The likelihood of the Republican Party winning the House of Representatives is increasing, leading the market to continue betting on the "Trump trade." The U.S. Dollar Index surged to a more than four-month high, with a stronger dollar pushing the yen down to as low as 154 during the day, and the offshore yuan falling below 7.23. According to CCTV News, Shigeru Ishiba, President of the Liberal Democratic Party, was re-elected as Prime Minister of Japan. The summary of opinions from the Bank of Japan's October monetary policy meeting indicated that some members believe it will take time to cautiously raise interest rates.

Most of Elon Musk's wealth is concentrated in the Tesla shares he owns. In the four trading days since the election, the electric vehicle manufacturer’s stock has surged by about 39%, driving the company’s market value well above $1 trillion.

Tesla's stock peaked in November 2021, breaking through $414. In October 2021, Tesla’s market value surpassed $1 trillion for the first time in history. The stock later retreated after this peak, staying in the $1 trillion market cap club for only a few months. As of Monday's close, Tesla's stock was about 15% below its all-time high.

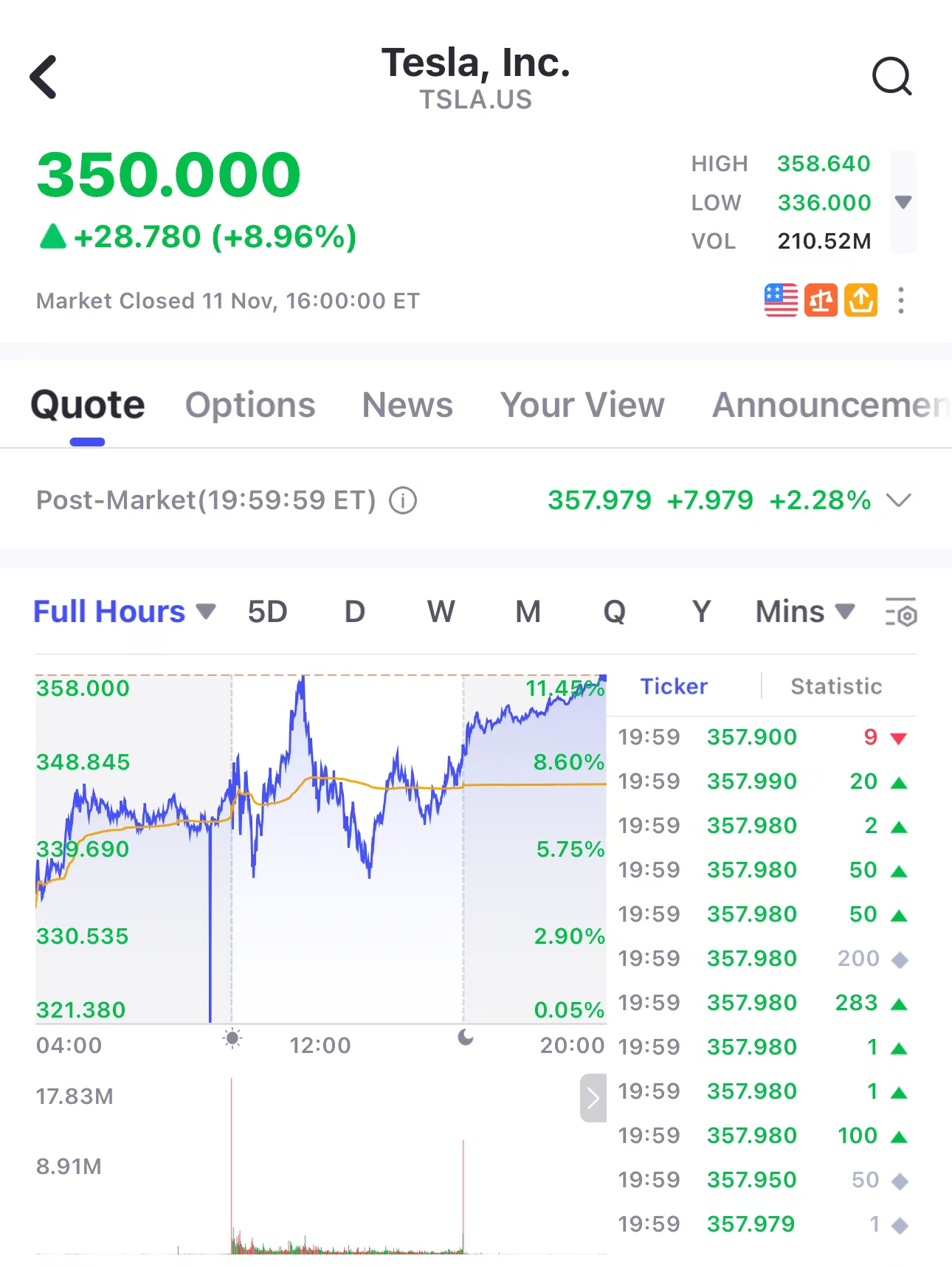

Since Donald Trump won the U.S. presidential election, Tesla Inc. (TSLA.US) has been rising daily. On Monday, Tesla's stock closed up nearly 9%, ending at $350, with an intraday high of $358.64. This marked the biggest five-day cumulative increase for Tesla in the past four years.

Source: uSMART SG

For Musk, getting Trump back into the White House has become another full-time job. He has funded a "Swing State Initiative" aimed at registering right-leaning voters and has acted as an agent for candidates he supports, leading rallies. He began offering $1 million to registered voters who signed a petition from his U.S. political action committee and faced a lawsuit for running an illegal lottery in Pennsylvania.

Musk has also used the social media platform X, which he acquired in 2022, to repeatedly voice his support for Trump while frequently spreading misinformation about Trump’s rival, Vice President Kamala Harris, as well as topics like immigration and voter fraud.

