After a 76% stock plunge, Super Micro Computer is finally addressing its compliance issues. On November 18, Super Micro announced that it had hired BDO, the world's fifth-largest accounting firm, as its independent auditor and submitted a plan to Nasdaq that meets the listing requirements. This move fulfills Nasdaq's regulatory requirements for listed companies and strengthens investor confidence in the company’s future compliance.

Super Micro CEO Charles Liang stated in a press release: "This is an important next step to keep our financial statements current, and we are working with diligence and urgency to achieve this."

Back in August, Super Micro delayed submitting its 2024 year-end report to the U.S. Securities and Exchange Commission (SEC). Earlier this month, the company revealed that it was searching for a new accounting firm after its previous auditor, Ernst & Young (EY), resigned in October. EY had only replaced Deloitte as Super Micro’s auditor in March 2023.

Following these developments, well-known short-seller Hindenburg Research disclosed a short position in Super Micro and reported “new evidence of accounting manipulation.” The Wall Street Journal later reported that the U.S. Department of Justice had launched a preliminary investigation into Super Micro.

Super Micro indicated that it has informed Nasdaq of its belief that it will be able to submit its annual report for the period ending June 30 and the quarterly report for the period ending September 30. The company stated it would continue trading on Nasdaq while the exchange reviews its compliance plan.

