1) What happened to Chocolate Finance?

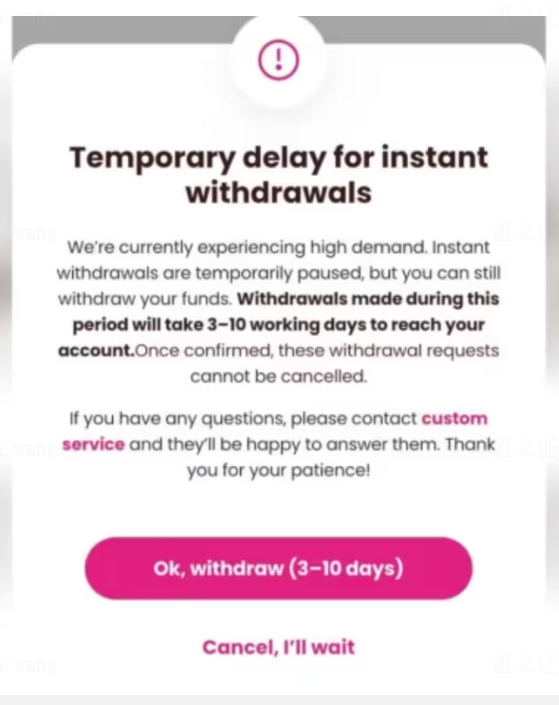

On March 10th, Chocolate Finance issued a statement on its mobile app, stating that the platform is experiencing an unusually high volume of withdrawal requests. The company stated that all withdrawal requests initiated during this period will take 3 to 10 days to process, and once a withdrawal application is submitted by the user, it cannot be canceled.

(Image source: chocolate finance)

When it comes to investing, the safety of one's financial assets has always been a top priority for investors. In today's ever-changing market environment and the growing demand for wealth management solutions, choosing a reliable and secure investment platform has become increasingly important. In this article, we will be sharing why you should consider uSMART Securities (Singapore) Pte Ltd (hereinafter referred to as uSMART SG) as your go-to platform for all your investment needs.

2) Why Choose uSMART SG?

- Backed by Strategic Investor Chow Tai Fook Holding: uSMART SG is backed by Chow Tai Fook Holding, one of the largest conglomerates in Hong Kong, with capital funding exceeding USD 100 million.

- Regulated by the Monetary Authority of Singapore (MAS): uSMART SG is a licensed entity registered with MAS (License Number: CMS101161), holding a Capital Markets Services license (CMS).

- Segregated Client Funds: Client assets are held and custodied with clearing brokers in a segregated manner. Asset security is subject to strict reviews and internal and external audits by regulators. uSMART SG conducts due diligence on our counterparties and ensures sufficient controls are in place to monitor all funds.

- Trusted Financial Partner: We are committed to our clients and will uphold strict compliance and risk control standards, and provide round-the-clock support on our website and app.

3) How You Can Grow Your Wealth with uSMART

To help investors navigate market uncertainty, uSMART SG offers the following investment solutions:

- Interest Rewards:

- Earn up to 4.00% p.a. promotional interest on your available cash balance during the promotional period.

- Margin account holders can utilise one-third of their frozen funds for stock purchases

- Available in both USD and SGD, with holding periods of 3 months and 1 month, respectively.

For more details, click here.

- Regular Savings Plan:

- Enjoy zero commission, platform fees, exchange fees, and custodian fees.

- Start investing with a minimum of just SGD 100 or USD 100.

- Gain access a wide range of US and Singapore stocks and ETFs, including US fractional shares.

For more details, click here.

4) How to Participate in Interest Reward and Smart Investment Services on uSMART

- Interest Rewards

Open your uSMART SG app > Select 'Trade' > Select 'Interest Reward Promo'

(Image source: uSMART)

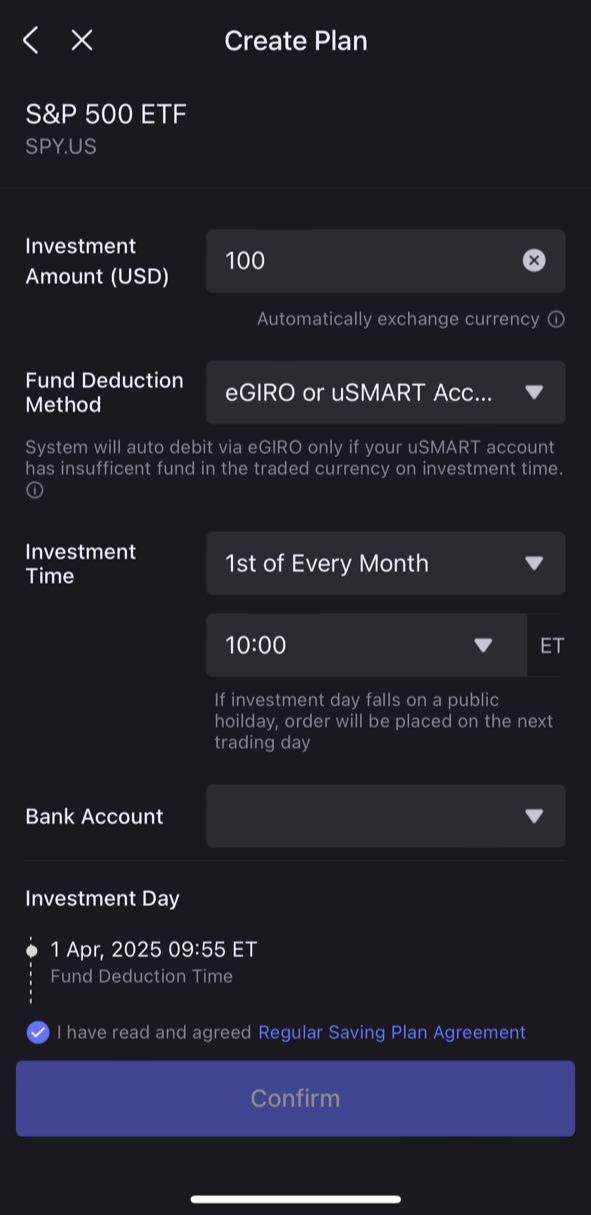

- Regular Savings Plan

Open your uSMART SG app > Select 'Trade' > Tap on 'More' > Under 'Trade', select 'Regular Saving Plan' > Select the stocks or ETF you wish to subscribe > Select the investment amount, fund deduction method and investment frequency > Select 'Confirm'

(Image source: uSMART)

If you have any questions regarding about interest reward campaign and the Regular Savings Plan, email us at support@usmart.sg.

Singapore

Singapore Hongkong

Hongkong Global

Global Group

Group