Company Overview: AI-Driven Advertising Tech Giant

AppLovin (APP.US) is a company focused on mobile advertising technology, leveraging artificial intelligence (AI) to optimize ad placements and improve ad monetization. The company’s business spans across advertising platforms, game publishing, and application development tools. Since its IPO on the Nasdaq in 2021, AppLovin has continuously enhanced its ad targeting efficiency with advanced AI algorithms and established strong partnerships with major tech giants like Google and Meta. As AI technology has advanced, the company’s AXON 2.0 intelligent advertising engine has further propelled its ad revenue growth, making AppLovin one of the most sought-after AI application companies on the US stock market.

In the past year, AppLovin’s stock has surged, rising by over 8.5 times since the beginning of 2024, far surpassing Nvidia’s (NVDA.US) 165% gain over the same period. The company’s exceptional AI-powered ad monetization capabilities have positioned it as one of the fastest-growing firms in the AI application space. The latest Q4 2024 earnings report once again demonstrates its strong profitability, which led to a 22.26% increase in stock price post-market.

Q4 Earnings Significantly Exceed Expectations

For Q4 2024, AppLovin's revenue, net income, and various profitability metrics significantly exceeded market expectations, delivering an outstanding performance. According to the earnings report, Q4 total revenue reached $1.373 billion, a 44% year-on-year increase, far exceeding the market's forecast of $1.26 billion. Among these, advertising revenue showed remarkable strength, driving the overall revenue growth.

Key Financial Data (Q4 2024 vs. Q4 2023):

- Total Revenue: $1.373 billion (up 44%, forecast: $1.26 billion)

- Advertising Revenue: $999.5 million (up 73%)

- Apps Revenue: $373.3 million (down 1%)

- Adjusted EBITDA: $848 million (up 78%, forecast: $762.5 million)

- Net Income: $599 million (up 248%)

- Earnings Per Share (EPS): $1.73 (forecast: $1.26)

(source: investors.applovin.com)

From the data, it's clear that the explosive growth in advertising revenue was the key highlight of the quarter. With continuous upgrades to the AI-driven advertising optimization tool AXON 2.0, AppLovin has made significant breakthroughs in large-scale traffic matching and precise ad targeting. The company has increased its ad monetization rates through smarter ad matching, resulting in a 73% year-on-year increase in advertising revenue, reaching nearly $1 billion.

In addition, AppLovin's profitability has surged. Adjusted EBITDA grew 78% to $848 million, with operating profit margin rising from 28.3% in 2023 to 44.3%. Free cash flow margin also increased from 46% to 50.6%, indicating that the company has achieved an efficient profit model.

(source: investors.applovin.com)

On the cost side, despite a slight decrease in sales and marketing expenses ($215 million), R&D expenses ($169 million) continued to increase, showing the company's ongoing investment in AI advertising technology. Administrative expenses increased to $60 million, reflecting the expansion of the company’s business scale.

Future Outlook: Q1 Guidance Again Surpasses Expectations

Looking ahead to Q1 2025, AppLovin's guidance continues to exceed market expectations, further boosting investor confidence.

Q1 2025 Guidance (Median vs. Market Consensus):

- Total Revenue: $1.37 billion (market forecast: $1.32 billion)

- Advertising Revenue: $1.03–$1.05 billion

- Apps Revenue: $325–$335 million

- Adjusted EBITDA: $870 million (market forecast: $793.9 million)

(source: investors.applovin.com)

The company expects its advertising business to maintain strong growth in Q1, and overall profitability is also expected to improve further. AI advertising technology optimization is still in its early stages, and future improvements will bring more precise ad targeting, further driving revenue growth. Wedbush analyst Michael Pachter states that in the $15 billion global mobile gaming ad spend market, AppLovin is steadily capturing a larger share, which is a key factor behind its recent earnings outperformance.

Additionally, the company’s expansion into Connected TV (CTV) advertising has attracted significant attention, with analysts predicting this market could provide new growth opportunities for AppLovin. The company also began allowing online retailers to purchase mobile ads, further expanding its presence in the e-commerce ad market.

Stock Performance and Market Response

Following the strong earnings report, AppLovin’s stock surged 22.26% to $494, significantly surpassing its previous record high of $417.64. Since the beginning of 2024, the company’s stock price has skyrocketed by 8.5 times, far outpacing Nvidia's (NVDA.US) 165% gain. In Q3 2024, AppLovin's stock had already surged by 72% after the earnings release, and the Q4 report has once again validated the market’s high expectations for its AI-powered ad monetization capabilities.

Bank of America has named AppLovin as one of its “top stocks for 2025”, citing the company's strong growth in AI software, overall profitability, and potential expansion in the e-commerce ad space.

Furthermore, in a shareholder letter, AppLovin stated, "The road ahead is filled with opportunities for iterative optimization, and as we continue to execute, we are confident we can continue creating value for shareholders." The company also announced a significant business change, with Chief Marketing Officer Katie Jansen set to depart on March 14, 2025, and a deal to sell its mobile gaming division for $900 million, including $500 million in cash and $400 million in common stock.

