In the third quarter, AMD achieved record-breaking revenue of $6.82 billion, marking an 18% year-over-year increase and slightly surpassing analysts’ forecast of $6.71 billion. Adjusted earnings per share (EPS) came in at $0.92, matching expectations. On Tuesday, AMD announced a Q4 revenue estimate of approximately $7.5 billion, marginally below analysts' consensus estimate of $7.55 billion.

According to AMD’s financial report, third-quarter capital expenditures stood at $132 million, up 6.5% YoY but down over 14% sequentially. For the first nine months of 2023, cumulative capital expenditures totaled $428 million, reflecting a 5.2% increase YoY.

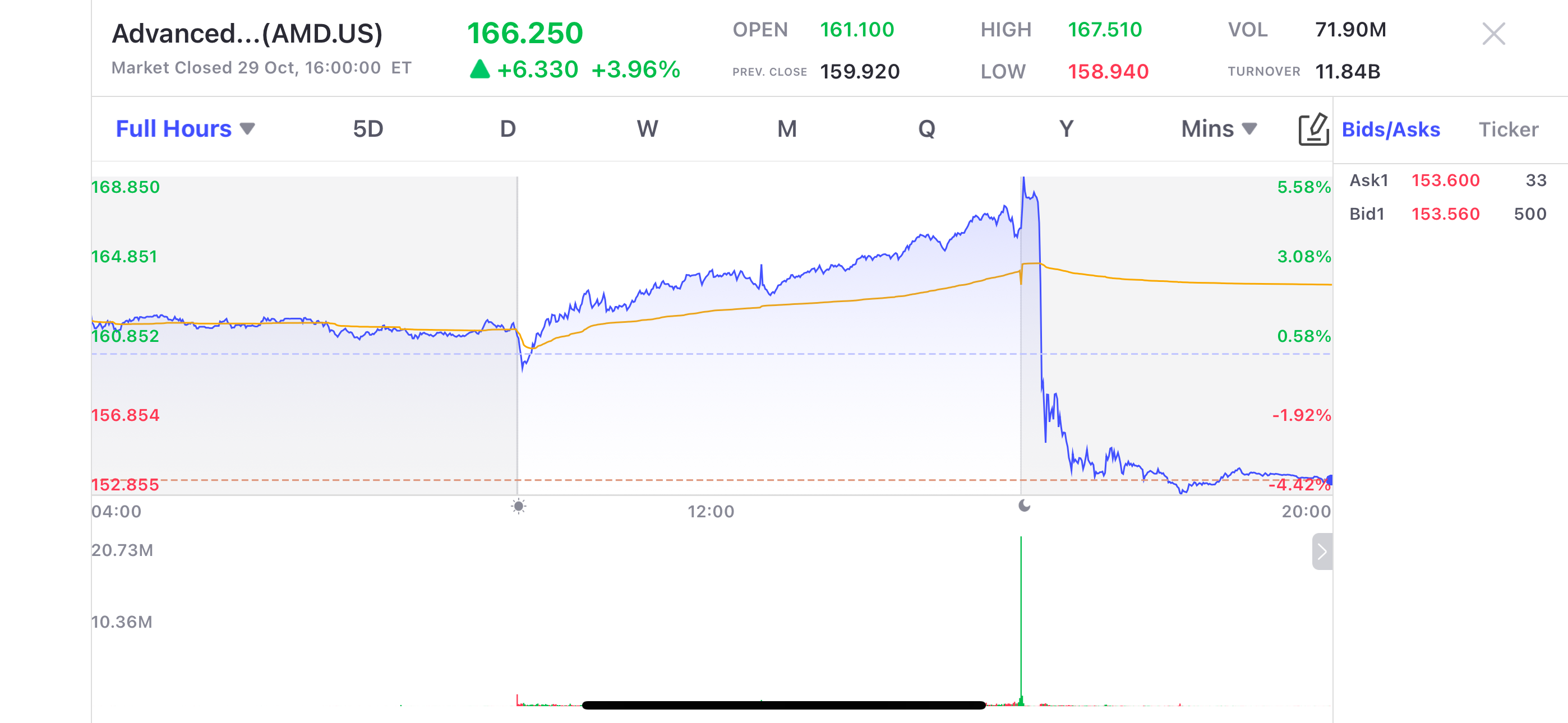

Despite record-high total revenue and data center income for Q3, the midpoint of AMD’s Q4 revenue guidance slightly underperformed market expectations. Analysts suggest supply chain limitations could be preventing AMD from meeting high demand for AI chips. Following the earnings release, AMD's stock dipped nearly 7% in after-hours trading, though it had risen almost 4% earlier in the day. Year-to-date, AMD shares have climbed close to 13%, compared to a 25% gain for the NASDAQ index. Competitors Nvidia and Intel also saw modest after-hours declines.

