What is SPY?

SPY refers to the S&P 500 Index, one of the most widely used stock market indices in the United States. Compiled by Standard & Poor's, it consists of the stocks of 500 large publicly traded companies in the U.S. It represents the overall performance of the U.S. stock market and is widely regarded as a barometer for the health of the U.S. economy. The S&P 500 includes companies with large market capitalizations and high liquidity, spanning various sectors such as information technology, healthcare, finance, and consumer goods. SPY is a market-capitalization-weighted index, meaning that the companies with larger market values have a greater impact on the index. SPY is commonly used to measure the health of the U.S. stock market and is the benchmark for many investment funds and ETFs.

How to Invest in SPY via Monthly Contributions?

"Monthly investing in SPY" usually refers to contributing funds regularly on a monthly basis to financial products related to the S&P 500 Index. This is similar to a mortgage or other investment plans where a fixed amount is invested regularly, accumulating wealth over time and participating in the stock market's growth.

Monthly contributions mean investing a fixed amount on a regular basis, and this process is usually automated, so investors don't need to perform manual actions every time.

Example:An investor can set a fixed amount (e.g., $1000) to be automatically deducted each month and used to buy shares of an S&P 500 ETF like SPY. uSMART would automate this monthly purchase, allowing the investor to take part in long-term stock market growth.

What are the Advantages of Monthly Contributions in SPY through uSMART?

- No Commission Fees

uSMART offers commission-free trading, meaning investors don’t need to pay stock trading commissions. This is particularly beneficial for regular investments, as it helps save on commission costs and boosts long-term returns.

- No Platform Fees

uSMART does not charge platform usage fees, reducing the long-term investment cost, especially for frequent small-scale investments, and effectively increasing investment returns.

- No Custody Fees

uSMART waives custody fees, meaning investors don’t need to worry about account management fees, offering greater flexibility with their funds and the ability to adjust investment strategies.

- Convenient Investment Experience

The uSMART platform is user-friendly and supports automated monthly contribution plans. Investors can adjust the investment amounts based on their financial situation, enjoying a hassle-free investment process.

- Support for Fractional Share Monthly Contributions

uSMART allows fractional share investing, meaning investors can still contribute monthly even if they don’t have enough funds to buy a full share. This lowers the investment threshold and enables flexible investing.

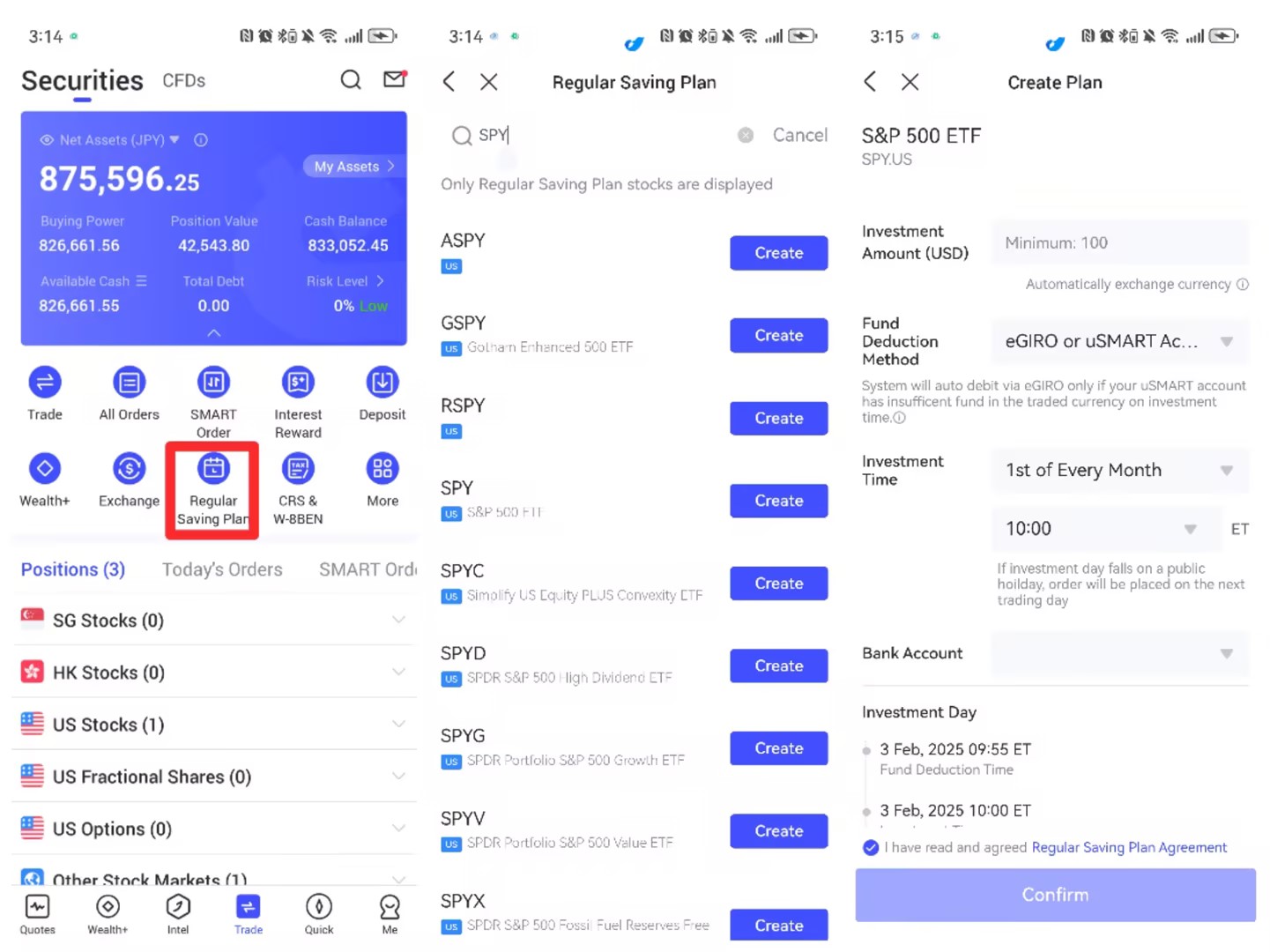

How to Make Monthly Contributions to Stocks on uSMART

Step 1: Log in to the uSMART SG app and click on "Trading" at the bottom right corner of the page.

Step 2: Click on "Monthly Payment Stocks" in the second column and select "All Monthly Payment Stocks."

Step 3: Choose your preferred stock, set the monthly payment amount, payment method, and deduction date, and create your Monthly Payment.

Stock plan. Once confirmed, the plan will take effect immediately.

(Source: uSMART.sg)

Singapore

Singapore Hongkong

Hongkong Global

Global Group

Group