China-Concept ETFs Surge, Investment Enthusiasm on the Rise

At the beginning of 2025, China-related ETFs in the U.S. stock market have shown strong performance, driven by global expectations of China's economic recovery. According to data provided by uSMART, as of February 18, 2025, five major China-concept ETFs have recorded double-digit gains since the beginning of the year, with the Direxion Daily FTSE China Bull 3X Shares ETF (YINN) leading the pack with a 48.89% increase. This trend reflects growing confidence in China’s technology, internet, and large-cap stocks, with capital flowing back into Chinese equities.

(Source: uSMART.sg)

Below is a detailed performance overview of the top-performing China-concept ETFs:

1. YINN (Direxion Daily FTSE China Bull 3X Shares ETF)

- Year-to-date gain: 48.89%

- Fund characteristics:

YINN is a triple-leveraged ETF that tracks the FTSE China 50 Index, which includes China’s largest companies, such as Alibaba, Tencent, and Ping An Insurance.

Due to its leverage strategy, this ETF is highly volatile—it gains significantly when the market rises but may also face greater losses during downturns.

- Reasons for the surge:

Increased policy support in China, including monetary easing and government backing for the technology sector.

Investors are betting on a stronger economic recovery in China in 2025, boosting market confidence.

As a leveraged ETF, YINN amplifies gains in a rising market, making it a standout performer.

2. XPP (ProShares Ultra FTSE China 50 ETF)

- Year-to-date gain: 31.79%

- Fund characteristics:

XPP is a double-leveraged ETF that also tracks the FTSE China 50 Index. While its leverage is lower than YINN, it remains highly volatile, making it suitable for investors with a higher risk tolerance.

The fund primarily holds large state-owned enterprises and technology giants, such as Alibaba, Tencent, and the Bank of China.

- Reasons for the surge:

China’s economic stimulus measures have improved market sentiment.

Global investors are increasing their allocation to Chinese stocks, leading to inflows into related ETFs.

XPP benefits from leverage, which amplifies gains during market upswings, though it carries slightly lower risk compared to YINN.

3. KWEB (KraneShares CSI China Internet ETF)

- Year-to-date gain: 21.85%

- Fund characteristics:

KWEB focuses on China’s internet sector, with holdings in Alibaba, Tencent, Meituan, JD.com, Pinduoduo, and other leading technology firms.

This ETF primarily invests in Chinese internet companies listed in the U.S. and Hong Kong, closely tracking the global technology sector’s trends.

- Reasons for the surge:

Regulatory easing in China’s internet sector has improved market sentiment.

Recovery in earnings from internet giants has driven stock prices higher.

Global tech stocks have rebounded, increasing investor confidence in the sector.

4. PGJ (Invesco Golden Dragon China ETF)

- Year-to-date gain: 21.85%

- Fund characteristics:

PGJ tracks the Nasdaq Golden Dragon China Index, covering China-based companies listed in the U.S. The ETF’s portfolio spans multiple industries, including technology, consumer goods, and healthcare.

Key holdings include Pinduoduo, JD.com, NetEase, and Baidu.

- Reasons for the surge:

Strong earnings from e-commerce giants Pinduoduo and JD.com have boosted the ETF’s performance.

Investor optimism surrounding U.S.-listed China stocks has led to increased buying activity.

China’s consumer recovery has improved the outlook for consumer-related stocks.

5. FXI (iShares China Large-Cap ETF)

- Year-to-date gain: 15.97%

- Fund characteristics:

FXI primarily invests in China’s large-cap stocks, including major state-owned enterprises (SOEs) such as the "Big Four" banks, China Petroleum & Chemical Corporation, and China Mobile.

It tracks the FTSE China 25 Index, which is dominated by traditional industries and has less exposure to the internet and technology sectors.

- Reasons for the surge:

Benefiting from China’s steady economic recovery, large-cap firms have shown improving profitability.

Government policies supporting real estate and infrastructure have favored large SOEs.

Capital is flowing back into undervalued blue-chip stocks, helping boost prices.

Conclusion

China-concept ETFs have posted remarkable gains in early 2025, with YINN soaring nearly 50% and overall market sentiment turning bullish. As China’s economic recovery gains traction, policy support increases, and global capital flows back into Chinese stocks, these ETFs are likely to see further upside potential.

For investors, strategically allocating China-concept ETFs can be a key approach to capturing market trends. Based on recent performance:

Aggressive short-term investors may consider YINN and XPP, as their leverage magnifies gains, though they come with higher risk.