source:uSMART SG

Key Financial Highlights

Quarterly Revenue: Achieved a record $6.82 billion, up 18% YoY and 17% QoQ. This exceeded the market expectation of $6.71 billion and was within AMD’s guidance range of $6.4 to $7 billion.

Gross Margin: GAAP gross margin rose to 50% from 47% YoY, and non-GAAP gross margin improved to 54% from 51%.

Operating Income: GAAP operating income rose sharply by 223% to $724 million, while non-GAAP operating income increased by 34% YoY and 36% QoQ to $1.72 billion.

Net Income: GAAP net income surged by 158% to $771 million, while non-GAAP net income grew by 33% YoY and 34% QoQ to $1.5 billion.

Diluted EPS: GAAP EPS of $0.47 increased by 161% YoY, while non-GAAP EPS of $0.92 grew by 31% YoY and 33% QoQ, in line with market expectations.

Q4 Outlook

Revenue: Expected to be between $7.2 billion and $7.8 billion, with a midpoint of $7.5 billion, representing approximately 22% YoY and 10% QoQ growth. Analysts projected $7.55 billion.

Non-GAAP Gross Margin: Expected around 54%.

Some analysts speculate that AMD's guidance reflects supply constraints rather than a weakening in AI demand, which remains strong. In July, TSMC, the world’s largest semiconductor foundry, warned of tight AI chip production capacity through 2025, indicating ongoing supply challenges for advanced semiconductors.

Earlier in October, AMD held its "Advancing AI" event, introducing its next-generation AI chip lineup. The company, however, did not update its annual sales forecast for the MI300 AI accelerator or announce additional major customer partnerships.

The newly launched MI300 accelerator is a critical growth driver, positioning AMD in direct competition with Nvidia. However, growth is impacted by supply constraints, as AMD, like many companies in the industry, no longer owns its manufacturing facilities and relies on outsourcing to TSMC.

AMD CEO Lisa Su commented, "Customer acceptance of AMD is very high; every customer gives us a fair shot, and we are working hard to win their business." She noted that AMD is accelerating production while gaining the trust of data center companies reliant on AI accelerators. Su also mentioned that while AMD has made progress in the supply chain, there remains a risk of supply pressure should demand exceed current projections. "We anticipate a tight market environment but expect significant growth by 2025, and we remain optimistic about supply chain capacity," she added.

