonds are a type of debt instrument, similar to an agreement where one party borrows from another and pays interest periodically. Common types of bonds include government bonds (such as U.S. Treasury bonds) and corporate bonds (like Coca-Cola’s corporate bonds). By purchasing bonds, investors essentially “lend” money to the government or corporations, which promise to return the principal and pay interest after a set period.

Advantages:

Lower Risk: Compared to stocks, bonds generally carry less risk, especially government bonds. For instance, the U.S. 10-year Treasury bond is considered one of the safest investments, suitable for conservative investors.

Fixed Income: Bonds offer fixed interest payments, providing investors with relatively stable cash flow. For example, U.S. Treasury bonds pay interest every six months, while corporate bonds, such as AT&T bonds, also pay interest quarterly.

Capital Preservation: At maturity, bonds return the principal amount, making them suitable for investors seeking safety.

Disadvantages:

Lower Returns: Generally, bond returns are lower than stocks, especially the interest rates of government bonds. During inflationary periods, the real returns on bonds may be eroded.

Limited Liquidity: Bonds are not as actively traded in the secondary market, and investors may face a risk of selling at a discount if they sell before maturity.

Suitable for: Bonds are suitable for conservative investors seeking fixed income and capital preservation. Retirees may choose Treasury bonds as part of their investment portfolio or select high-quality corporate bonds from companies like Coca-Cola and Johnson & Johnson that have good credit ratings.

How to Choose the Right Investment Option for You?

Choosing the right investment option depends on your risk tolerance, investment goals, and the time and energy you are willing to invest. Here are some simple suggestions:

High Risk, High Reward: If you are young, have a high risk tolerance, and can pay attention to the market, consider investing in stocks, such as technology stocks or growth stocks.

Steady and Conservative: If you are nearing retirement age or have a lower risk preference, you might choose bonds or bond funds as your main investment tools to ensure the stability of your funds.

Balanced Approach: For investors who want stable income and appropriate returns, consider investing in funds, especially hybrid funds (like Vanguard’s VBIAX), which typically allocate funds between stocks and bonds, providing both yield and stability.

During the investment process, it is essential to stay informed about market trends, diversify investments, and continuously assess risks. This way, you can remain resilient in a changing market environment.

Follow us

Find us on Twitter, Instagram, YouTube, and TikTok for frequent updates on all things investing.

Have a financial topic you would like to discuss? Head over to the uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Important Notice and Disclaimer:

We have based this article on our internal research and information available to the public from sources we believe to be reliable. While we have taken all reasonable care in preparing this article, we do not represent the information contained in this article is accurate or complete and we accept no responsibility for errors of fact or for any opinion expressed in this article. Opinions, projections and estimates reflect our assessments as of the article date and are subject to change. We have no obligation to notify you or anyone of any such change. You must make your own independent judgment with respect to any matter contained in this article. Neither we or our respective directors, officers or employees will be responsible for any losses or damages which any person may suffer or incur as a result of relying upon anything stated or omitted from this article.

This document should not be construed in any jurisdiction as constituting an offer, solicitation, recommendation, inducement, endorsement, opinion, or guarantee to purchase, sell, or trade any securities, financial products, or instruments or to engage in any investment or any transaction of any kind, nor is there any intention to solicit or invite the purchase or sale of any securities.

The value of these securities and the income from them may fall or rise. Your investment is subject to investment risk, including loss of income and capital invested. Past performance figures as well as any projection or forecast used in this article is not indicative of its future performance.

This advertisement has not been reviewed by the Monetary Authority of Singapore

Singapore

Singapore Hongkong

Hongkong Global

Global Group

Group