On October 30, it is reported that BYD's Q3 financial report showed the company's quarterly revenue reached 201.1 billion RMB, marking a 24% year-over-year increase. Notably, this is the first time BYD's quarterly revenue in the electric vehicle sector has surpassed Tesla’s.

According to Tesla's Q3 financial report released on October 24, the company’s total revenue for the quarter was $25.182 billion, approximately 180 billion RMB, with an 8% year-over-year increase.

In addition, according to sales data from the China Automotive Data Research Institute for the 43rd week, BYD led new energy vehicle (NEV) sales in China with 95,600 units, a 6.7% increase from the previous week. BYD has further solidified its leading position in China’s NEV market; in the top ten ranking, BYD's sales outpaced the combined total of the other nine brands.

In its report today, BYD announced that its total revenue for the first three quarters of this year was 502.251 billion RMB, an 18.94% year-over-year increase, with net profit attributable to shareholders reaching 25.238 billion RMB, a rise of 18.12%. In Q3 alone, BYD's revenue hit 201.125 billion RMB, up 24.04% year-over-year, while net profit rose to 11.607 billion RMB, a growth of 11.47%.

According to official data, in the first nine months of 2024, BYD sold a cumulative total of 2.7479 million NEVs, representing a 32.13% year-over-year increase. In Q3, BYD sold approximately 1.1349 million new vehicles, exceeding market expectations of 1.1 million.

Crossing the 200-billion-RMB revenue threshold for the first time, BYD's single-quarter revenue exceeding Tesla's has attracted significant market attention. Tesla’s Q3 report for the 2024 fiscal year, released on October 24, showed that the company's automotive revenue for Q3 was $20.016 billion, up 2% year-over-year. Tesla delivered 462,890 vehicles in Q3, marking a 6.4% year-over-year increase but falling short of analysts’ earlier estimate of 463,900.

BYD’s Q3 revenue reached an all-time high of 201.1 billion RMB, surpassing Tesla’s quarterly revenue. Additionally, BYD's year-over-year growth rate of 24% far exceeded Tesla’s 8%. In terms of profitability, BYD’s quarterly profit also set a new record at 11.61 billion RMB. However, Tesla’s Q3 profit was $2.167 billion. BYD still has some catching up to do in terms of per-vehicle profit and pricing, areas where Tesla holds a lead and for which BYD has received some criticism.

Q4 may be even brighter for BYD. According to a Citi report, BYD's orders in October totaled around 570,000 units, with exports estimated at 35,000-40,000 units. Total demand (domestic and export) for October should exceed 600,000 units, and Q4 sales could reach 1.57 million units, with potential profits of 15-16 billion RMB. BYD’s annual net profit may reach 41-42 billion RMB.

BYD’s current market cap stands at 888.926 billion RMB, and with the performance boost, its market cap is expected to continue rising, potentially surpassing its previous peak of over 1 trillion RMB.

