Berkshire Hathaway has reduced its stake in Apple by 25% in the third quarter; since May, the "Omaha Prophet" has not shared any sentiments about stocks.

Warren Buffett, known as the "Oracle of Omaha," and his company Berkshire Hathaway Inc. significantly cut their holdings of Apple stock in the third quarter of this year, leaving only a fraction of the massive position held at the beginning of the year. Meanwhile, Buffett has once again put into practice his “cash is king” strategy, with Berkshire’s cash reserves reaching an astonishing $325.2 billion, setting a new historical record. The market interprets this move as the world’s top investment master seemingly betting on a turbulent U.S. economy.

Berkshire Hathaway's latest financial report indicates that after reducing its stake in Apple by nearly half in the second quarter, the company further cut its Apple holdings by about 25% in the third quarter. As of September 30, Apple’s stock price rose by 10.6% in the third quarter, and the cumulative increase for the year reached 16%. Based on Berkshire’s average cost of Apple shares, since purchasing Apple seven years ago, the holding has realized a return of up to 5.4 times, excluding dividend factors.

Cash Reserves Hit Record High

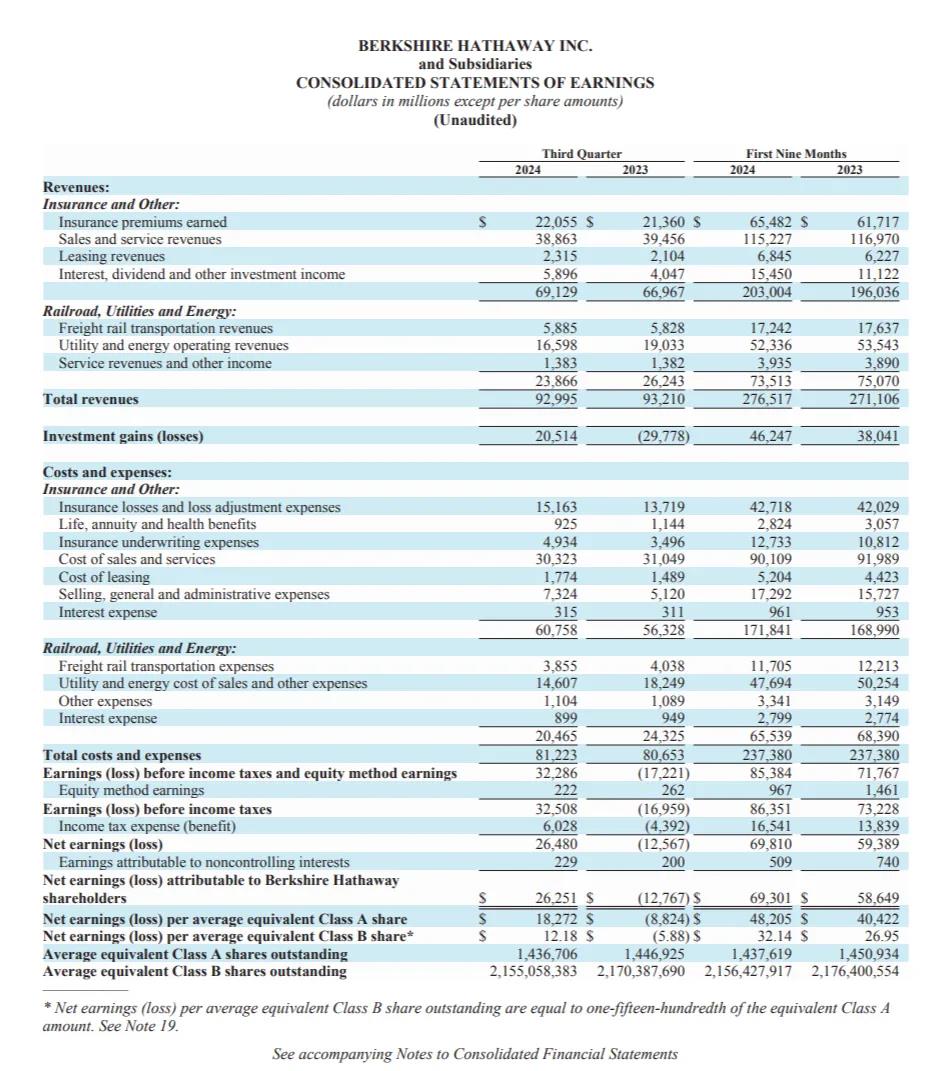

On November 2, Berkshire Hathaway released its third-quarter financial report, showing total revenue of $92.995 billion for the quarter, slightly below $93.210 billion in the same period last year. Operating profit fell 6.2% year-on-year to $10.09 billion, below market expectations of $10.9 billion. Earnings per share for the third quarter reached $18,272, with net profit amounting to $26.25 billion (approximately ¥186.97 billion), compared to a loss of ¥12.77 billion in the same period last year. Investment income reached $20.51 billion, compared to a loss of $29.78 billion the previous year.

The performance of the insurance business was mixed: operating income from the insurance underwriting business declined by 69% to $750 million, while operating income from insurance investments grew by 48% to $3.66 billion, with insurance float reaching $174 billion.

Additionally, operating income from other subsidiaries was $3.34 billion; income from non-controlled businesses was $199 million; and other operating income was -$877 million.

