By James Ooi - uSMART Securities Market Strategist

This report provides an outlook for the week, highlighting the release of earnings reports from major US companies like Microsoft, Alphabet, Meta Platforms, Amazon, Coca-Cola, Visa, McDonald's, Boeing, Intel, Texas Instruments, American Airlines, ExxonMobil, and Chevron. uSMART Securities Market Strategist James provides this US Macro Strategy Weekly Report.

About James Ooi:

- Over 13 years of experience in buy-side and sell-side of capital markets

- Former Fund Manager of renowned asset management firm

- Focus on fundamental analysis and macro-outlook for US & Singapore markets

- SGX Academy Trainer

US Macro Strategy Weekly Report

Outlook for the Week:

This week, companies that account for 42% of the total market value of the S&P 500 index will release their financial reports, including tech giants Microsoft, Alphabet, Meta Platforms, and Amazon. Other important companies reporting their performance include Coca-Cola, Visa, McDonald's, Boeing, Intel, Texas Instruments, American Airlines, ExxonMobil, and Chevron.

Important economic data release this week includes US Q1 GDP on Thursday, and US March Core PCE Price Index and US Employment Cost Index on Friday.

The US stock market continued to trade in a range in April, with the S&P 500 index rising by only 0.75%. The main reason is that economic data and performance did not show significant surprises.

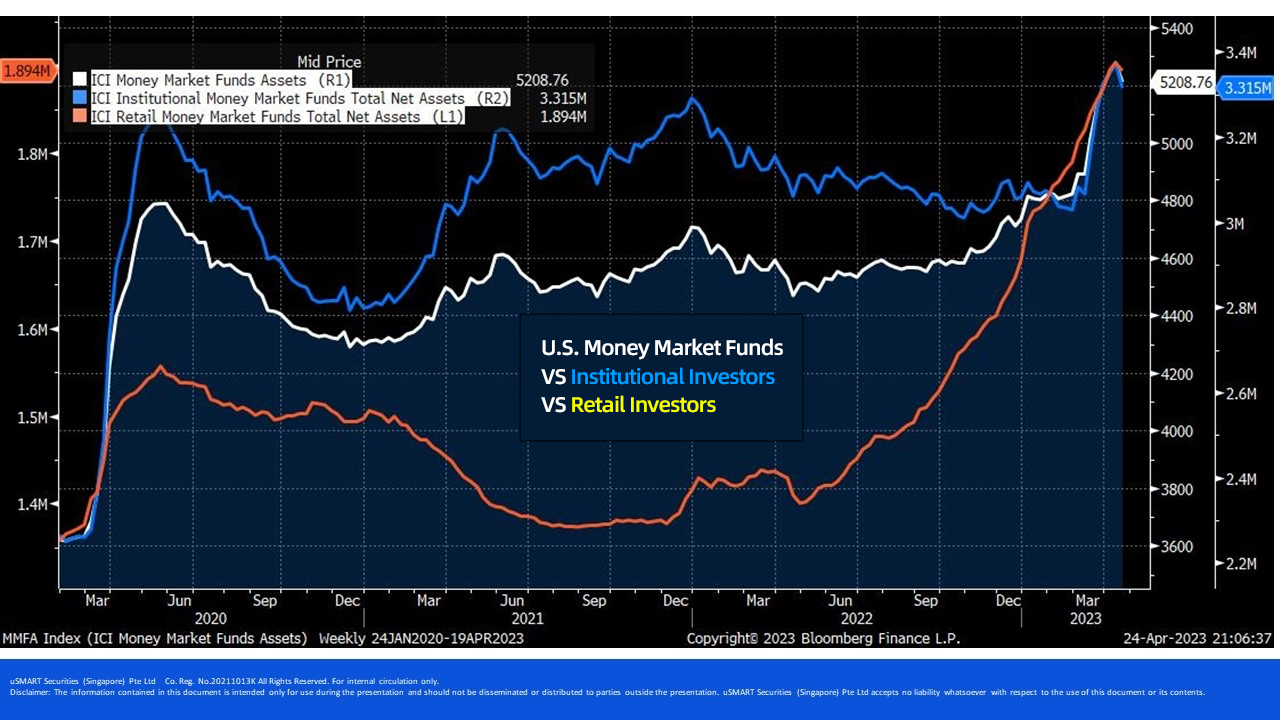

The funds of US Money Market Funds (MMFs) remain close to the historical high of $5.2 trillion (Figure 1), indicating strong global demand for safe-haven assets. Investors have yet to recover from the fear of the banking crisis, and the current high level of the stock market is difficult to sustain.