Now, Musk is striving to ensure that his investments pay off.

Empowering Musk's Empire

Musk has long sought to reduce regulatory oversight to eliminate barriers hindering the expansion of his vast business empire, which includes Tesla and X, as well as defense contractor SpaceX, AI startup xAI, brain-computer interface company Neuralink, and tunneling enterprise The Boring Company.

These companies are currently involved in a series of investigations and lawsuits by federal agencies, covering issues such as alleged violations of securities laws, workplace safety, labor and civil rights infringements, breaches of federal environmental laws, consumer fraud, and vehicle safety defects.

Given the executive branch's significant influence over federal regulatory agencies, Musk could anticipate that some or all of the 19 known ongoing federal investigations and lawsuits involving Tesla, SpaceX, and X will be dropped.

According to recent filings, Musk owns 411.06 million shares of Tesla stock and approximately 304 million performance-based options. In January, Delaware Chancery Court Judge Kathaleen McCormick ruled that Musk's historic 2018 compensation package (including options) was invalid, calling it "absurd" partly due to Musk's control over the board. Shareholders later voted in June to retroactively approve the package. McCormick noted that a final decision on whether Musk's compensation will be reinstated would be forthcoming.

Musk is Not the Only Beneficiary

Since Trump’s election win, Coinbase CEO Brian Armstrong’s net worth has increased by approximately $4.5 billion. Coinbase's stock soared 20% on Monday, with gains of 67% since last Tuesday. The cryptocurrency exchange is a major supporter of pro-crypto candidates, mainly through a political action committee called Fairshake. Most candidates favored by the exchange won, laying the groundwork for a more favorable regulatory environment for the industry.

This has also been a victory for Tesla. By the end of the third quarter, the company reported the fair value of its “digital assets” at $729 million. Since the election, cryptocurrency prices have been on the rise, with Bitcoin jumping about 29% on Monday, reaching a new high of over $88,000.