Berkshire Hathaway’s cash reserves increased to $325.2 billion in the third quarter, setting a new record. This increase primarily resulted from Buffett’s continued avoidance of major acquisitions while reducing some key holdings. At the end of the second quarter, the company's cash reserves were $276.9 billion, up from $189 billion at the end of the first quarter.

Data Source: Berkshire Hathaway

The third-quarter report shows that Berkshire Hathaway sold 100 million shares of Apple stock. After reducing its Apple stake by nearly 50% in the second quarter, the company further cut its Apple shares by 25% in the third quarter. Since the beginning of this year, Berkshire's Apple holdings have decreased from 905 million shares to 300 million shares, a reduction of about two-thirds.

From the market’s perspective, the 94-year-old Buffett is avoiding risks. The actions of Berkshire Hathaway, which has substantially sold off its Apple shares, combined with its recent "fire-sale" of U.S. Bank shares and significant accumulation of short-term U.S. Treasury bonds, reflect a strategy of cash accumulation against the backdrop of high interest rates in the U.S., interpreted by the market as Buffett betting on a downturn in the U.S. economy.

There is no doubt that Apple faces a series of serious challenges that bring uncertainty to its stock outlook. The company's flagship product, the iPhone, lacks significant growth in sales. Last week, during the earnings call, Apple executives indicated that the sales growth rate for the quarter ending in December is expected to be only in the low to mid-single digits, falling short of market expectations for the holiday shopping season.

Moreover, iPhone sales in one of Apple's key markets—China—continue to decline, while domestic competitors are seeing steady increases in their sales figures. At the same time, antitrust regulators in Europe and the U.S. are intensifying their scrutiny of Apple regarding antitrust and competition issues. Apple is also lagging behind Google and some domestic smartphone manufacturers in terms of artificial intelligence applications. Last week, Apple launched a series of iPhone, iPad, and Mac products featuring "AI upgrades," but warned customers that some of the most anticipated AI features would not be available until December.