Figure 1: Total US Money Market Fund, institutional and retail investors' Money Market Fund

Source: Bloomberg, 24 Apr 2023

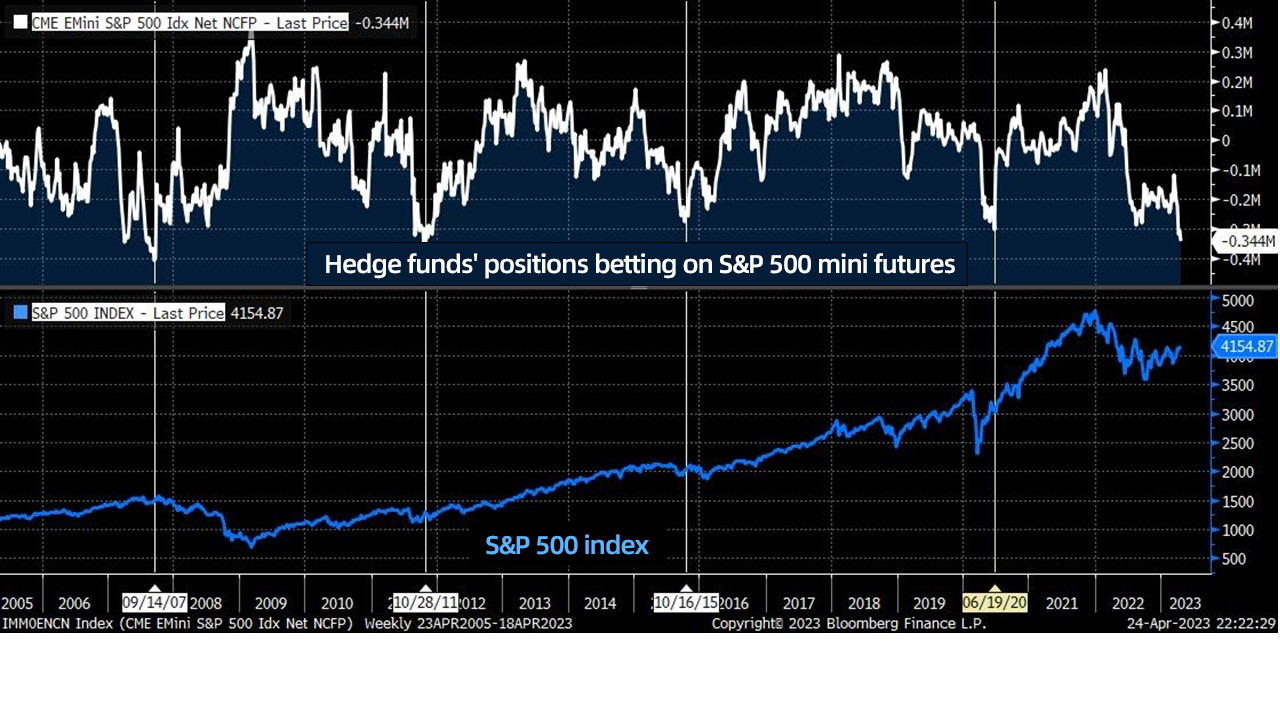

Hedge funds are currently betting on net short positions for S&P 500 mini futures, with the number of contracts increasing to about 344,000, close to the high in 2011 (Figure 2). Their main view is that the economy and corporate profits are about to decline, leading to a contraction in valuations. Past data shows that when hedge fund net short positions rise to a high level, the S&P 500 index usually falls. Successful examples include 2007, 2011 (a slight decline), and 2015, but the recent 2020 was a failed example (Figure 3).