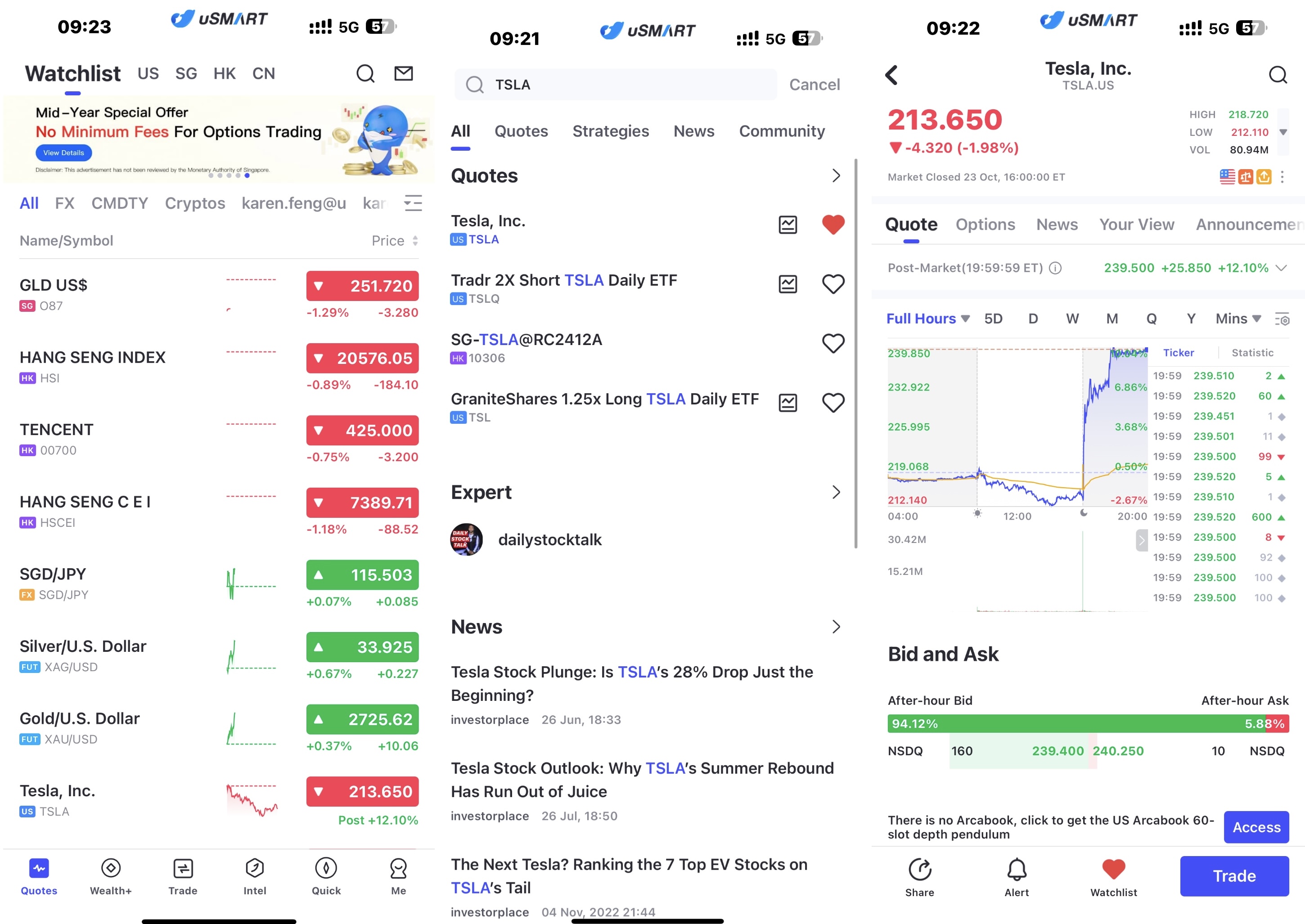

How to trade investments on uSMART:

After logging into uSMART SG APP, click "Search" from the upper right corner of the page, enter the target code, such as "TSM", and enter the details page to learn about transaction details and historical trends. Click "Trade" in the lower right corner and select "Buy/Sell" "Send" function, finally fill in the transaction conditions and send the order; the image operation instructions are as follows:

Source: uSMART SG

Follow us

Find us on Twitter, Instagram, YouTube, and TikTok for frequent updates on all things investing.

Have a financial topic you would like to discuss? Head over to the uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Important Notice and Disclaimer:

We have based this article on our internal research and information available to the public from sources we believe to be reliable. While we have taken all reasonable care in preparing this article, we do not represent the information contained in this article is accurate or complete and we accept no responsibility for errors of fact or for any opinion expressed in this article. Opinions, projections and estimates reflect our assessments as of the article date and are subject to change. We have no obligation to notify you or anyone of any such change. You must make your own independent judgment with respect to any matter contained in this article. Neither we or our respective directors, officers or employees will be responsible for any losses or damages which any person may suffer or incur as a result of relying upon anything stated or omitted from this article.

This document should not be construed in any jurisdiction as constituting an offer, solicitation, recommendation, inducement, endorsement, opinion, or guarantee to purchase, sell, or trade any securities, financial products, or instruments or to engage in any investment or any transaction of any kind, nor is there any intention to solicit or invite the purchase or sale of any securities.

The value of these securities and the income from them may fall or rise. Your investment is subject to investment risk, including loss of income and capital invested. Past performance figures as well as any projection or forecast used in this article is not indicative of its future performance.

This advertisement has not been reviewed by the Monetary Authority of Singapore

Singapore

Singapore Hongkong

Hongkong Global

Global Group

Group