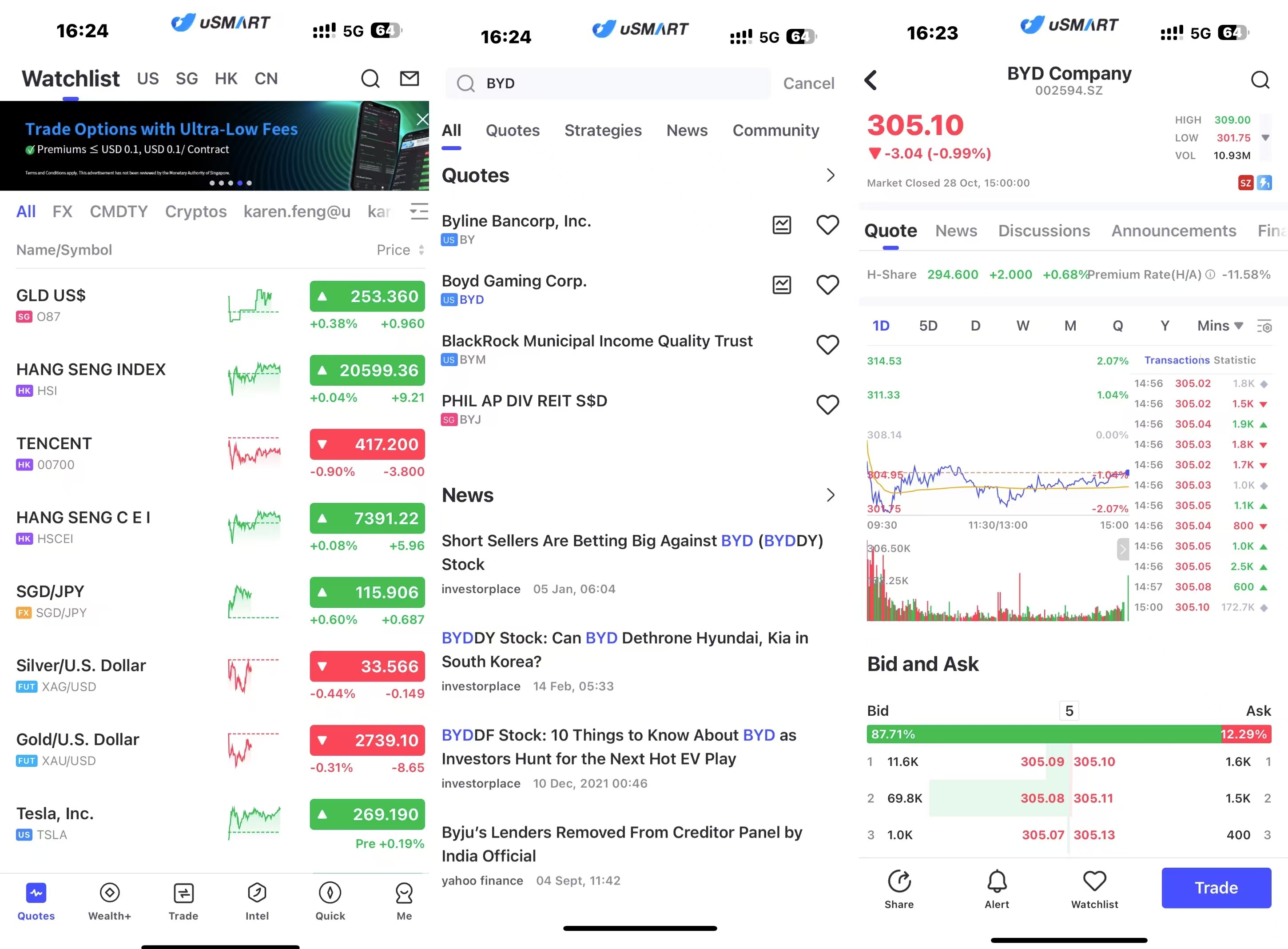

How to trade investments on uSMART:

After logging into uSMART SG APP, click "Search" from the upper right corner of the page, enter the target code, such as "BYD", and enter the details page to learn about transaction details and historical trends. Click "Trade" in the lower right corner and select "Buy/Sell" "Send" function, finally fill in the transaction conditions and send the order; the image operation instructions are as follows:

Source: uSMART SG

Follow us

Find us on Twitter, Instagram, YouTube, and TikTok for frequent updates on all things investing.

Have a financial topic you would like to discuss? Head over to the uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Important Notice and Disclaimer:

We have based this article on our internal research and information available to the public from sources we believe to be reliable. While we have taken all reasonable care in preparing this article, we do not represent the information contained in this article is accurate or complete and we accept no responsibility for errors of fact or for any opinion expressed in this article. Opinions, projections and estimates reflect our assessments as of the article date and are subject to change. We have no obligation to notify you or anyone of any such change. You must make your own independent judgment with respect to any matter contained in this article. Neither we or our respective directors, officers or employees will be responsible for any losses or damages which any person may suffer or incur as a result of relying upon anything stated or omitted from this article.

This document should not be construed in any jurisdiction as constituting an offer, solicitation, recommendation, inducement, endorsement, opinion, or guarantee to purchase, sell, or trade any securities, financial products, or instruments or to engage in any investment or any transaction of any kind, nor is there any intention to solicit or invite the purchase or sale of any securities.

The value of these securities and the income from them may fall or rise. Your investment is subject to investment risk, including loss of income and capital invested. Past performance figures as well as any projection or forecast used in this article is not indicative of its future performance.

This advertisement has not been reviewed by the Monetary Authority of Singapore

Singapore

Singapore Hongkong

Hongkong Global

Global Group

Group