Figure 2: Hedge funds' bet on S&P 500 mini futures positions

Source: Bloomberg, 24 Apr 2023

Figure 3: Hedge funds' bet on S&P 500 mini futures positions vs S&P 500 index

Figure 3: Hedge funds' bet on S&P 500 mini futures positions vs S&P 500 index

Source: uSMART, Bloomberg, 24 Apr 2023

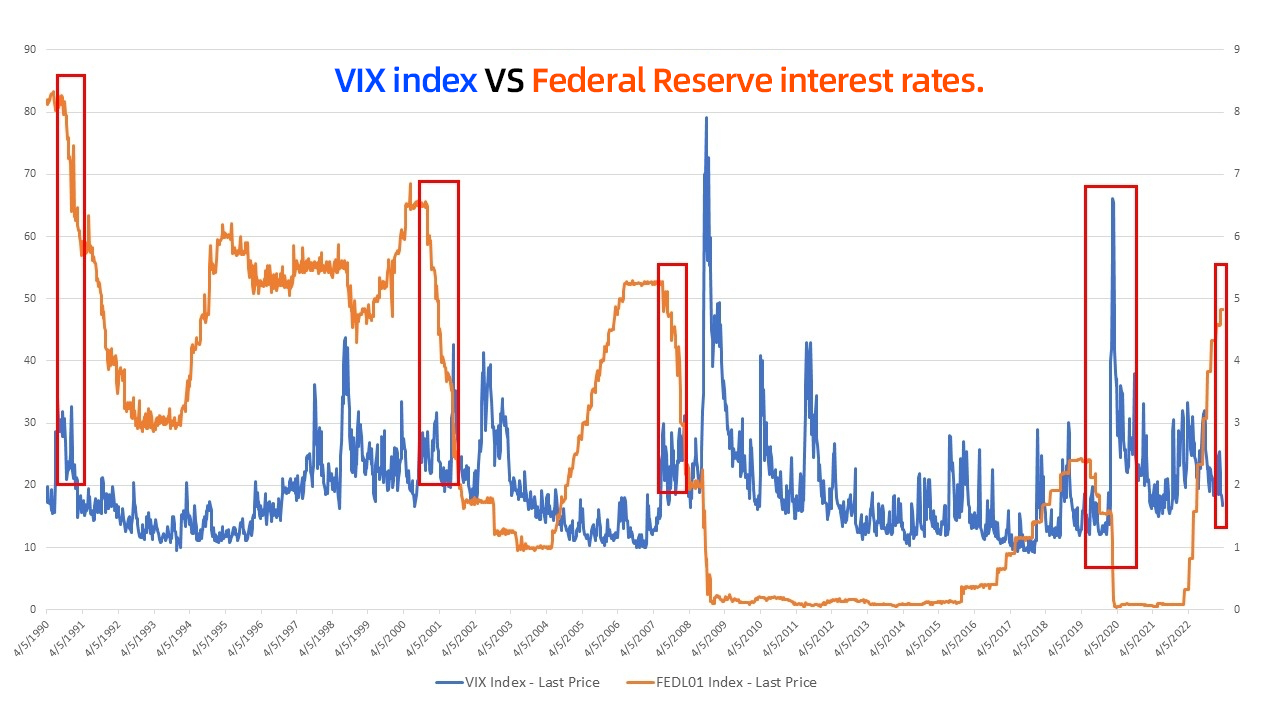

Currently, the VIX index continues to decline, with the current level at 16.89. According to historical data (Figure 4), the Fed will only cut interest rates when the VIX index is above 20. In other words, the market is not fearful enough, and economic data is not bad enough. A high interest rate environment is expected to continue this year.

Figure 4: VIX Index vs Fed Interest Rates

Source: uSMART, Bloomberg, 24 Apr 2023

In conclusion:

The investors’ sentiment has been low throughout April. The market is waiting for the Federal Reserve's interest rate decision and the earnings reports of major tech companies this week to decide their investment strategy.

The Federal Open Market Committee (FOMC) of the Federal Reserve will hold a two-day meeting on 2ndMay to 3rd The market currently predicts the last 25 basis points of interest rate hike, bringing the terminal rate to 5%-5.25%. Investors are uncertain about how long the terminal rate will continue before a rate cut. In addition, if Powell's statement is too hawkish, it may trigger the "Sell in May and go away" market sentiment.

