On Wednesday, the U.S. Bureau of Labor Statistics released data showing that the U.S. Consumer Price Index (CPI) increased by 2.6% year-over-year in October, hitting a three-month high and ending a six-month decline streak. Month-over-month, the CPI rose by 0.2%, while core CPI rose by 0.3%, both aligning with expectations. Wall Street analysts noted that the data largely ensures the Federal Reserve will cut rates again next month, though markets still need to assess the potential impact on inflation from President-elect Trump’s incoming administration, which could slow the pace of rate cuts next year.

Market data showed that recent buying pressure pushed the yield on the two-year U.S. Treasury note down by approximately six basis points on Wednesday to 4.296%. The two-year Treasury is more closely tied to Fed rate decisions compared to longer-term bonds.

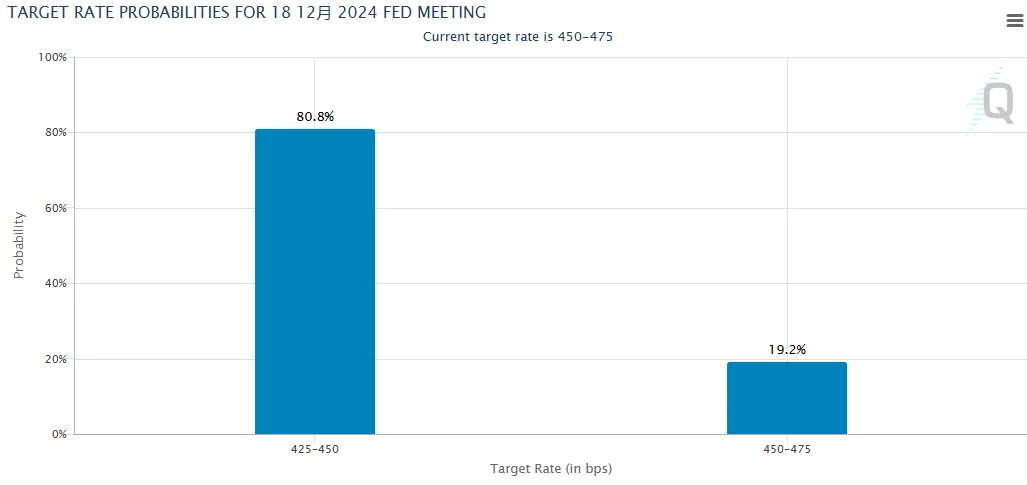

Interest rate traders have raised their expectations for the probability of a rate cut at the December 18 Federal Reserve meeting from around 58% earlier on Wednesday to about 80%.

December Rate Cut Likely? Fed Officials Say Inflation Is Headed in the Right Direction

Minneapolis Fed President Neel Kashkari expressed confidence minutes after the CPI report was released, stating that inflation is moving in the right direction, though he added that it would take another six weeks to analyze the data. Dallas Fed President Lorie Logan remarked that further rate cuts might be needed but advised caution, citing inflation risks from demand and geopolitical factors. She indicated a preference for a gradual reduction in rates. St. Louis Fed President Alberto Musalem stated that if inflation continues to decline, rate cuts should proceed gradually, maintaining "slightly restrictive" monetary policy. Kansas City Fed President Jeff Schmid expressed uncertainty about the future extent of rate cuts.

The U.S. Department of Labor’s Wednesday report indicated that October's CPI rose by 2.6% year-over-year, meeting market expectations but up from 2.4% in the previous month, halting the six-month decline. Core CPI remained at 3.3%, unchanged from September. Following the data release, National Economic Council Director Lael Brainard issued a statement noting that October’s CPI figures were close to pre-pandemic levels. The Biden administration will continue efforts to reduce the costs of key household expenses, such as housing and healthcare, while opposing policies that could disrupt the disinflation process.

Commenting on the latest inflation report, prominent Fed watcher Nick Timiraos wrote that the new data might not be enough to deter the Fed from cutting rates again in December. However, considering the previously strong consumer spending and stable hiring, the inflation uptick could provoke more debate at the next Fed meeting over whether to slow the pace of rate cuts early next year.

Timiraos noted that investor optimism about the report could partly stem from the belief that President-elect Trump and the Fed will avoid immediate conflicts. Trump had repeatedly called for lower interest rates during his first term. Economists have pointed out that some of Trump’s proposed policies, such as tariff increases, could raise inflation.

Fed Chair Jerome Powell suggested at a press conference last week that the Fed is prepared to respond to stronger-than-expected data or volatility. He emphasized that some of the persistent price pressures reflect past increases rather than new sources of inflation. For instance, overall rent prices continued to rise at a historic pace in the CPI report, but new lease rents have been increasing at a more moderate rate for over a year.

Also on Wednesday, two voting members for the 2025 Federal Open Market Committee (FOMC) gave speeches.

St. Louis Fed President Alberto Musalem stated that if inflation continues to fall, the Fed could achieve its dual mandate of full employment and price stability through a gradual rate-cutting approach. He emphasized that when inflation remains above the Fed’s 2% target, monetary policy should stay "slightly restrictive."

Musalem noted that his baseline expectation is for inflation to approach the Fed’s 2% target over the medium term, with further cooling in the labor market and slower wage growth. This forecast assumes "appropriate restrictive" monetary policy while inflation stays above 2%.

Musalem pointed out the risks of inflation rising. He mentioned that recent information suggests the risk of inflation stabilizing or even increasing has grown. At the same time, concerns over a potential deterioration in the labor market remain constant or may have diminished.

Kansas City Fed President Jeff Schmid, however, expressed caution regarding the extent of future rate cuts. He stated that the previous rate cuts show confidence in the inflation trajectory towards 2%. He added: “While it is now appropriate to start easing monetary policy, how much further rates will fall or at what level they will stabilize remains to be seen.”

Follow us

Find us on Twitter, Instagram, YouTube, and TikTok for frequent updates on all things investing.

Have a financial topic you would like to discuss? Head over to the uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Important Notice and Disclaimer:

We have based this article on our internal research and information available to the public from sources we believe to be reliable. While we have taken all reasonable care in preparing this article, we do not represent the information contained in this article is accurate or complete and we accept no responsibility for errors of fact or for any opinion expressed in this article. Opinions, projections and estimates reflect our assessments as of the article date and are subject to change. We have no obligation to notify you or anyone of any such change. You must make your own independent judgment with respect to any matter contained in this article. Neither we or our respective directors, officers or employees will be responsible for any losses or damages which any person may suffer or incur as a result of relying upon anything stated or omitted from this article.

This document should not be construed in any jurisdiction as constituting an offer, solicitation, recommendation, inducement, endorsement, opinion, or guarantee to purchase, sell, or trade any securities, financial products, or instruments or to engage in any investment or any transaction of any kind, nor is there any intention to solicit or invite the purchase or sale of any securities.

The value of these securities and the income from them may fall or rise. Your investment is subject to investment risk, including loss of income and capital invested. Past performance figures as well as any projection or forecast used in this article is not indicative of its future performance.

This advertisement has not been reviewed by the Monetary Authority of Singapore

Singapore

Singapore Hongkong

Hongkong Global

Global Group

Group