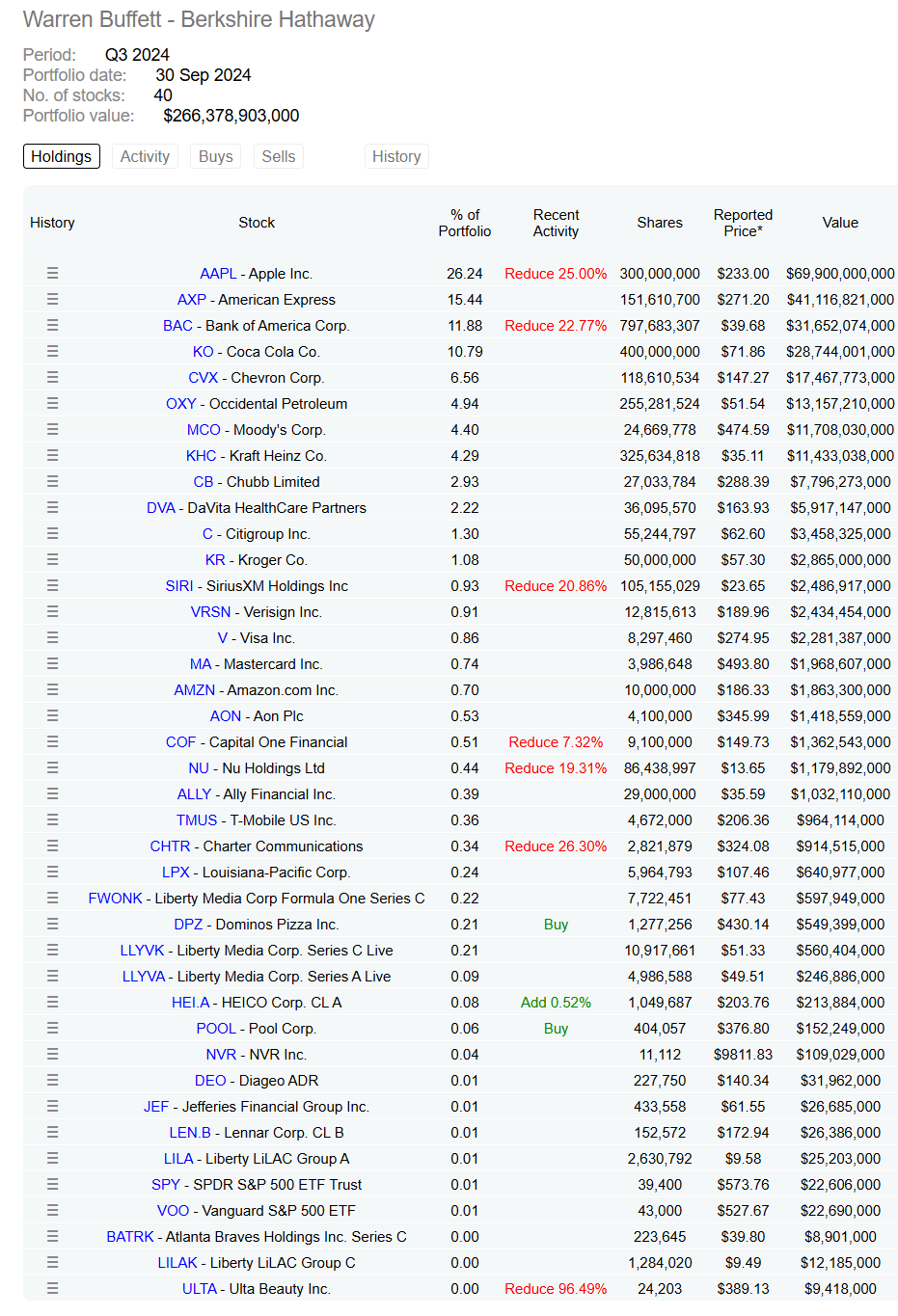

As of the end of the third quarter, the total market value of Berkshire Hathaway's equity holdings fell from $280 billion to $266 billion. The top five holdings included Apple, American Express, Bank of America, Coca-Cola, and Chevron. Warren Buffett continued to reduce his stakes in Apple and Bank of America, while investing in consumer companies Domino’s Pizza and Pool Corp.