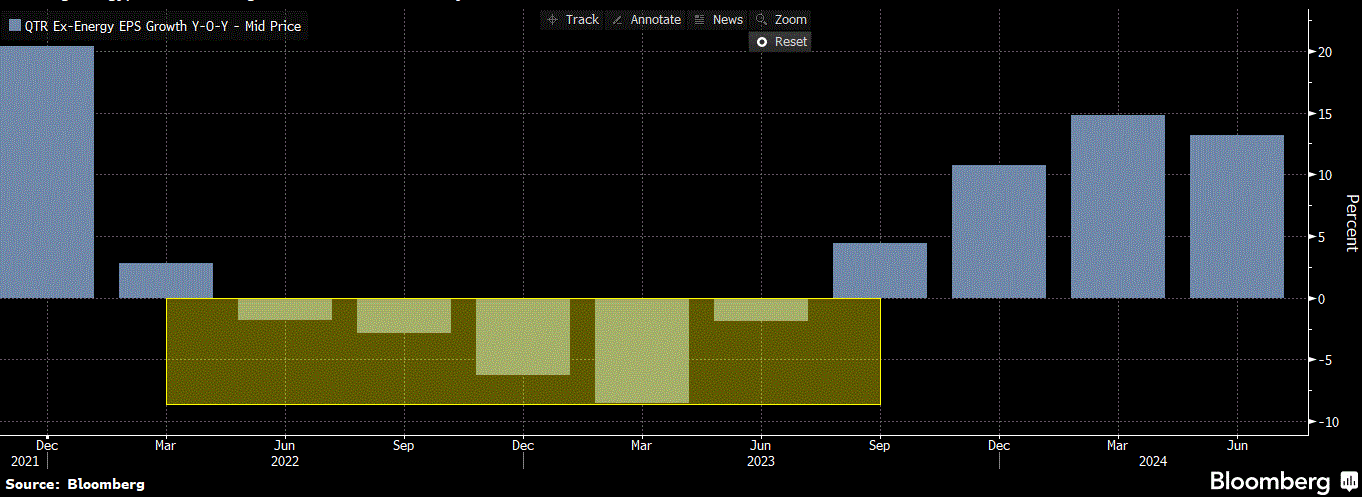

Analysts are beginning to predict that the year-on-year growth of earnings per share in the first quarter of 2023 will reach the bottom (see Figure 5), which has led to the S&P 500 index being at a high level. Investors need to pay attention to the performance outlook revealed in the earnings report to confirm whether the year-on-year growth has bottomed out from the previous quarter. I still believe there will be one more decline, and the worst case scenario is that the S&P 500 index will fall to around 3600. However, it is expected that the decline will rotate between sectors, so the bottom of individual stocks does not represent the bottom price of the overall market. Currently, some high-quality companies such as Apple, Amazon, Visa, Tesla, Costco, and Microsoft do not appear to be overvalued. Investors should gradually establish long-term holding positions in the next market downturn.

Figure 5: S&P 500 index excluding energy stocks (year-on-year growth of earnings per share)

Source: uSMART, Bloomberg, 24 Apr 2023

Disclaimer:

This article is intended for general circulation and educational purpose only and does not take into account of the specific investment objectives, financial situation or particular needs of any particular person. You should seek advice from a financial adviser regarding the suitability of the investment products mentioned. In the event you choose not to seek advice from a financial adviser, you should consider whether the investment product in question is suitable for you.

Past performance figures as well as any projection or forecast used in this article, are not necessarily indicative of future performance of any investment products. Your investment is subject to investment risk, including loss of income and capital invested. The value of the investment products and the income from them may fall or rise. No warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this article. Overseas investments carry additional financial, regulatory and legal risks, you should do the necessary checks and research on the investment beforehand.

The information contained in this article has been obtained from public sources which the uSMART Securities (Singapore) Pte Ltd (“uSMART”) has no reason to believe are unreliable and any research, analysis, forecast, projections, expectations and opinion (collectively “Analysis”) contained in this article are based on such information and are expressions of belief only. uSMART has not verified this information and no representation or warranty, express or implied, is made that such information or Analysis is accurate, complete or verified or should be relied upon as such. Any such information or Analysis contained in this presentation is subject to change, and uSMART, its directors, officers or employees shall not have any responsibility for omission from this article and to maintain the information or Analysis made available or to supply any corrections, updates or releases in connection therewith. uSMART, its directors, officers or employees be liable for any or damages which you may suffer or incur as a result of relying upon anything stated or omitted from this article.

Views, opinions, and/or any strategies described in this article may not be suitable for all investors. Assessments, projections, estimates, opinions, views and strategies are subject to change without notice. This article may contain optimistic statements regarding future events or performance of the market and investment products. You should make your own independent assessment of the relevance, accuracy, and adequacy of the information contained in this article. Any reference to or discussion of investment products in this article is purely for illustrative purposes only, is not intended to constitute legal, tax, or investment advice of any investment products, and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products mentioned. This article does not create any legally binding obligations on uSMART. uSMART, its directors, connected persons, officers or employees may from time to time have an interest in the investment products mentioned in this article.

Singapore

Singapore Hongkong

Hongkong Global

Global Group

Group