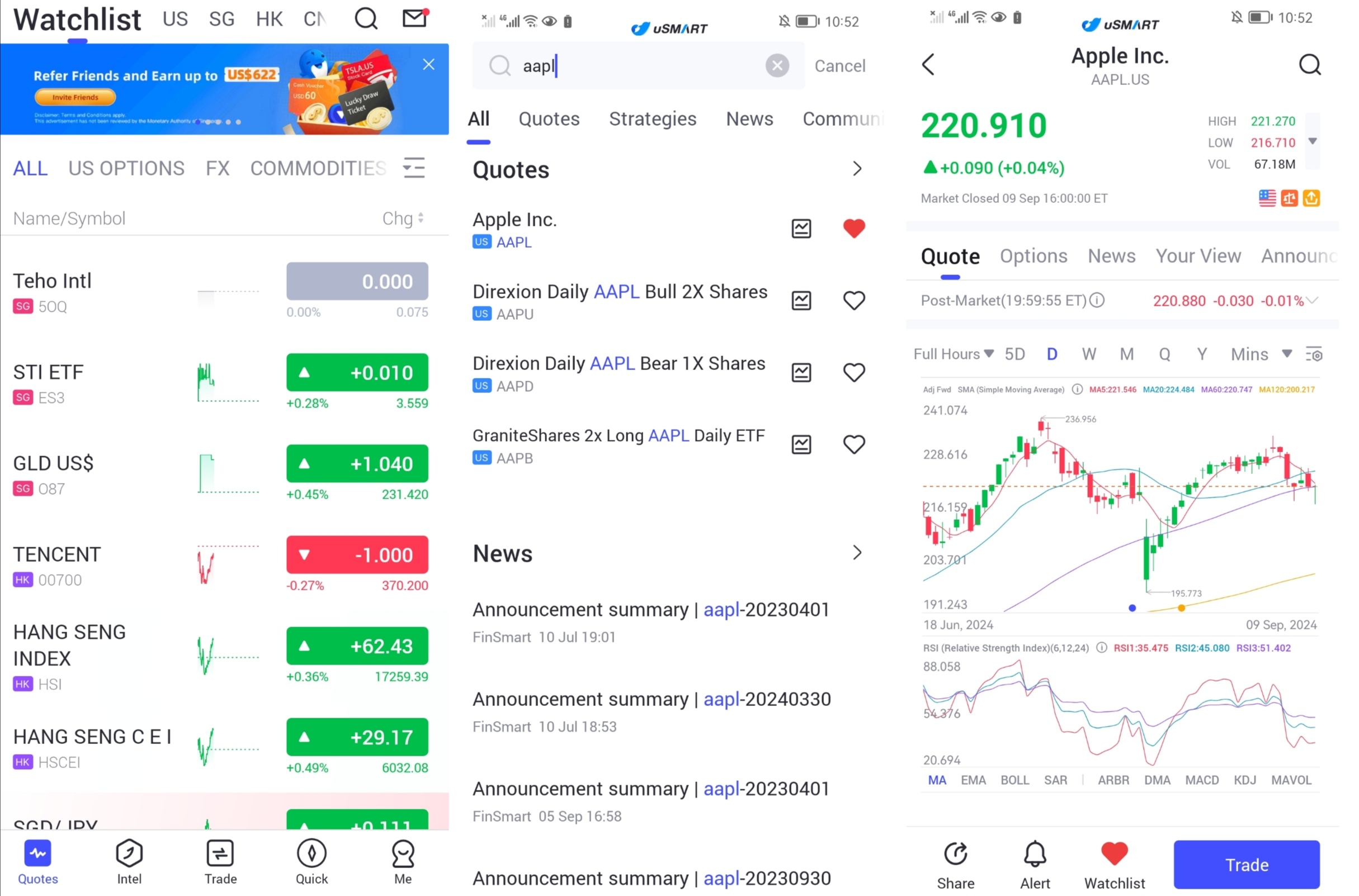

How to trade investments on uSMART:

After logging into uSMART SG APP, click "Search" from the upper right corner of the page, enter the target code, such as "TSM", and enter the details page to learn about transaction details and historical trends. Click "Trade" in the lower right corner and select "Buy/Sell" "Send" function, finally fill in the transaction conditions and send the order; the image operation instructions are as follows:

Source: uSMART SG

Follow us

Find us on Twitter, Instagram, YouTube, and TikTok for frequent updates on all things investing.

Have a financial topic you would like to discuss? Head over to the uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Important Notice and Disclaimer:

We have based this article on our internal research and information available to the public from sources we believe to be reliable. While we have taken all reasonable care in preparing this article, we do not represent the information contained in this article is accurate or complete and we accept no responsibility for errors of fact or for any opinion expressed in this article. Opinions, projections and estimates reflect our assessments as of the article date and are subject to change. We have no obligation to notify you or anyone of any such change. You must make your own independent judgment with respect to any matter contained in this article. Neither we or our respective directors, officers or employees will be responsible for any losses or damages which any person may suffer or incur as a result of relying upon anything stated or omitted from this article.

This document should not be construed in any jurisdiction as constituting an offer, solicitation, recommendation, inducement, endorsement, opinion, or guarantee to purchase, sell, or trade any securities, financial products, or instruments or to engage in any investment or any transaction of any kind, nor is there any intention to solicit or invite the purchase or sale of any securities.

The value of these securities and the income from them may fall or rise. Your investment is subject to investment risk, including loss of income and capital invested. Past performance figures as well as any projection or forecast used in this article is not indicative of its future performance.

This advertisement has not been reviewed by the Monetary Authority of Singapore

Singapore

Singapore Hongkong

Hongkong Global

Global Group

Group