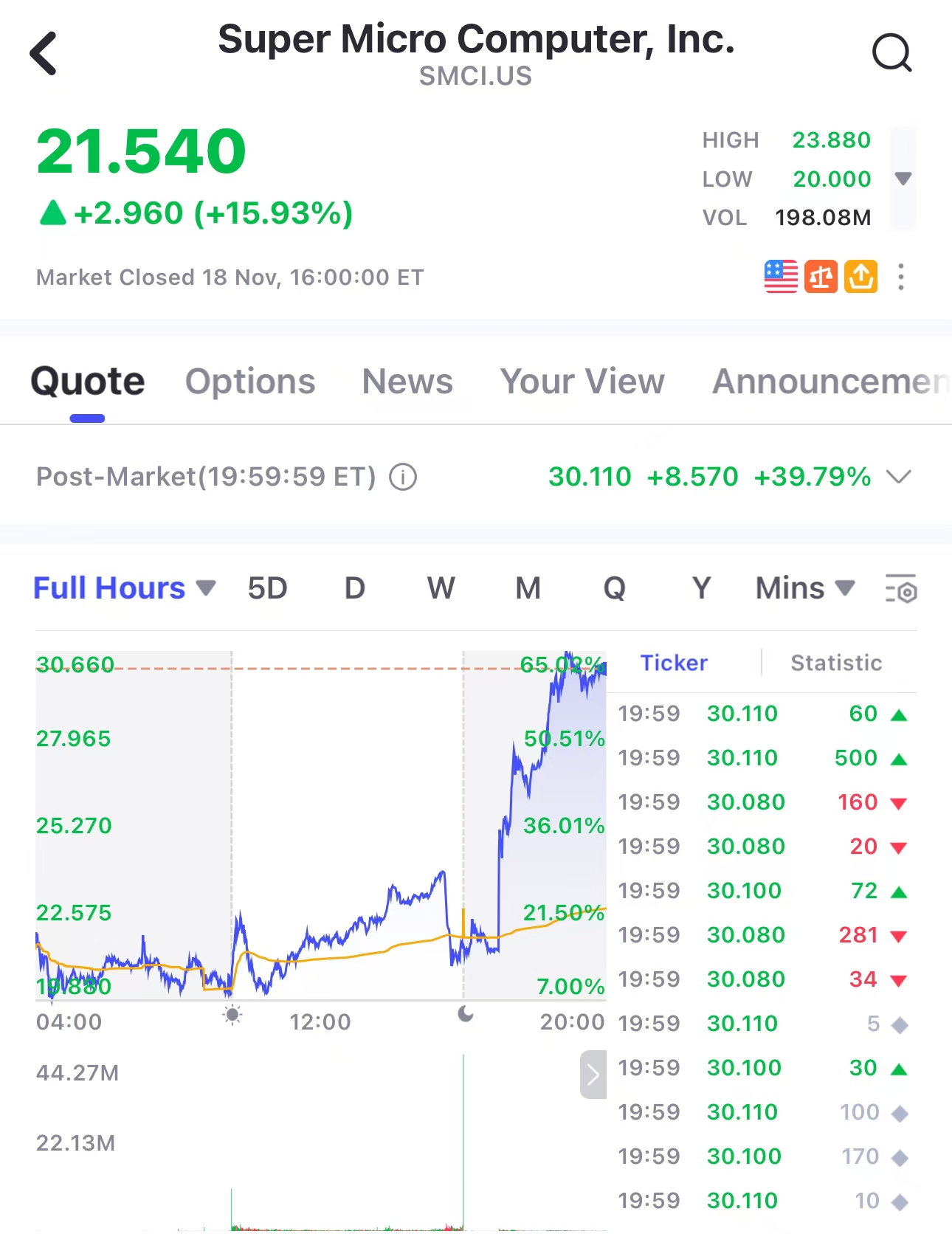

Between early 2022 and March this year, Super Micro's stock surged more than twentyfold. However, unsettling news regarding compliance with Nasdaq regulations severely impacted the stock. The company’s market capitalization, once about $70 billion, stood at $12.6 billion at Monday’s close after a 16% gain during regular trading hours.

As of the time of this report, Super Micro shares had risen 38.49% in after-hours trading, briefly surpassing a 40% increase.

Data Source: uSMART SG

Due to its relationship with Nvidia, Super Micro is one of the main beneficiaries of the AI boom. Sales more than doubled in the past fiscal year to $15 billion. On Monday, Super Micro announced it is now selling products incorporating Nvidia’s next-generation AI chip, Blackwell. The company competes with suppliers such as Dell and Hewlett Packard Enterprise in offering packaged Nvidia AI chips to other companies.

It is notable that Super Micro previously underwent delisting and relisting. In 2019, its stock was delisted from Nasdaq for failing to submit a 10-K report and several quarterly reports on time. However, the company secured approval to rejoin the exchange in 2020 and paid a $17.5 million fine to resolve an SEC investigation. As part of the settlement, Super Micro neither admitted nor denied the regulator’s allegations. Whether the company can successfully navigate this latest financial reporting challenge and regain market trust remains to be seen.

Follow us

Find us on Twitter, Instagram, YouTube, and TikTok for frequent updates on all things investing.

Have a financial topic you would like to discuss? Head over to the uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Important Notice and Disclaimer:

We have based this article on our internal research and information available to the public from sources we believe to be reliable. While we have taken all reasonable care in preparing this article, we do not represent the information contained in this article is accurate or complete and we accept no responsibility for errors of fact or for any opinion expressed in this article. Opinions, projections and estimates reflect our assessments as of the article date and are subject to change. We have no obligation to notify you or anyone of any such change. You must make your own independent judgment with respect to any matter contained in this article. Neither we or our respective directors, officers or employees will be responsible for any losses or damages which any person may suffer or incur as a result of relying upon anything stated or omitted from this article.

This document should not be construed in any jurisdiction as constituting an offer, solicitation, recommendation, inducement, endorsement, opinion, or guarantee to purchase, sell, or trade any securities, financial products, or instruments or to engage in any investment or any transaction of any kind, nor is there any intention to solicit or invite the purchase or sale of any securities.

The value of these securities and the income from them may fall or rise. Your investment is subject to investment risk, including loss of income and capital invested. Past performance figures as well as any projection or forecast used in this article is not indicative of its future performance.

This advertisement has not been reviewed by the Monetary Authority of Singapore

Singapore

Singapore Hongkong

Hongkong Global

Global Group

Group