In the third quarter, Berkshire Hathaway acquired 1.28 million shares of Domino’s Pizza, valued at $549 million at the end of the period. The company also bought 404,000 shares of Pool Corp., with an end-of-quarter value of $152 million, while selling shares of Floor & Decor. Following this, shares of Domino’s Pizza and Pool Corp. surged by about 6% in extended trading on Thursday. The latest 13F filing released on Thursday revealed that Berkshire Hathaway sold its shares in Floor & Decor during the third quarter.

Domino’s and Pool Corp. share some common ground: both have underperformed the broader market so far this year. Domino’s Pizza’s stock price has been under pressure due to spending constraints among low-income consumers, while Pool Corp.'s stock has been weighed down by weak demand for pools as people become more cautious about discretionary spending.

The 13F filing released on Thursday in the U.S. also showed that Berkshire Hathaway trimmed its holdings in Apple, Bank of America, Ulta Beauty, satellite radio company Sirius XM, and Charter Communications during the third quarter.

Notably, Buffett nearly liquidated his stake in Ulta Beauty, which was unexpectedly acquired in the second quarter. Analysts suggest that this significant adjustment within just one quarter could be attributed to the company’s underwhelming Q2 earnings report and lowered full-year guidance.

As previously disclosed, Berkshire reduced its stake in Bank of America from 10.3 million shares to approximately 7.98 million shares and its stake in Apple from 40 million shares to 30 million shares. The filing also showed that the company cut its holdings in Nu Holdings from 107 million shares to 86.4 million shares and in Charter Communications from 3.83 million shares to 2.82 million shares.

As of the end of the third quarter, Berkshire Hathaway’s major holdings included Apple, American Express, Bank of America, Coca-Cola, and Chevron. Among the top ten holdings, only Apple and Bank of America were reduced in the third quarter.

Earlier this month, Berkshire’s earnings report indicated that the company’s third-quarter revenue and operating profit unexpectedly declined slightly due to weaker performance in its insurance business. Operating profit for the quarter fell by 6.2% year-over-year, missing expectations. The company's cash reserves rose to $325.2 billion, marking an all-time high.

There is widespread speculation that the reasons for Berkshire’s reduction in its stakes in Apple and Bank of America might include high valuations and portfolio management aimed at reducing concentration. Coupled with the fact that Berkshire did not repurchase any of its own stock in the third quarter, and that its new holdings underperformed in terms of stock price, this further supports market speculation that Buffett believes U.S. stocks are currently too expensive.

Analysts generally agree that Buffett’s significant cash holdings indicate a cautious outlook on the current market, particularly with U.S. stock valuations at elevated levels. The valuations of U.S. stocks, especially in sectors such as technology and popular industries like artificial intelligence and green energy, have reached historical highs. Despite strong corporate profitability, many stock prices far exceed their intrinsic values, suggesting an overvalued market.

In terms of valuation metrics, the S&P 500 index currently has a price-to-earnings (P/E) ratio of 28, consistently above its 10-year average this year. In comparison, stock markets in other major developed economies generally have P/E ratios below 20. The "Buffett Indicator," which measures the ratio of the total market capitalization of U.S. stocks to GDP, has risen to over 200, marking the highest level since the end of 2021.

As of Thursday's close, Berkshire's stock has gained about 31% year-to-date.

Follow us

Find us on Twitter, Instagram, YouTube, and TikTok for frequent updates on all things investing.

Have a financial topic you would like to discuss? Head over to the uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Important Notice and Disclaimer:

We have based this article on our internal research and information available to the public from sources we believe to be reliable. While we have taken all reasonable care in preparing this article, we do not represent the information contained in this article is accurate or complete and we accept no responsibility for errors of fact or for any opinion expressed in this article. Opinions, projections and estimates reflect our assessments as of the article date and are subject to change. We have no obligation to notify you or anyone of any such change. You must make your own independent judgment with respect to any matter contained in this article. Neither we or our respective directors, officers or employees will be responsible for any losses or damages which any person may suffer or incur as a result of relying upon anything stated or omitted from this article.

This document should not be construed in any jurisdiction as constituting an offer, solicitation, recommendation, inducement, endorsement, opinion, or guarantee to purchase, sell, or trade any securities, financial products, or instruments or to engage in any investment or any transaction of any kind, nor is there any intention to solicit or invite the purchase or sale of any securities.

The value of these securities and the income from them may fall or rise. Your investment is subject to investment risk, including loss of income and capital invested. Past performance figures as well as any projection or forecast used in this article is not indicative of its future performance.

This advertisement has not been reviewed by the Monetary Authority of Singapore

Singapore

Singapore Hongkong

Hongkong Global

Global Group

Group