Conclusion

AppLovin, driven by AI-powered ad monetization, has become one of the biggest winners in the US stock market’s AI application sector. Its Q4 earnings far exceeded expectations, with advertising revenue up 73%, adjusted EBITDA up 78%, and net income soaring 248%, driving a 22.26% post-market surge in its stock price. Looking ahead to 2025, the company expects continued strong growth, with advertising remaining a key driver.

With the continuous upgrades to tools like AXON 2.0 and expansion into CTV and e-commerce advertising, AppLovin's future growth potential remains massive. This earnings report not only solidifies its leadership position in the AI application space but also demonstrates the business monetization potential of AI technology in the advertising industry. As AI technology continues to evolve, AppLovin is poised to lead the industry and deliver long-term growth opportunities for investors.

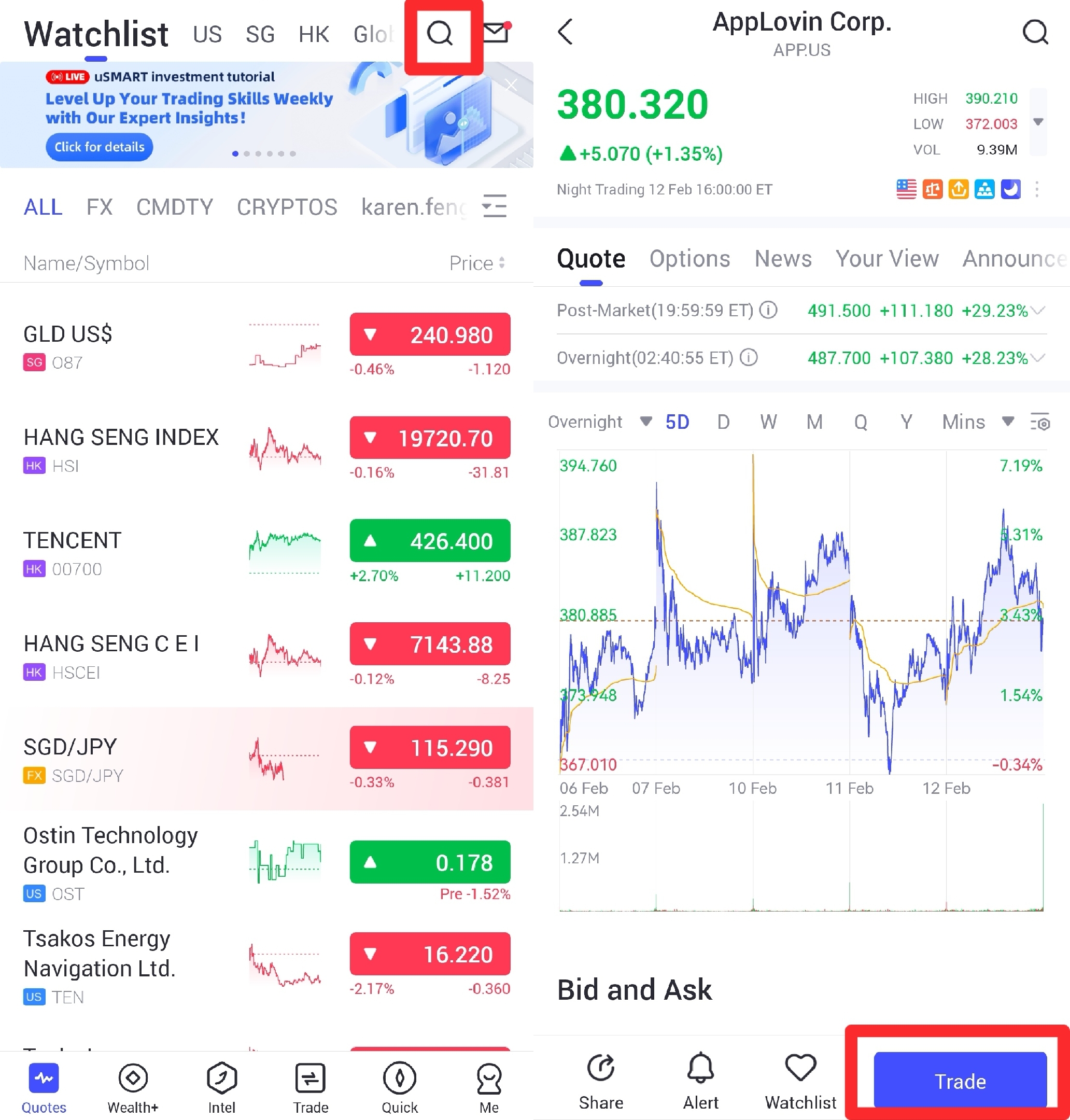

How to buy「APP」stock on uSMART

Log in to the uSMART APP, click "Search" in the top-right corner, enter stock codes and select a stock to view details. To trade, click "Trade" in the bottom-right, choose "Buy/Sell," fill in the details, and submit your order.The image guide is as follows:

(source: usmart.sg)

Singapore

Singapore Hongkong

Hongkong Global

Global Group

Group