Technology-focused investors may opt for KWEB and PGJ, which provide exposure to China’s internet and consumer sectors.

More conservative, long-term investors could look at FXI, which tracks China’s state-owned blue-chip stocks and offers lower volatility.

How to Buy China-Concept ETFs on uSMART

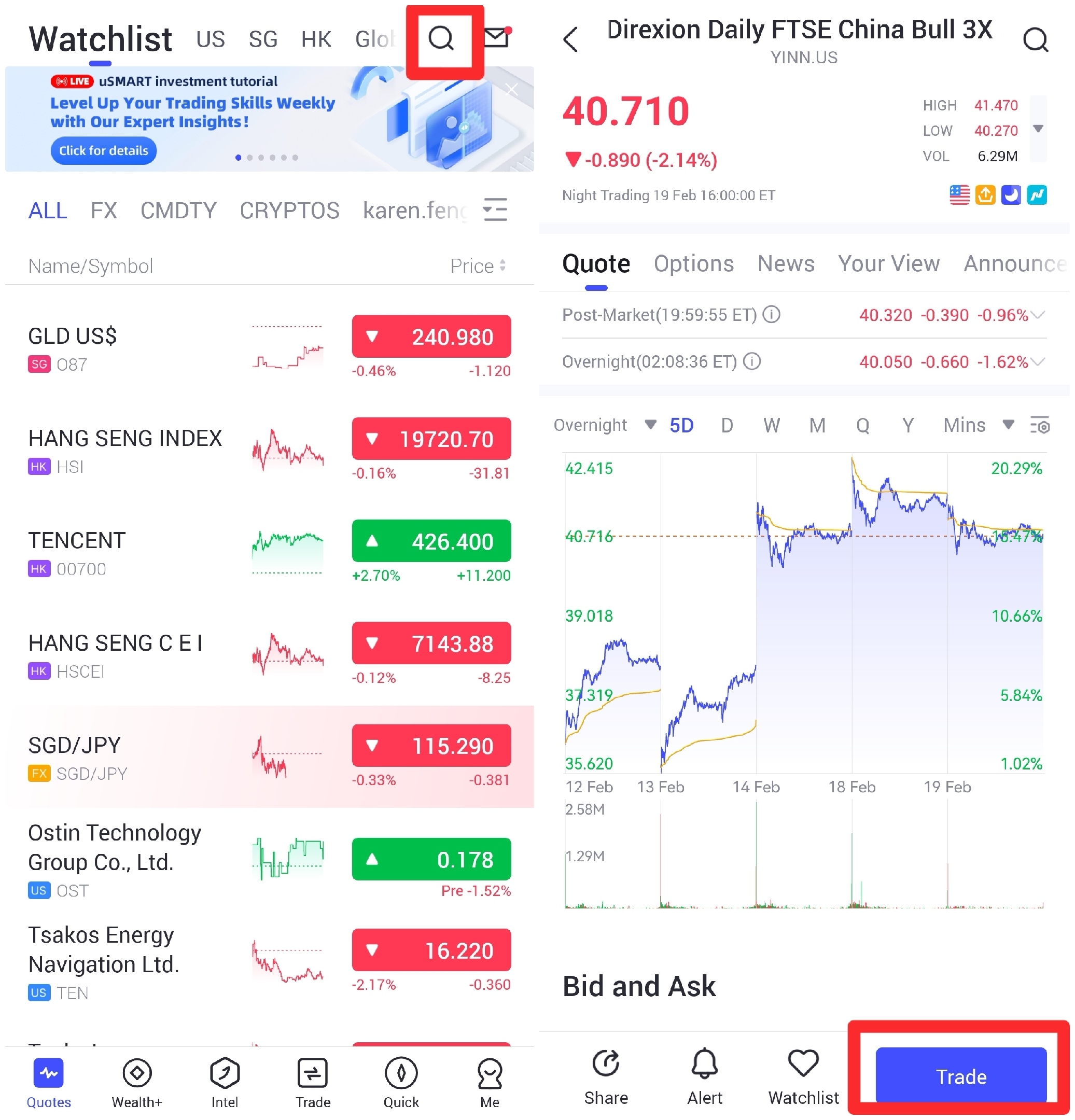

Log in to the uSMART APP, click "Search" in the top-right corner, enter stock codes and select a stock to view details. To trade, click "Trade" in the bottom-right, choose "Buy/Sell," fill in the details, and submit your order.The image guide is as follows:

Singapore

Singapore Hongkong

Hongkong Global

Global Group

Group