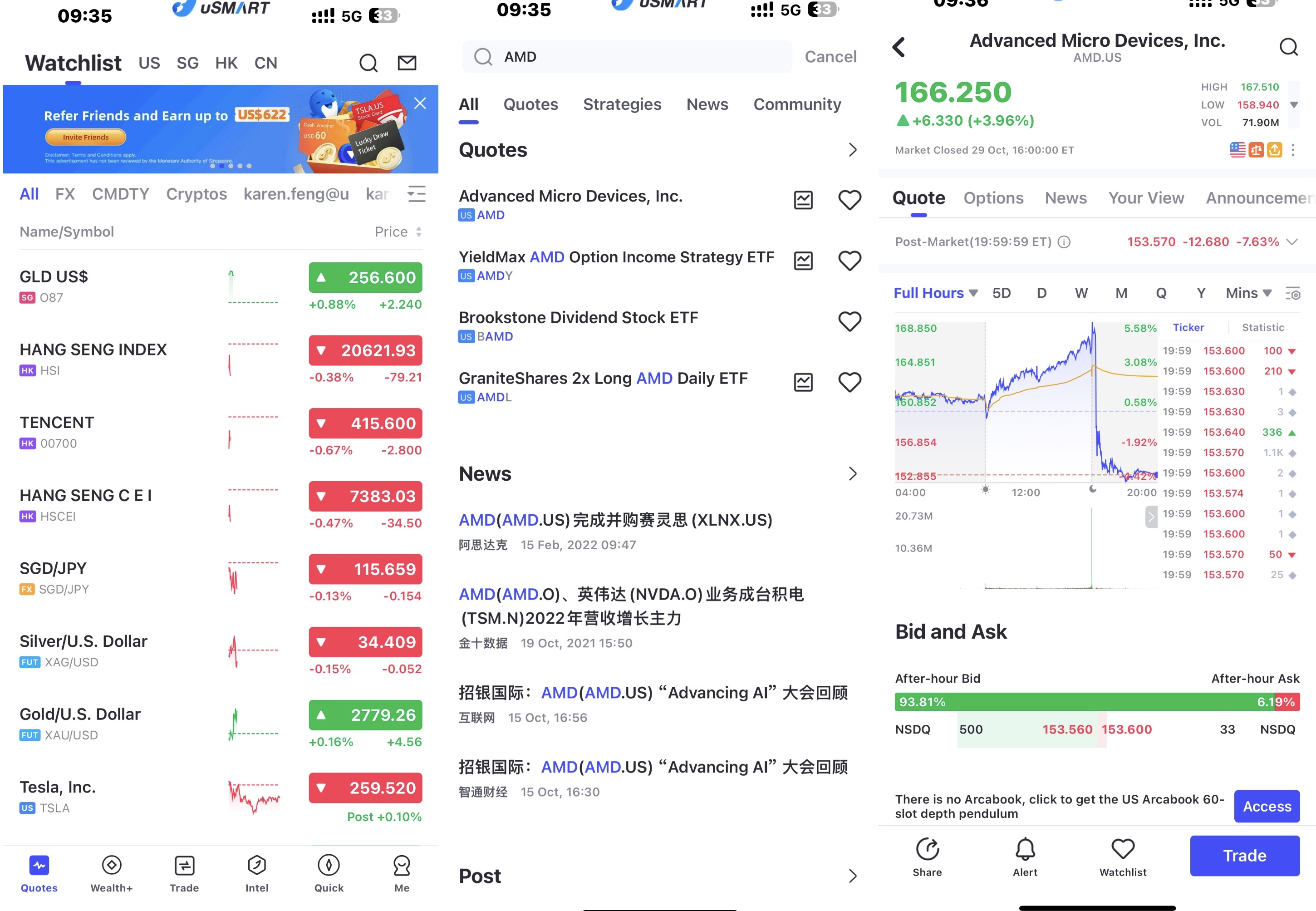

How to trade investments on uSMART:

After logging into uSMART SG APP, click "Search" from the upper right corner of the page, enter the target code, such as "TSM", and enter the details page to learn about transaction details and historical trends. Click "Trade" in the lower right corner and select "Buy/Sell" "Send" function, finally fill in the transaction conditions and send the order; the image operation instructions are as follows:

Source: uSMART SG

Follow us

Find us on Twitter, Instagram, YouTube, and TikTok for frequent updates on all things investing.

Have a financial topic you would like to discuss? Head over to the uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Important Notice and Disclaimer:

We have based this article on our internal research and information available to the public from sources we believe to be reliable. While we have taken all reasonable care in preparing this article, we do not represent the information contained in this article is accurate or complete and we accept no responsibility for errors of fact or for any opinion expressed in this article. Opinions, projections and estimates reflect our assessments as of the article date and are subject to change. We have no obligation to notify you or anyone of any such change. You must make your own independent judgment with respect to any matter contained in this article. Neither we or our respective directors, officers or employees will be responsible for any losses or damages which any person may suffer or incur as a result of relying upon anything stated or omitted from this article.

This document should not be construed in any jurisdiction as constituting an offer, solicitation, recommendation, inducement, endorsement, opinion, or guarantee to purchase, sell, or trade any securities, financial products, or instruments or to engage in any investment or any transaction of any kind, nor is there any intention to solicit or invite the purchase or sale of any securities.

The value of these securities and the income from them may fall or rise. Your investment is subject to investment risk, including loss of income and capital invested. Past performance figures as well as any projection or forecast used in this article is not indicative of its future performance.

This advertisement has not been reviewed by the Monetary Authority of Singapore

Singapore

Singapore Hongkong

Hongkong Global

Global Group

Group